Wiley reaffirms 'flat' revenue for FY16

YOU’VE REACHED YOUR ARTICLE LIMIT

Sign in or register below for free to unlock 2 articles each month and receive personalised newsletters to your inbox.

OR

Help support our journalism and subscribe with unlimited access.

Subscribe from less than £3.50, and you'll receive:

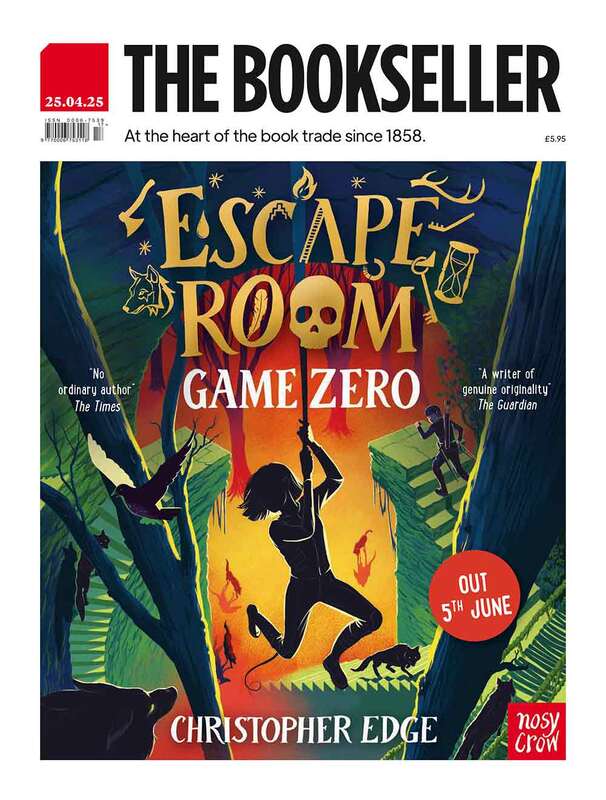

- Every issue of The Bookseller magazine

- Unlimited access to thebookseller.com (single user)

- The Bookseller e-edition app for tablet and mobile

- Subscriber-only newsletters

- Twice yearly Buyer's Guides worth £30

- Discounts on The Bookseller awards and conferences