You are viewing your 1 free article this month. Login to read more articles.

Budget: business rate relief but industry hit by national insurance rise

Chancellor Philip Hammond has partially bowed to pressure from retailers to tackle “crippling” business rate hikes in April with three measures aimed at relief, equating to £435m a year. However, he also said National Insurance (NI) would be increased for self-employed workers, hitting authors and independent publishers.

Delivering the budget yesterday (8th March), Hammond said he wanted the business rate system to be “fairer” and pledged to reform it, but only committed to setting out the government's “preferred reforms” before the next revaluation.

Rates bring in £25bn a year in tax so can’t be abolished, Hammond said yesterday. However, under pressure from intense media scrunity over the last few weeks, he gave a new pledge that no business coming out of small business rate relief because of the new revaluation would see its rates increase by more than £50 a month, thanks to an extra cap.

On top of this, a £300m fund will be made available to councils to allow them to provide discretionary relief to businesses under their jurisdiction.

Hammond also singled out pubs for special treatment, pledging that drinking establishments with a rateable value of less than £100,000 will get a £1,000 discount on rate bills – benefitting 90% of such establishments. Together the three measures equate to £435m cut in business rates, Hammond said.

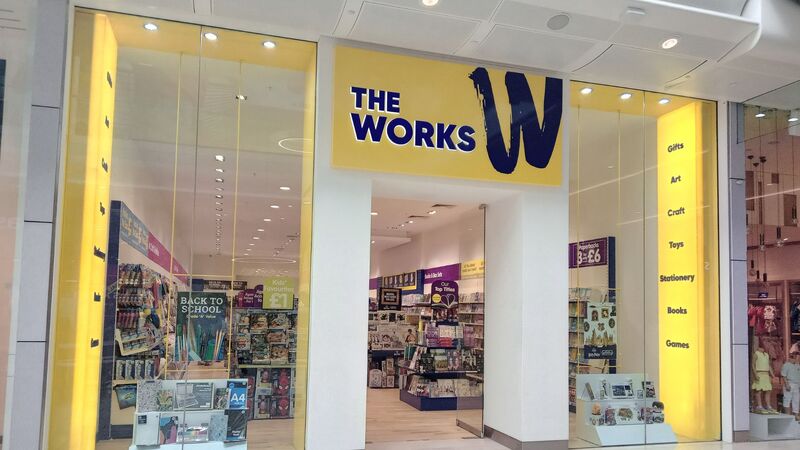

The chancellor also made reference to levelling the playing field between brick and mortar retailers and their online rivals, saying that the digital part of the economy needed to be better taxed in the medium term - although no specific measures were announced to do this. While some high street booksellers will be “crippled” by the business rate revaluations coming in in April, Amazon had its business rates slashed in nine areas where it has warehouses.

However, he also announced that national insurance would be increased for self-employed workers, which is likely to affect authors. He said self-employed people now have much the same pension and benefit rights as those in employment, so the disparity in National Insurance rates can no longer be justified. "What I think we have done now is get the relationship between employed and self-employed National Insurance contributions into a fairer place," Hammond said.

The new changes announced yesterday will see the 9% rate of Class 4 National Insurance contributions currently paid by those self-employed people earning between £8,060 and £43,000 go up to 10% in April 2018 and to 11% in April 2019.

In December, the Society of Authors already warned of a ‘triple whammy tax blow’ to authors after the Autumn Budget, which proposed changes to the VAT flat rate scheme and the abolition of Class 2 National Insurance in 2018, along with demanding the self-employed submit quarterly tax updates online as part of a bid to digitise the UK's tax system.

Today, a spokesperson for the SoA said: "Again, this will present yet another financial burden at a time when our members’ incomes are falling. While we support chancellor Philip Hammond’s view that in tax matters there must be ‘fairness amongst individuals’, this attempt to be fair conveniently ignores the fact that self-employed workers enjoy none of the statutory benefits in kind enjoyed by PAYE workers, such as sick pay and maternity pay...The government must consider whether these measures are the best way to narrow the tax gap and whether small businesses will be shouldering an unfair burden.”

Independent publishers have also expressed disappointment about the news that NI contributions are to increase for the self-employed as the industry “relies heavily on freelancers”.

IPG member Jim Smith, publisher at Globe Law & Business, said: “In an industry that relies heavily on freelancers, the hike in NI for the self-employed is disappointing.”

Di Page, founder of Critical Publishing, added: “As is typical of most small publishers, we use plenty of freelance staff who will be hit by the rise in NI and the reduction in the dividend payments threshold. The continuation of austerity means that budgets in the public sector, one of our key markets, will continue to be squeezed.”

