You are viewing your 1 free article this month. Login to read more articles.

Global 50 Publishing Ranking 2024: profitability continues to rise, but sales are not soaring

The brakes have been pumped on post-pandemic sales growth, though profitability remains enviable

The huge revenue spikes of the post-pandemic era have slowed for the world’s biggest publishers, but the top 10 groups’ modest growth still propelled them to a record haul.

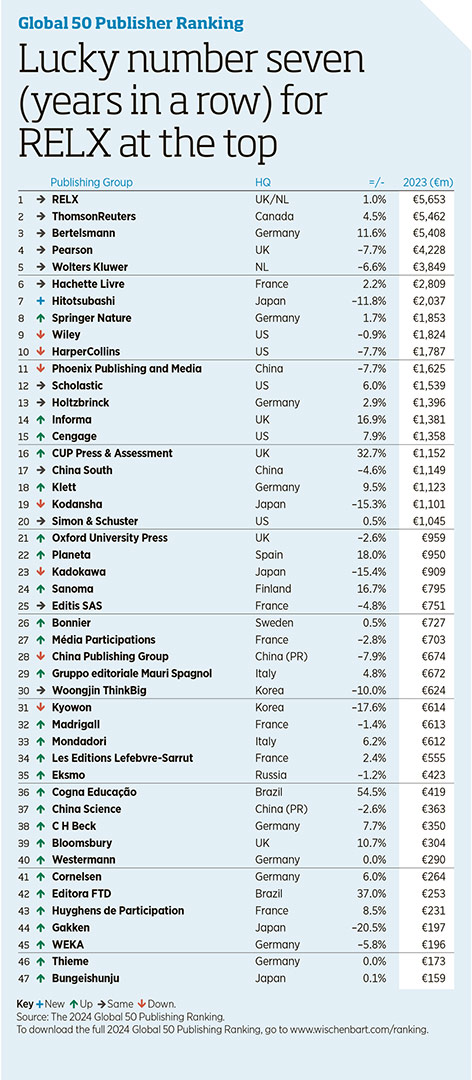

That is one of the topline findings of the 2024 Global 50 Publishing Ranking, the annual report of the international trade’s biggest houses, compiled and researched by Ruediger Wischenbart Content and Consulting since 2007. This year’s edition covers the fiscal year 2023, with revenue figures shown in or converted to Euros, as that is the currency in which a plurality of the list (19 groups) report.

The Global 50’s top 10 earned a tasty €35.9bn in 2023, a best-ever result, though it represents a modest gain of 1.1% year-on-year. Compare that against the previous year’s list when the Big 10 had a collective 10.8% jump and 2021 when it was 9.4%. Half the top 10 (Pearson, Wolters Kluwer, Hitotsubashi, Wiley and HarperCollins) had revenue contraction; in the 2023 ranking it was a perfect 10/10 of growth, with Hachette Livre the slowpoke at “just” a 5.8% lift.

You might want to put the Kleenex away if you are feeling sad for those big groups with sales slips, as the more nuanced picture is rather rosy. The Global 50’s overall chart focuses on revenue and not profit—though Wischenbart’s full report provides deep dives into most groups’ financials. Actually, keep that Kleenex, as the bulk of these big players are still reaping eye-watering gains.

Take Pearson, which had a sales dip of 7.7% to the equivalent of €4.2bn in 2023, but c.e.o. Omar Abbosh (in an early task after taking the reins at the beginning of the year) was able to announce a 31% rise in operating profit to €684.3m (£573m). Similarly, Dutch Science, Technical and Medical giant Wolters Kluwer’s overall sales dropped 6.6% to €3.8bn but its annual operating profit hit €1.5bn.

Once again there remains a remarkable consistency at the head of the ranking, with the top six groups fixed in the same positions they have held for the past four years. Elsevier parent RELX retained its iron-like grip on the top spot for the seventh straight time, a €192m gap between it and second-placed Thomson Reuters.

Missing links

The entire list earned €61.6bn, down on the previous chart’s €62.9m. But eagle-eyed readers will have spotted a very good reason for the contraction: 2024’s Global 50 is, for the first time, not playing with a full deck, as only 47 groups could be verified to have eclipsed the €150m in annual turnover threshold needed for inclusion.

Of course, several publishing houses would undoubtedly merit a place if a proper peek at the P&Ls were available. Some are private companies in markets that do not require large entities to file results publicly. US schools and higher education powerhouse McGraw Hill, for example, has not made full annual reports available since its acquisition in 2021 (and return to private ownership) by investment firm Platinum Equity. It does, however, press-release truncated figures, and in May this year said its 2023/24 “total billings” were at $2bn with an EBITDA of $728m.

Continues...

A handful of groups included previously, most on the ed-tech edge, have shifted focus so that they are no longer truly in the books world. The Freiburg-headquartered Haufe, for example, told the Global 50 report writers that it now views itself as a software company, not a publisher. There has been a casualty of geopolitics: Prosveshcheniye is Russia’s leading textbook provider—and thus closely aligned with the country’s government—and has not responded to queries about its financial status since the Ukraine invasion, so it has been delisted. Prosveshcheniye had previously been a solid, lower-half-of-the-list performer in the €300m to €350m range.

Then there are the inevitable acquisitions and corporate restructures that have taken away some players. Japan’s Hitotsubashi is this year’s only “new” entry, but it is the combination of Shueisha (11th in 2023) and Shogakukan (23rd). Hitotsubashi has always been the umbrella group for the two publishers, but changes in the company’s operations made it more sensible to list it under one name.

