You are viewing your 1 free article this month. Login to read more articles.

Bertelsmann reports 'record' nine-month operating result

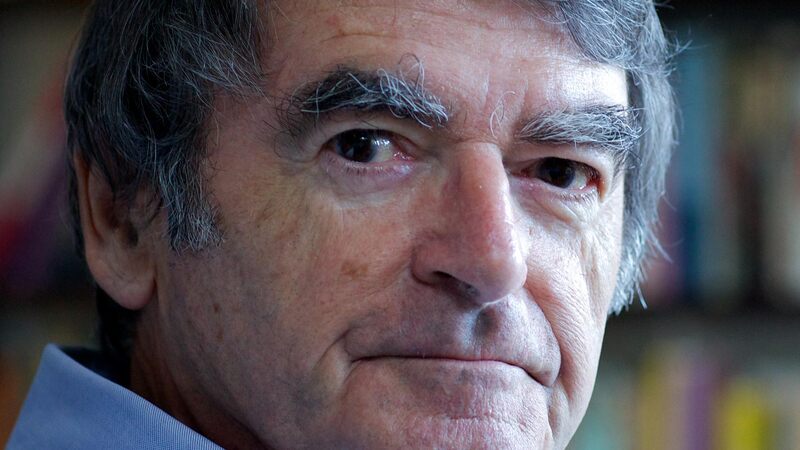

Penguin Random House's parent company Bertelsmann, which has a 53% stake in PRH, says it is expecting its annual group profit to exceed one billion after reporting a record operating result for the first nine months of its current fiscal year.

For the period from 1st January 2016 to 30th September 2016, operating EBITDA rose €38m (£33m) to a record €1.63bn (£1.43bn), surpassing last year's record level in spite of start-up losses for digital and new business totaling €80m (£70.29m). Bertelsmann attributed the increase to the "significant" contributions of its TV, music and services businesses. The EBITDA margin was 13.7% (2015: 13.1%).

Group net income also saw a "strong increase" of €79m (£69.41m) to €652m (£572m), up 13.8% on 2015, due to the positive operating performance and lower special items.

Consolidated revenues came in at €12bn during the reporting period, slightly down on the previous year (2015: €12.2bn). When adjusted for portfolio-related and exchange-rate effects, though, this reflects a 0.6% increase. The total revenue share contributed by high-growth businesses increased to 29% (2015: 27%).

Bertelsmann noted the expansion of Penguin Random House's e-book portfolio to more than 115,000 title and bestsellers including The Girl on the Train by Paula Hawkins and Me Before You by Jojo Moyes as highlights for the period. The Bookseller reported at the end of August global revenues at Penguin Random House fell 10.7% year-on-year in the first half of 2016 due to lower e-book sales: revenues dropped to €1.5bn (£1.27bn), down from €1.7bn (£1.44bn). The half-year figures issued by Pearson for PRH worldwide showed profit grew for the first six months to £32m, up from £24m.

Thomas Rabe, chairman and c.e.o. of Bertelsmann, said: "Our positive business development has continued. An operating result at record levels, a significantly higher EBITDA margin, and higher group net income in the year to date give us confidence for the full year 2016. Bertelsmann is more profitable than ever before. The various advances made in our four strategic priorities are paying off - Bertelsmann is now a faster growing, more digital and more international company than it was even a few years ago. We will continue resolutely on this path."

Bertelsmann has invested in more than 30 companies in the past nine months via its digital funds pooled in the new Bertelsmann Investments division. They include the budget-hotel marketplace Treebo in India, and the NRE Education Group, one of the largest groups of medical higher education institutions in Brazil.

Bertelsmann c.f.o. Bernd Hirsch said: “We continue to shape the ongoing transformation of our group from a sound financial position. Our cash flow from operations is strong, our equity ratio comfortable, and our ratings stable. We expect that our group profit for the full year will once again exceed the one-billion mark.”