You are viewing your 1 free article this month. Login to read more articles.

Winterson fears 'species wipe out' of London shops after business rate hike

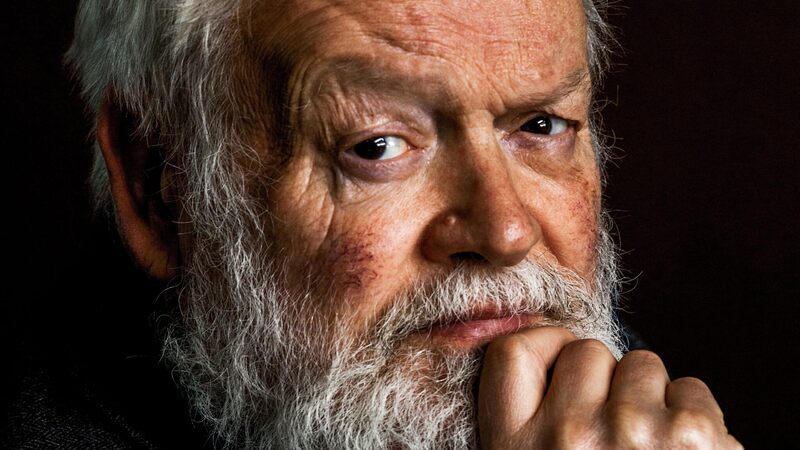

Author Jeanette Winterson has said she fears a "species wipe out" of small independent shops in London in the wake of the business rates re-evaluation set to come in April.

The author told The Bookseller she would be forced to close or sell her independent cafe and deli Verde & Company in London's Spitalfields after the business rate overhaul has pushed her bill up from £21,500 a year to £54,000.

The Oranges Are Not the Only Fruit writer also feared for the future of bookshops in the capital whose turnover is unlikely to be unable to sustain the rise.

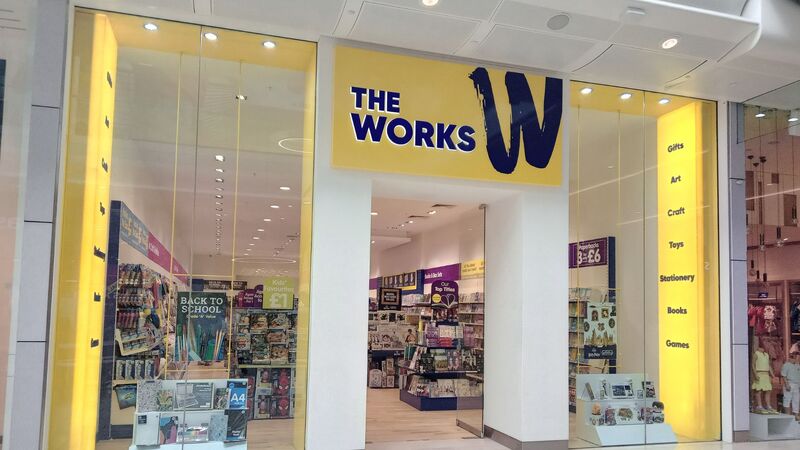

“The little shops will go and once they are gone, they will not come back," she told The Bookseller. "It is a species wipe-out, once they are gone, they are gone, and London will only have one type of shop (chains) left.

“Rent is high in London, so small shops can’t cope when business rates rise as well. They only can have so much turnover and especially something like a little bookshop, the economic scale isn’t there. These people who run little shops will not be able to."

The government recently released new ratable values for tens of thousands of businesses in England and Wales, effective as of April, in its first overhaul since the recession in 2008. Businesses in London and the south-east will bear the brunt of the changes, with rates set to soar because the rentable value of properties in those areas have increased, where in other areas such as northern towns like Blackpool, they have fallen.

Winterson also worried about what the policy will do to the capital and called on people to protest the revaluation and the government to reverse the policy.

“A lot of people in London are going to see a huge change in their local areas," she said. “Jobs will go, something important will go from the community and why? The rises are enormous. Even the big boys are squeaking about it, Selfridges and the Oxford Street shops.

“The government should reverse it. They have not thought about what it will do to the capital. London is special – there is no point in the rest of the country trying to argue it isn’t, it is, it attracts a lot of tourism and they want to visit little districts with their little shops, but they will be wiped out. I’m not joking when I say this is species annihilation."

She added: "Bookshops are really vulnerable. We re have to get out and fight this time, it is really important, we want our little shops."

The Bookseller has previously reported that Waterstones will be left with a £2m a year shortfall thanks to the new rates, a charge its m.d James Daunt said was "short-sighted" and "unjust".

Blackwell's c.e.o David Prescott has also said it will be adversely hit by the rate change in locations such as Oxford, where it has its flagship store.

At the time, Daunt said: "The estate is skewed towards London and the south-east, and we will especially suffer in central London. We have budgeted for an increase in the order of £2m per annum. I regard the taxation of physical retail businesses in this way to be short-sighted and regrettable; that the burden is to be so sharply increased simply exacerbates the injustice.”

He added: “It will reduce our profitability substantially. Because our business is particularly weighted towards London and the south-east, we have a major hurdle on our hands.”

Last March, the then chancellor George Osborne announced a reform which meant around 40% of indie bookshops would pay no business rates at all in the 2017-18 financial year, after he increased the rateable value threshold from £6,000 to £12,000. Meanwhile, properties of a rateable value of between £12,000–£15,000 benefited from “tapered” relief.

The Department for Communities and Local Government (DCLG) has said that nearly three-quarters of all UK businesses will see no change—or even a fall—in their bills. It estimates that from April, 600,000 will be exempt from paying business rates altogether. “Firms need to be confident that the rates they pay are accurate and fair, no matter where they are in country, and these updates will give them that reassurance,” a DCLG spokesperson said.

“For those rate-payers facing increases, London will benefit more than anywhere else in the country from the transitional relief scheme with almost £1bn of support [for properties with a rateable value of £12,000– £15,000] over the next few years.”