Rule Britannia

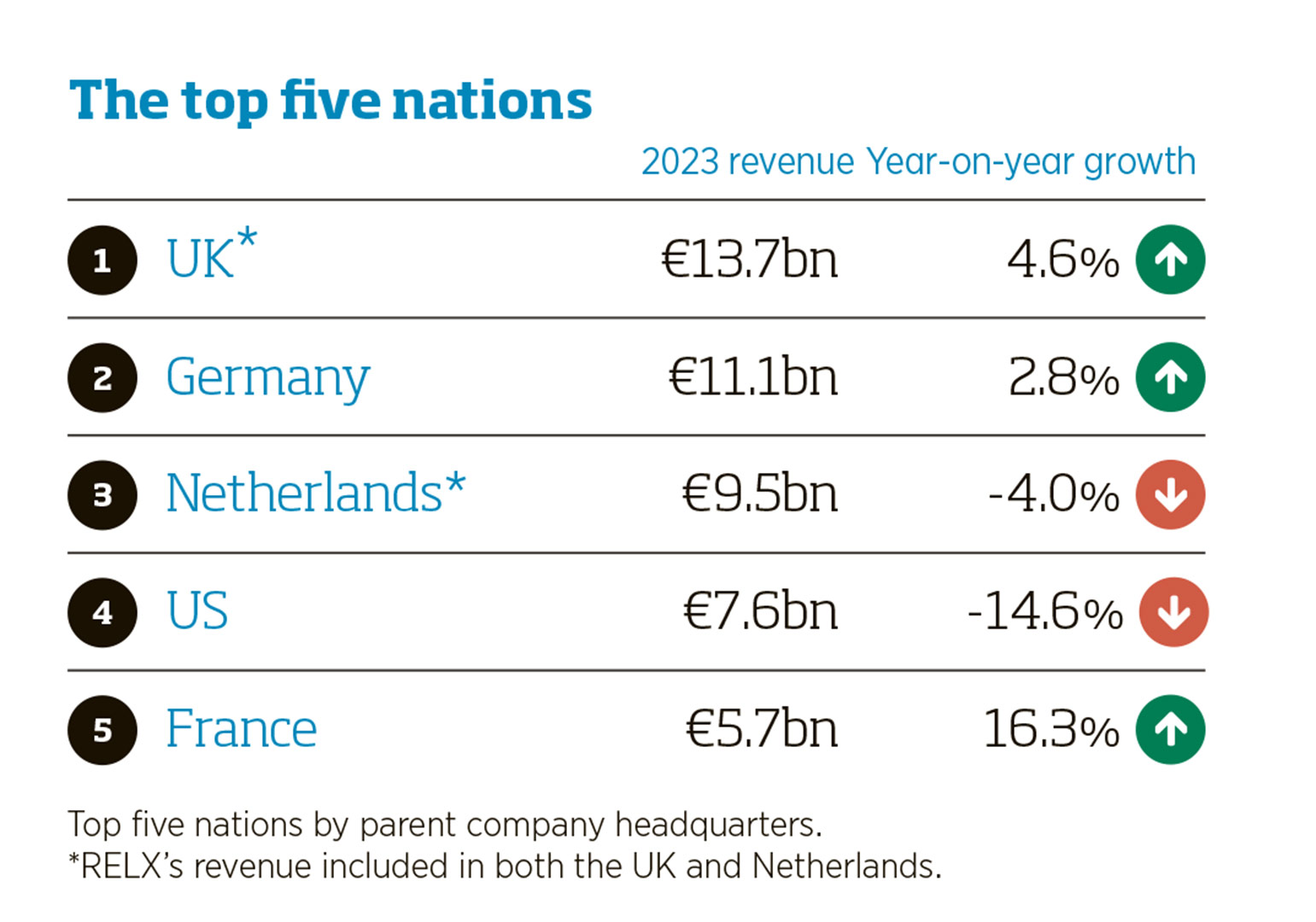

The UK once again led the nations’ league table, largely because two of the world’s four biggest publishers are headquartered in London (in fact, on the same street, The Strand, about 450 metres apart).

Seventy-five percent of Britain’s €13.7bn was generated by RELX and Pearson but the academic and education behemoths weren’t the only stories. Only eight groups in the entire ranking had double-digit sales percentage jumps and three are British: Informa (+16.9% to €1.38bn), Bloomsbury (+10.7% to €304m) and Cambridge University Press & Assessment (CUPA), which catapulted up 33% to €1.15bn—and not for nothing, surpassed arch-rival Oxford University Press for the first time.

CUPA’s rise, of course, is down to the merger of CUP with the “A”, Cambridge University’s educational testing arm Cambridge Assessment, in 2021. But it also means it is by far the biggest mover up the chart, leaping 21 places and cracking the top 20 for the first time.

Continues...

The next-biggest climbers are Finland’s Sanoma and Brazil’s Cogna Educação, both of which vault seven spots. Cogna Educação had by far the biggest improvement in revenue percentage terms, of 54.5% (to €419m), after posting an 11.1% gain in the previous ranking. The jump was aided by a shift of focus to digital products but mainly a stabilisation of the Brazilian economy; São Paulo-based Editora FTD is the other high climber, on 37%.

At nine, Germany has the most entries in the ranking, topped by third-placed Bertelsmann’s €5.41bn—€4.5bn of which came from its trade division, a.k.a. Penguin Random House. PRH does not merit its own spot in the chart as it is not a stand-alone group, but that €4.5bn is the first time it has ever earned more than Pearson; impressive, as just five years ago Pearson’s revenue was €1.2bn greater than the world’s biggest trade publisher.

Every one of the US’ five entries are in the €1bn turnover club; its collective 14.6% revenue drop is largely down to HarperCollins’ sales sinking by €150m in 2023 (though in a continuation of a theme, its operating profit was still €153m). But as a result, HC dropped from seventh in the 2023 list—its highest-ever ranking—to 10th.