You are viewing your 1 free article this month. Login to read more articles.

Europe’s retail chains in flux

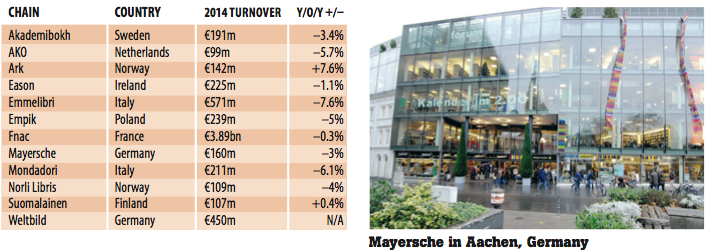

The bookselling landscape throughout Europe is in a state of flux. A look at the performance of major book retailers on the continent in the summer of 2015 shows that consumer confidence in many countries has not yet recovered from the recent economic downturn. While there were no large- scale bookshop crashes in recent months—like that of Dutch book chain Polare earlier last year or Germany’s Weltbild in 2013—sales losses are the order of the day, resulting in further consolidation and restructuring.

During the past two or three years, the landscape in many book markets has changed drastically. These days, very few bookselling companies go about their business by sticking to proven concepts. Faced with eroding sales and the continuing migration to online shopping, most chains instead rely heavily on cost-saving measures, including job cuts and the downsizing of stores.

Take Hugendubel for example: Germany’s largest family-owned chain has just announced the temporary closure of its 3,000 square metre branch in Berlin’s borough of Steglitz at the end of January 2016. Following extensive reconstruction works, Hugendubel will move back in on the ground floor in mid-2016 but with only 1,400 square metres of space, including a sizeable coffee shop. It will let the remaining sales space. In the meantime the bookseller is looking at renting a nearby interim outlet.

All in all, Hugendubel has reduced its presence in the capital from nearly 11,000 square metres in 2011 to 2,900 square metres across three locations.

It would appear that it is also not a good time to put a book chain on the market. Germany’s Thalia was taken off the block at the end of 2014 after no buyer emerged for the bookseller, which is owned by US investor Advent International.

And in Sweden it took Kooperativa Förbundet two years to offload Akademibokhandeln. The country’s largest bookseller was, however, sold to investment company Accent Equity in the early summer for an undisclosed sum.

While the search for the holy grail—in this case, workable strategies to safeguard the future of bricks-and-mortar bookstores—continues, there is at least a silver lining: a growing number of companies are going about their business with more composure and better judgement than they did a year or two ago. Some are also expanding again, albeit cautiously. Germany’s Mayersche, for example, recently announced that three new bookshops are in the pipeline for 2015.

Among the preferred tools for a viable store concept, two stand out: non-books and multi- channel. Many bookstores on the continent nowadays resemble gift shops with piles of non-book products—much loved by management because of their higher margins— greeting customers instead of book displays.

Multi-channel is booksellers’ favoured term to describe their various efforts of interlocking offline and online business, including click and collect, free WiFi, e-readers/ reading apps and search engines on the shop floor. Concerning e-readers, Kobo—which is being sold by the French chain Fnac, as well as by Feltrinelli and Mondadori in Italy—has lost ground in continental Europe to the German Tolino alliance.

Apart from its home market, Tolino has recently set up partnerships with Standaard Boekhandel (Belgium), Libris Blz (Netherlands) and Emmelibri (Italy). More are expected to follow.

Thalia (Germany)

Turnover: €950m (estimate)

Shops: circa 300

Management: Michael Busch and others

Webshop: www.thalia.de

Ever since US investment company Advent International took over German retailer Douglas Group in 2012 (it has begun dismantling it recently), speculation about the future of bookselling division Thalia has been doing the rounds. while Germany’s largest bricks- and-mortar bookseller seems to have been taken off the market for now because none of the interested parties was prepared to pay the asking price in a challenging retail climate, the restructuring and modernisation of the company is ongoing. The speed with which branches have been closed or downsized is clearly slowing down, but the management is still going through the large shop portfolio with a fine toothcomb. New openings have been reduced to a minimum with sizes ranging between 100 and 500 square metres. Currently Thalia operates around 300 bookshops in Germany, Austria and switzerland (since 2013 in a joint venture with local market leader Orell Füssli) which generated an estimated €950m in 2014. Most Thalia branches offer a deep book range with an emphasis on children’s books and adult fiction, plus the inevitable non- books offering ranging from stationery and cards to gift items. Like Hugendubel, Thalia is a founder member of the successful German e-reader initiative Tolino.

Librerie Feltrinelli (Italy)

Turnover: €291m (-4.6%)

Shops: 118 (105 owned, 13 franchises)