Writing in an Independent Publishers Guild (IPG) blog, Kate Wilson, Nosy Crow m.d. said: “My main concern in relation to the budget is the change to NI for people who are self-employed. Despite our small-ish size, Nosy Crow in fact works with relatively few freelancers: we like to maximise our brand and creative influence by keeping design and editorial in-house. But we do work with some freelancers and know how important they are to the publishing industry in general, so anything that hits them can’t be good.”

She added: “More significant for us, though, is the potential negative impact of this on the authors and illustrators with whom we work who are self-employed. They aren’t all self-employed, but many, especially the illustrators, are. I can’t welcome anything that discourages creativity by taking a toll—and, given government promises, an unexpected toll—on the life-blood of our industry. I am not saying that the creative industries are unique in taking the pain of this, but I suspect we will be disproportionately affected.”

The Booksellers Association (BA) has welcomed the chancellor's announcement on business rates, though, particuarly the £300m discretionary fund that local councils will have to help the hardest-hit cases. However, “even more importantly” the trade body welcomed the fact that the chancellor “explicitly recognised the need to find a better way in the medium term to tax the digital economy”.

“The BA has long argued that this is an issue of fundamental fairness and we are very pleased to learn that progress is being made in this direction,” Giles Clifton, head of corporate affairs at The Booksellers Association, said.

He added: “It is good the chancellor seemingly recognises that in the short term there is scope to reform the revaluation process to avoid the dramatic increases and, moreover, that the government will set out its preferred approach before the next revaluation is due.”

The BA has written to all ministers, MPs and members of the House of Lords, detailing the BA’s concerns on business rates. Tim Godfray, chief executive of the Booksellers Association, said: “Our concern was that many booksellers who will have to continue to pay business rates from April this year were going to be absolutely crippled by massive increases, especially those in London. However, let me be very clear – this was not just a London issue. We have had serious concerns over business rates increases for our members in other parts of the country.

“Business Rates have consistently been rated by BA members as one of their top concerns. Indeed, alongside the need to ensure free and fair competition in the book trade, Business Rates have consistently ranked as a top concern.”

Booksellers have previously spoken of their frustration and despair over the “unfair” rates hikes.

Tim Walker, manager at Walkers Bookshops, said: “We have been selling books since 1972 and I don’t think I’ve ever seen such unprecedented rises in costs [that] I have no control over.” He anticipated that his two premises, in Oakham (East Midlands) and Stamford (Lincolnshire), will have to tackle business rates rises of a third and 50% respectively.

Meanwhile Brett Wolstencroft, manager at Daunt Books, told The Bookseller at the time that the mini-chain felt “trapped” by the situation, and was steeling itself for a 100% rise in rateable value of its Marylebone shop; in effect, a rise of £50,000 annually. “This will have a huge impact and businesses can’t sustain it. We are trapped. Bookshops, more than other businesses, can’t just look at other premises,” he said.

Today (8th March) the independent booksellers The Bookseller spoke to said that it was a “shame” but the new measures introduced by the chancellor would most likely not benefit them.

Wolstencroft said that he suspected “very small” businesses would benefit from the relief, but as a mini-chain, Daunt Books would not see any change.

Ben Millwood-Harris, manager of Artwords, which has shops in Shoreditch and London Fields, agreed. “I don’t think we’ll qualify [for the rates relief]. We’ve got two outlets so I don’t think it will make any difference to us at all," he said. "I do hope it will make a difference for smaller, single outlet bookshops.”

Meanwhile Mike Cherry, national chairman at the Federation of Small Businesses (FSB), welcomed the fact that the chancellor has listened to the small business-led campaign on business rates.

"The £435 million of new money is a direct and much-needed response to those facing astronomical hikes in their business rates," he said. "This immediate relief is vital in the short-term, and action on more frequent revaluations will also help."

However, Helen Dickinson, chief executive of the British Retail Consortium (BRC), was concerned that the new business rate relief measures added “complexity to an already impenetrable system” and called the £435m figure a “drop in the ocean”.

“We hope that the relief measures will help some of those businesses hardest hit by the revaluation, albeit only temporarily,” she said. “However, more short term relief measures continue to add complexity to an already impenetrable system. £435 million is a drop in the ocean compared with the £25 billion a year that the tax raises. This is yet another sticking plaster on a chronically ill patient – an unsustainable property tax higher here than anywhere in the developed world."

She said the body agreed with Hammond that a business rate review was urgently needed and any new system must be “fit for purpose in the 21st century” and “incorporate business tax in its entirety and not be constrained by the technicality of fiscal neutrality around business rates”.