You are viewing your 1 free article this month. Login to read more articles.

Digital Census 2015: five key findings

Tom Holman looks at the five biggest talking points from this year's Digital Census.

More reading on smartphones, sizeable digital sales growth despite talk of a slowdown and deep divisions on pivotal publishing issues—these are among the headlines of this year’s Digital Census. Tom Holman picks the five biggest talking points

1. Mobile overtakes tablets and dedicated e-readers as the device of choice

The shift to reading on phones is perhaps the most significant finding. Last year’s Digital Census found that for the first time more people were reading on iPads than Kindles, but now more than two in five (44.6%) respondents say they commonly read on a mobile phone, surpassing both of the other devices.

Why the shift? The advance of smartphone technology, especially around screen size and resolution, is one reason. Another is the diminishing appeal of dedicated e-readers, with more and more people opting to carry a single, multi-use device instead.

But while the Kindle’s appeal may be slipping, Amazon’s popularity is decidedly not. It remains overwhelmingly the most common source of e-book purchases, with more than three-quarters (77.1%) of census respondents saying they regularly buy e-books from the online giant. Other e-book retailers, such as Apple’s iBook- store (11.8%), Kobo (6.4%), Google Play (6.1%) and Waterstones (5.7%), remain tiny by comparison.

2. Digital sales are still growing, but they are also slowing

For publishers, the year’s narrative has been the apparent slowing of e-book sales and the return to growth of print books. But the census has figures to dispute the theory that interest in digital content has peaked.

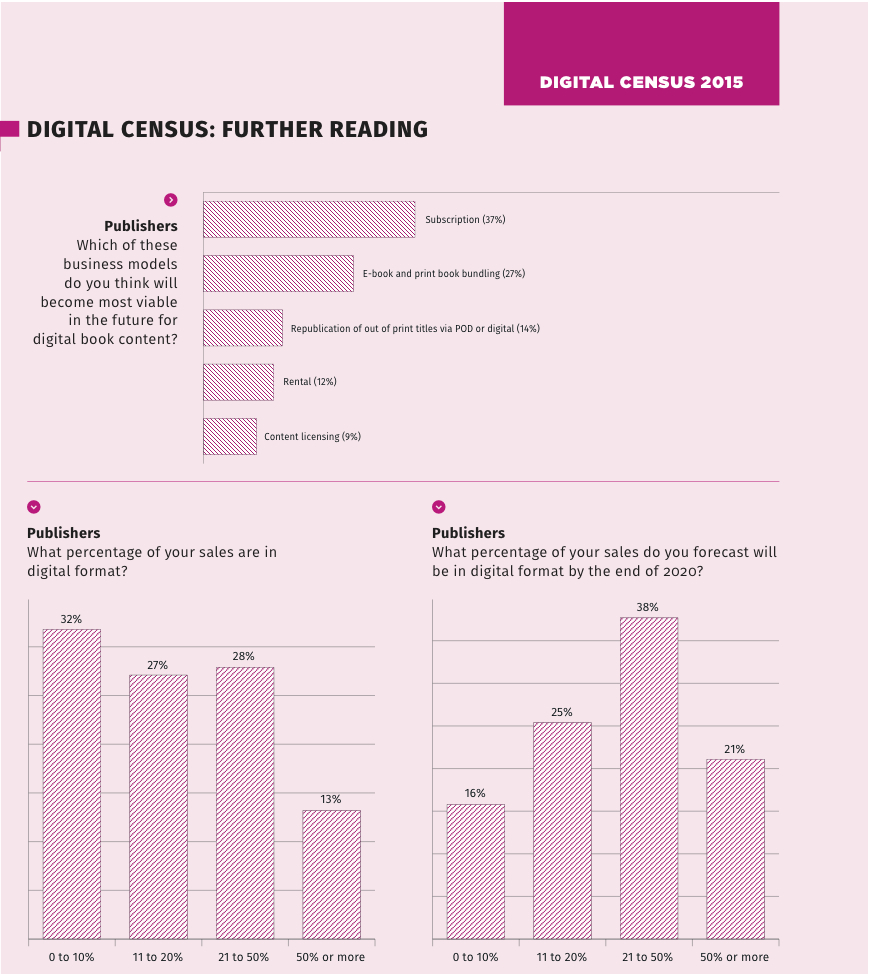

More than two-thirds (68.2%) of publishers say digital formats now account for more than 10% of their total sales, up from half (50.0%) last year. And for more than two in five (41.1%) publishers, digital formats now form more than 20% of their sales.

