You are viewing your 1 free article this month. Login to read more articles.

Pearson shareholders overwhelmingly reject Fallon's £1.5m pay

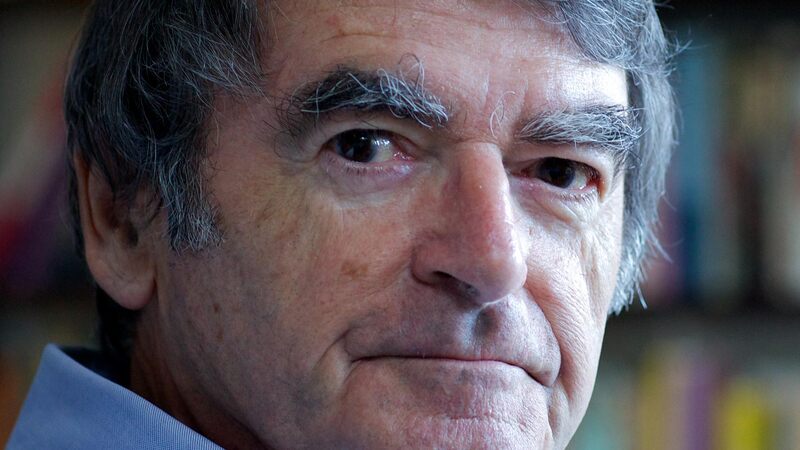

Pearson shareholders have rejected chief executive John Fallon's £1.5m pay package at the company's a.g.m. today (5th May), following a difficult year in which Pearson made the biggest loss in the company's history.

The vote saw 65.59% of shareholders vote against Pearson's remuneration report, after an annual bonus bolstered its c.e.o.'s pay packet by 20%. The vote in relation to policy is however non-binding and today Fallon reinvested his full, post-tax bonus of £343,000 back into Pearson shares.

The a.g.m., which took place in central London, was dominated by questions relating to Pearson's leadership and strategy, placing its chief executive in the firing line.

Fallon was accused by one shareholder as having been "asleep on the job" for failing to anticipate the North Amercian market change. Of directors' pay, he said, "Your remuneration strategy has manifestly failed and you have been over paying for failure," and added: "I argue that because of your shortcomings you are selling off in phases the family silver to keep this company afloat. How much longer is it going to go on and when will you get a grip on the situation?"

Responding to concerns regarding remuneration, Elizabeth Corley, head of Pearson's pay committee, told shareholders in the meeting she has "huge sympathy" with them, and conceded it was "a baffling question as to why certain roles are significantly higher [in pay] than other roles that have equal or more reponsibility" as a "societal point".

However, she went on to defend the committee's decisions with respect to executive remuneration that it explicitly disregards benchmarking against peers, "because we wanted to think about the conditions of the company, the experience of the shareholder and other employees in order to come to our conclusions," and that its executive's pay was "at the low end of the scale" compared with other FTSE 100 companies.

"It is a very difficult and demanding job running a company of this scale and complexity," she also said, "We do need experienced and senior talent and it is our responsibility to make sure we attract and retain that."

A Pearson spokesperson said in a statement: "“We are disappointed that the advisory vote for this year’s remuneration report was not passed. The board put a great deal of time and focus into the remuneration process, exercising significant discretion, to make sure we came to a fair conclusion. We acknowledge our shareholders’ feedback and will continue to engage with them to ensure our approach to remuneration reflects the best long term interests of the company.”

Despite the attacks on Pearson's leadership in the meeting, Fallon's re-election as c.e.o. gained the backing of 99.86% of shareholders.

Other topics raised in the meeting included Pearson's involvement in Bridge private schools in Africa. The issue inspired as many as four separate lines of questioning from the floor during the meeting and brought supporters of protest group Global Justice Now, which says the schools are "exploitative", to the doors of the a.g.m. with placards. Pearson responded it only has "a very, very small" stake in Bridge and that it plans to withdraw from the business over time.

The meeting followed its first quarter results, showing Pearson's underlying revenues are up 6% on the year before. It also revealed today a cost-cutting drive for further simplification of the business; its aim is to make £300m annualised savings by 2019.