Graphic novels help small publishers stay level year-on-year

After what seems like the longest January in history, we are now more than a month into 2025, and the chart headlines have been dominated by Nathan Anthony, Jennie Godfrey, Sue Lynn Tan and – of course – Rebecca Yarros.

The success of these authors’ books, according to Nielsen BookScan’s Total Consumer Market (TCM), has provided Penguin Random House (PRH) with two number ones and Hachette and HarperCollins with one each, meaning that our charts focus has concentrated on the larger publishing groups. But what of the smaller publishers?

The Bookseller’s Small Publishers charts in 2025 include groups with annual turnover of less than £5m via Nielsen’s TCM in 2024. In our latest update, small-publisher regulars David Fickling Books and Sourcebooks have moved above this benchmark – mainly thanks to Jamie Smart and Freida McFadden.

Conversely, Curious Universe – the publisher behind children’s activity books from Bookoli and Hinkler – saw a decline in the last 12 months, meaning they are now included in this cohort. Thus far in 2025, the group has recorded TCM sales of £279,749, a reduction of 18.7% compared with the same period in 2024 – so they are likely to continue in our small publisher list for another year.

The full TCM for the first four weeks of this year has seen an increase in sales of 1.8%, a total of £2.2m, which is almost identical to the amount Onyx Storm delivered in week four. Excluding the third instalment of Yarros’ Empyrean series, the TCM is down 0.1% – a difference of around £100,000. Our list of small publishers has remained near-enough flat though, with total sales down only £1,251 for the period.

Small publishers have generated £2m in the TCM’s graphic novel categories, representing 12% of total sales from this list

Despite this, there are some fluctuations at individual publisher level – while Curious Universe was our biggest publisher in the first month of 2024, it is New River Books that has taken the top spot this year. This is thanks to one title sitting at the very top of the Small Publishers chart – The Glucose Goddess Method by Jessie Inchauspé. The book was first published in 2023 but has seen a surge in popularity this year following a two-part Channel 4 series at the beginning of January. It has helped New River to a total of £334,691 so far in 2025, a 607.3% increase against this point in 2024.

While Inchauspé has delivered the bulk of that increase, New River – which released its first books in 2023 and was founded by Aurea Carpenter and Rebecca Nicolson, the duo behind indie Short Books, which they sold to Hachette in 2019 – has still seen an increase off a modest base with the health guru’s sales excluded; its non-Inchauspé books are worth £6,191 this year, up against 2024’s £1,715.

The second and third biggest publishers so far in 2025 are Yen Press and Dark Horse Comics – the comic book publishers have seen combined sales increase by more than £100,000, accounting for half of the category’s year-on-year increase. Small publishers have generated £2m in the TCM’s graphic novel categories, representing 12% of total sales from this list, just a small amount less than the rest of fiction combined. This number is spread across more than 11,000 individual ISBNs, with an average of just 10 copies being sold for each one. So, while it is one of the biggest categories for small publishers, it is not represented in the overall Top 50; 2025’s bestselling graphic novel Solo Leveling, Vol. 8 ranks 59th with 2,200 copies sold.

With overall sales flat and graphic novels delivering a year-on-year gain of circa-£211,000, there must be some losers. While all the categories have experienced some fluctuations, the biggest decline comes from design and commercial art, which has dropped £211,050. Gabrielle Chanel – a history of the fashion designer from V&A Publishing and a tie-in to an exhibition at the museum last year – accounts for 89.6% of that decline. The hardback edition was the fifth-bestselling title from small publishers in January 2024 and, combined with the paperback, it delivered £192,135 in the first four weeks of 2024, while in 2025 that number has dropped to just £3,482.

