You are viewing your 1 free article this month. Login to read more articles.

Pearson to sell its stake in Penguin Random House

Pearson intends to sell its 47% stake in Penguin Random House and will be issuing an "exit notice" to its joint venture partner Bertelsmann, which holds a majority 53% stake in the group. Bertelsmann has responded by saying it is "open" to increasing its share in the world’s biggest trade publishing group if the "financial terms are fair".

Pearson's stake in Penguin Random House will be sold or recapitalised with a view to extracting a dividend to maintain a strong balance sheet, invest in the business and return excess capital to shareholders while retaining an investment grade credit rating, the company said in its January trading statement this morning (18th January).

"With the integration of Penguin Random House complete, and with greater industry-wide stability on digital terms, we intend to issue an exit notice regarding our 47% stake in Penguin Random House to our JV partner Bertelsmann in the contractual window, with a view to selling our stake or recapitalising the business and extracting a dividend," the statement said.

In an email to staff seen by The Bookseller, PRH chief executive Markus Dohle said the process for the publisher to be wholly acquired by Bertelsmann would "take a number of months".

"We don't expect any further details regarding a transaction until later in the year," he said. "...In the meantime, it's business as usual for both of us."

Pearson also cut its profit guidance for the next two years and lowered its 2017 dividend - a move which has seen shares plunge 23% this morning.

In a call with analysts this morning, Coram Williams, Pearson's chief financial officer, said now was the "right time" to sell its stake in PRH because the impact of new e-book contractual terms negotiated under the new agency agreement was "now clear".

"You all know that we've been considering to issue an exit notice on Penguin Random House for some time," said Williams. "Now is the right time to exercise that option for the following reasons: firstly, the integration of the two businesses is complete and synergies have come through nicely; secondly, PRH has recently concluded a long negotiation on renewing digital e-book terms across the industry and the impact is now clear; and thirdly, we are now in the contractual window in which we are able to issue the notice of exit to Bertelsmann and will not have another one until 2019.

"This is a process that, as you know, can play out in a number of ways, and we expect it to take some months before the end result is clear. However, the proceeds of a full disclosal would allow us to maintain a strong balance sheet, invest in our business and return excess capital to shareholders whilst retaining an investment grade credit rating."

Bertelsmann, which has held a majority stake in PRH since 2013 when Penguin and Random House merged, has reconfirmed its commitment to the book business saying it wants PRH to continue to be the "publisher of choice" for authors.

Thomas Rabe, chairman and c.e.o. of Bertelsmann and a member of the Penguin Random House board of directors, said: “The book-publishing business has created a sense of identity for Bertelsmann for more than 180 years. It is our oldest core business. Accordingly, we are open to increasing our stake in Penguin Random House, provided the financial terms are fair. Strategically this would not only strengthen one of our most important content businesses, it would also once further strengthen our presence in the United States, our second largest market.”

He added: “Thanks to the excellent partnership with Pearson, Penguin Random House has developed into a success story. Under Markus Dohle’s leadership, the company has achieved all the goals of the combination in the past few years. With 800 million books, e-books and audiobooks sold per year, the group is the clear number one in the publishing industry, both commercially and in terms of creativity. It is also the publisher of choice for authors. We want to continue on this path. As the majority shareholder Bertelsmann will continue to guarantee the continuity of Penguin Random House’s business development, as well as the independence of our publishers.”

Williams added of the prospective sale of PRH that there was "no set price" for the 47% stake in the business. Next steps in the process for selling Penguin Random House would be to try for a mutual agreement with Bertelsmann, he explained. "There is not a set price; there are a series of evaluation steps that are outlined in our contracts. We (will) try initially to get to a mutual agreement, and if we can't do that then independent advisors are involved. In all cases, an evaluation will be based on current performance, which is strong, and future plans, and we do have financial plans agreed between the partners."

Pearson's January trading statement reported it would be cutting its profit forecast for 2017 and said it will "rebase" the dividend from 2017 onwards. There are no plans to put a number on what the 2017 dividend will be until later in the year, due to the potential disposal of PRH and uncertain market conditions, it said. The company also revealed it would be withdrawing its operating profit goal for 2018 to reflect "portfolio changes and challenging and uncertain markets".

In spite of difficulties this year, in which it experienced a £180m decline in North American higher education profits, Pearson said it would still make its guidance for 2016, in part due to the benefits of its restructuring program which saw it cut headcount by 10%, the equivalent of 4,000 jobs. Operating profit in 2017 will be £570m to £630m, it said.

"The challenges we have faced during 2016 mean we begin 2017 with a base level of underlying profitability that is around £180m lower than we had expected in early 2016," the trading statement said. "Our preliminary guidance range is for operating profit in 2017 of £570m to £630m, driving adjusted earnings per share of 48.5p to 55.5p."

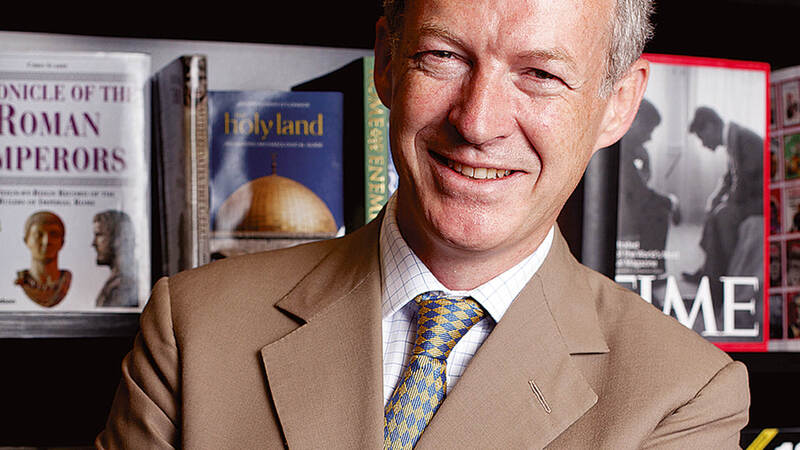

Pearson's chief executive John Fallon added: "The education sector is going through an unprecedented period of change and volatility. We have already taken significant steps on restructuring, reducing our cost base by £375m last year. However our higher education business declined further and faster than expected in 2016. So we are taking more radical action to accelerate our shift to digital models, and to keep reshaping our business."