Publishers anticipate more digital sales growth. More than a third (37.7%) think digital formats will account for between 21% and 50% of their sales by the end of 2020, while a further fifth (21.1%) think they will contribute more than half. As one publisher says: “It’s part of the natural ebb and flow of innovation—e-books will continue to grow and evolve.”

Another theme of 2015 for publishers has been the retrenchment on apps and the rise of other multimedia content. The percentage of publishers producing apps has fallen, from 50.8% in last year’s census to 46.2%, while those producing audio content has gone the other way, from 39.3% to 47.5%. Publishers have found that digital technology makes producing and delivering audio much more straightforward, but many are concluding that apps are not worth the candle.

3. Self-love levels recede as many indie authors report lower satisfaction levels

Change is a constant among authors as well as publishers, and the eye-catching trend in the census is a cooling of enthusiasm for self-publishing. On a scale of one to 10, authors who publish their own books rated their satisfaction at 6.7—a point higher than traditionally published authors (5.7), but down on last year’s rating of 7.1. More authors are realising they will not make their fortune in self-publishing. Half (50.9%) of those responding have sold fewer than 1,000 e-books so far, and only one in eight (12.4%) has sold more than 50,000. For many, the realities of self-publishing are hitting home.

4. Publishing remains very much divided on matters digital

Amid so much digital change for publishers and authors, the census reveals opinions are split on many issues.

The first is pricing. Around two-thirds of all respondents think e-books should sell for either a slight discount (35.8%) or a significant discount (29.4%) from their print equivalents—but nearly a quarter think they should cost around the same as either the r.r.p. (7.7%) or the “street” price (15.5%) of the print edition. But discounting risks a race to the bottom, and 52.5% of respondents worry that e-books are now being sold too cheaply. “Low e-book prices communicate to customers that the value of a book is in how it is made, not what it contains,” says one publisher respondent.

Second is e-book royalties; roughly half (48.6%) of respondents think e-book royalty rates should be the same as print, but many think they should be higher (34.7%) or lower (13.9%); the rest (2.8%) favour some other mechanism.

Third is the agency model. Given three options, just under half (45.1%) think this is a smart move that will keep value in the market; more than a third (38.2%) think it is something publishers may regret but had no choice over; and the rest (16.7%) consider it a disaster.

Finally, Digital Rights Management. Two in five (42.7%) respondents think publishers should remove DRM from their e-books, but 30% think they should not. The rest (27.2%) are unsure.

5. …And the majority believe publishers remain unprepared for what is coming

The Digital Census also uncovers alarm at the ever-rising dominance of web-based giants, including Amazon at the expense of bricks-and-mortar retailers, and Google at the expense of libraries and publishers. Some are anxious that publishers are still not doing enough to adapt to change, under-investing in innovation and training in particular. Almost half (49.7%) think the sector is not prepared for the next stage of the digital revolution; the rest think it is (14.6%) or don’t know (35.7%). “We are so far behind the curve when it comes to technology,” admits one publisher.

But there are many reasons to be optimistic too. For one thing, two-thirds (66.9%) of respondents think rising digital sales will grow the overall books market rather than shrink it. And despite concerns that consumers now have so many more distractions, nearly half (48.4%) say they read more since they started buying e-books, with very few (7.7%) reading less.

On balance, within this poll of the industry at least, the future looks bright. More than half (51.4%) are optimistic about the prospects of reading and learning for coming generations, and only a small fraction (5.7%) pessimistic, with the rest somewhere in between. Whether on paper or in pixels, the appetite to read is not diminishing.

This article was originally published in the content.yudu.com/web/1vcls/0A1xp12/FB2015/index.html">FutureBook 2015 programme. For more on the conference click here. Tickets can be purchased here.