In the Spotlight

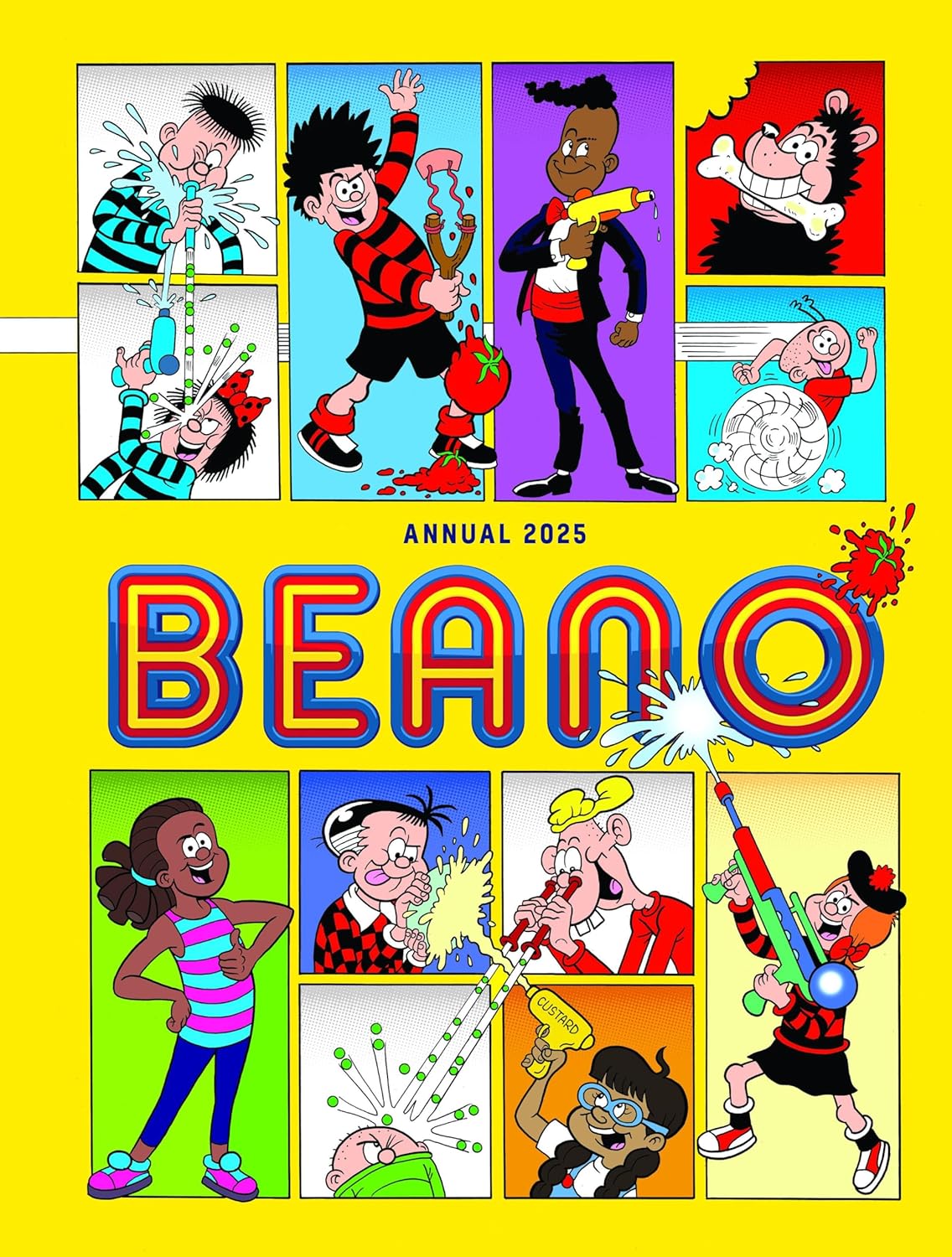

Beano

Beano Annual 2025

DC Thomson, £11.99, 9781845359911

The Beano Annual is a mainstay of any annuals display in the run-up to Christmas – and subsequently the January sales. In January 2025, volume sales are down 8.9%, but value sales have remained flat thanks to an increased average selling price. This pattern is represented across the board with the ASP on the entire annuals category up more than £1 for small publishers – delivering an extra £4,600 – despite a reduction in quantity of 5,286 copies.