You are viewing your 1 free article this month. Login to read more articles.

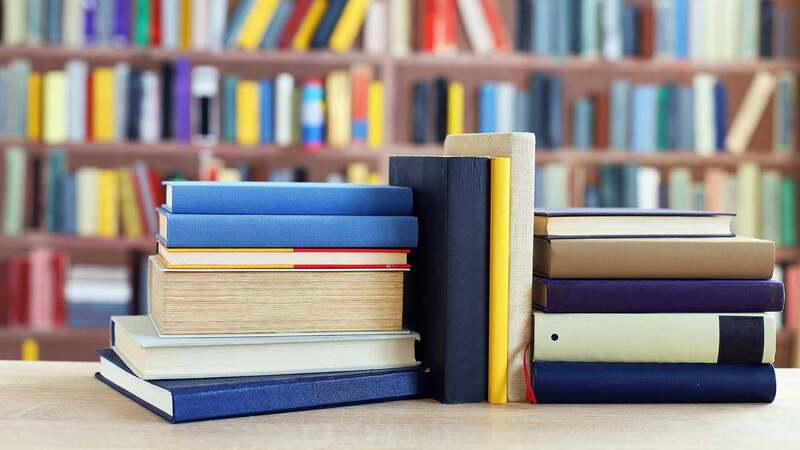

The power of the backlist

Frontlist audiobooks get the lion’s share of marketing spend, but backlist titles really pull in the listeners.

While it’s often the lavishly-created frontlist titles that are the marketing hooks used by the audio platforms to attract customers, in mature audiobook markets it’s the backlist that generates the most consumption. Who wins in this scenario? The publisher or the platform or the listener?

We are all used to audiobook services promoting the new bestsellers or brandishing their marketing campaigns with the faces of A-list authors and brand new book jackets. It’s commonplace and obvious to see those same titles then placed prominently within the platforms’ store fronts, and to receive email blasts and push notifications about the next must-read bestseller. And we all certainly see these titles always reflected in the Top 10 charts, don’t we?

But this doesn’t necessarily tell the story of what’s actually being consumed by listeners. Data garnered and amalgamated from across Beat Technology’s platforms in 10 European markets allows us to explore the ramifications for the listener, the publisher and the platforms.

Across the board, less than 20% of listening-time spent on the services comes from frontlist titles. Admittedly, the picture isn’t always as clearly defined as frontlist vs backlist, as some services include podcasts and the grey area of platform-exclusive original content (two wholly additional topics). But the statistic and its related questions remain, in that, for all their pomp and bluster, frontlist audiobooks certainly seem to underperform against their perceived expectation.

Let’s look at the story through the backlist lens which seemingly punches way above its weight.

Traditionally, backlist audio sits on a fragile P&L fault-line. Publishers’ decision-making around which titles to record sits in uncomfortably between production cost versus financial return, likely discoverability and the potential loss of rights to platforms or competing publishers. It’s a conundrum and one that can’t be viewed only in the short-term.

It’s fair to say backlist audiobooks involve a long-tail strategy and have longer earn-out periods versus their frontlist cousins, but given this huge consumption metric for backlist titles on services (remember it’s 80%), the opportunities are significant and improving all the time.

Improvements to the profitability of backlist recordings have arrived in many forms, sometimes production-related and others involving simple publisher-marketing forethought. While the quality of the recordings and the voice can never be compromised, publishers should invest strategically and carefully when choosing narrators.

Finding the correct voice for the narrative is key and certainly doesn’t always have to be a household name.

The last two years have shown a 200% growth in searches for narrator names indicating a trend towards loyalty to a particular voice. That statistic also applies to “unknown” voices as much as it does, famous names. In tandem with this, savvy publishers seeking to record author cannons – and , in particular, book series – have benefited from this search statistic in terms of their revenues as well as the profitability of volume recording deals with studios.

It’s also impossible to avoid the subject of potential positive profitability impact of synthesised voice recordings (AI) where appropriate and always insuring the quality is of a high enough standard so as not to compromise the users’ experience. As technology improves rapidly, and in multiple languages, the prospects for larger audiobook catalogues and even quicker earn-out periods are super significant.

For all their pomp and bluster, frontlist audiobooks certainly seem to underperform against their perceived expectation

Right here, I’ll suggest something obvious and lightly controversial. Publishers’ frontlist titles equate to expensive consumption for a platform to pay out against. Deeper backlist titles are often bear lower royalties. Original or platform-owned content may bear no royalties. In short, perhaps these frontlist titles are mostly the marketing hooks to draw consumers in, to then later be served lower royalty titles. Even if so, when understanding this reality, the publisher still stands to benefit from this shady reality.

Of course we shouldn’t discount those powerhouse frontlist A-listers. In fact, when planned correctly, an author’s backlist, a specific genre-category or maybe a whole imprint, can use the weight and prowess of a more costly frontlist recording and its associated marketing campaign as the springboard from which to launch a whole rabbit-hole deep dive into the backlist. And the more canny publishers don’t even have to juxtapose a backlist recording plan with a frontlist title of their own. Just as with the traditional print world, audiobook publishing schedules should be crafted with an awareness of what else is being published more generally, a consideration of seasonality and an cognisance of consumer trends and habits.

When the stars align – and why shouldn’t they in the ludicrously intelligent world of publishing – all parties stand to benefit: publisher, platform and listener.

If publishers follow their traditional instincts on what to create, price fairly and then market astutely, their investments will reaper quicker and longer-term rewards. Moreover, they can retain their rights. Platforms retain the benefits of major frontlist titles still, along with much deeper high-value catalogues supported and upsold by publishers – all providing cost-effective user-retention.

Most importantly, the listener, will be more likely to get the next great listen with less fear of poor recordings and weak recommendations. The listener wants relevance, ease of access, quality, value and enjoyment.

The frontlist may shout the loudest and be the bait that attracts listeners, but statistics clearly tell us it’s the backlist that actually roars relevance, depth and value for longevity and listener loyalty.