Management: Carlo Feltrinelli, Roberto Rivellino

Website: lafeltrinelli.it

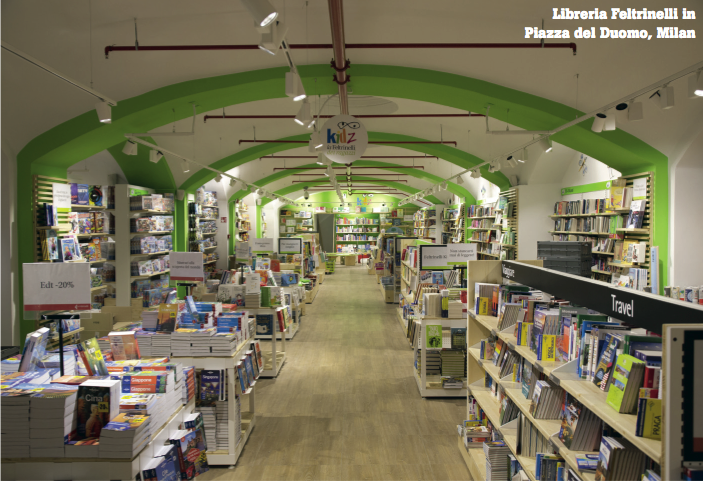

Owned by the Feltrinelli family, Librerie Feltrinelli is one of the most popular retail brands in Italy. Based in Milan and owned by the Feltrinelli family, the chain currently operates 118 shops in seven different formats tailored to each location, including 31 Librerie Feltrinelli bookshops, 31 laFeltrinelli Libri e Musica, 13 franchise stores (Feltrinelli Point) and two branches of Feltrinelli ReD (Read eat Dream) that combine books, a culinary marketplace and a restaurant under one roof.

Feltrinelli has a reputation for sticking to the carefully orchestrated expansion of its bookselling business even when times are tough. One recent example: a sales decline of 4.6% didn’t stop the family joining forces with Italian luxury retailers Gucci and Versace in the spring; each business is investing €1m in the modernisation of Milan’s historic shopping arcade Galleria Vittorio emanuele—and a new, 2,500 square metre Feltrinelli bookstore will open there.

The first Feltrinelli bookshop opened in 1957, only two years after the publisher Giangiacomo Feltrinelli editore was founded, which is also still owned by the family. Feltrinelli is still a classic bookseller, but it has also embraced non-book products such as music, games and stationery. It also sells Kobo’s e-reading devices.

Standaard Boekhandel (Belgium)

Turnover: €207m (+4%)

Shops: 145

Management: Geert Schotte

Website: standaardboekhandel.be

Standaard Boekhandel is a company that shuns the limelight, but reliably delivers year-on-year growth. It was founded in 1919 and has been owned by newspaper company Zuidnederlandse Uitgeverij since 2002. Under the leadership first of Frans schotte and, since 2012, his son Geert schotte as m.d., standaard Boekhandel has grown from 59 shops in 1991 to 145 today. Apart from books, stationery, CDs and DVDs, comics and magazines/ newspapers are also sold in the stores, which on average occupy 250 square metres. In July 2014 the largest bookseller in the Flemish- speaking Flanders region of Belgium was the first international company to join the Tolino e-reader alliance.

Only a few months earlier Standaard Boekhandel announced its first foray into the French-speaking part of Belgium by acquiring the Club chain for an undisclosed sum from Distriplus. In its 28 branches Club sells books, stationery and office supplies. Because of the language divide in Belgium, Standaard Boekhandel, which is little known outside Flanders, will run the Club shops under its established name. The sales figure of €207m for 2014 does not include Club’s numbers. All shops are run as “soft” franchises.

Indeks Retail (Denmark)

Turnover: €181.9m (-23%)

Shops: 188

Management: Marianne Pedersen

Website: boghandleren.dk; bog-ide.dk; boegerogpapir.dk

Indeks Retail may be little known outside Denmark, but as the holding company for the three book chains Bog & idé, Bøger & papir and BOGhandleren, it is one of the most important and influential players in the country’s book industry. Also part of the holding is stationery specialist Legekaeden, which Indeks Retail bought for an undisclosed sum two years ago. Between them the quartet has 188 branches, about half of which are run as Bog & idé, one of Denmark’s best-known brands. Indeks Retail, set up in 2005 after the merger of Bog & idé and Boger & papir, went through a rough economic patch that led to the surprise departure of managing director Henrik Christensen at the end of 2014. He was succeeded by Marianne Pedersen, who was brought in from retail chain XL-Bygg to implement a more modern, customer- oriented strategy, sharpen the company’s digital profile and return it to profitability; altogether a stiff task in Denmark’s current weak retail climate. In 2014 Indeks Retail reported sales of €181.9m, down 23%. while this looks dramatic, the decline is due in no small part to a discontinued business co-operation with 14 office supplies shops.

Hugendubel (Germany)

Turnover: €390m (estimate)

Shops: circa 85

Management: Maximilian and Nina Hugendubel, plus others

Website: hugendubel.de

Following a major upheaval in 2013/14, when Hugendubel was forced to sever its close business ties with financially stricken weltbild, the family-owned bookseller is back on track. with siblings Maximilian and nina Hugendubel in the driving seat, the bookseller has closed an unspecified number of branches over the past two years and is in the process of changing its retail concept from XL-sized stores to a more manageable selling space of around 600 square metres.

E-commerce and a dedicated concept of combining online and offline channels play an important part in the company’s strategy. With 85 specialist bookstores and a successful online shop, which was recently boosted by the acquisition of a majority share in eBook.de from wholesaler Libri, the “new” Hugendubel is Germany’s largest family-run bookseller and continues to be a power player on the German high street. The Munich-based company also runs small shop-in-shops in Karstadt department stores. Total sales for 2014 are estimated at €390m. Together with Thalia, weltbild and Deutsche Telekom, Hugendubel is a founding member of the German e-reader initiative Tolino. While digital plays an important role in Hugendubel’s strategy, the focus remains on the bricks- and-mortar stores, which date back to 1893.

Other major European chains