You are viewing your 1 free article this month. Login to read more articles.

Strong print sales through Nielsen’s TCM show first-half market at record level

Solid sales in fiction and another exceptional return in children’s has boosted sales through the TCM in the first six months to an all-time high.

Driven by a strong fiction market and a record haul in children’s, the first half of 2022 has notched up the biggest ever January to June run since accurate records began. In the first 26 weeks of this year, £767.7m has been generated through Nielsen BookScan’s Total Consumer Market (TCM), £19.5m greater than 2008, the previous first-half leader.

There are T&Cs. Lockdown data gaps prohibit direct comparisons to 2020 and 2021, though BookScan has estimated that both full years were all-time market highs, of £1.8bn and £1.82bn respectively. Though Nielsen strongly hinted in its Books and Consumer report that the initial six months of 2021 was very robust, it cannot provide first-half pandemic period data, estimates or otherwise. Measuring against the last full half-year of 2019, 2022 has jumped £71.4m (10.3%).

Another qualification is The Works joining the TCM panel in 2020. BookScan is forbidden to reveal individual retailer market share, but it seems that its booksellers can: in its 2021 annual report, The Works said “in our new relationship with Nielsen, data tells us that we represent nearly 10 per cent of the volume” of UK consumer books. As The Works is a discount chain, that volume probably means an added 5% to the overall market value.

The cost of living crisis hasn’t really bitten in the TCM. Compared against 2019, average selling price is marginally up in 2022 (£8.41 versus £8.40); the hardback share has increased slightly (31.9% to 30.8%); and hardback a.s.p. has jumped to £11.83 from £11.10. At this point, consumers are still paying more for books. This, of course, does not reflect declining margins for publishers and booksellers. And, as we revealed last week, there are some chinks in this armour—particularly shrinking Adult Non-fiction: Trade sales in the second quarter this year—which could make for a bumpy autumn.

Children’s is flying: the £187.5m earned in the first six months obliterates the previous record (in 2019) by £30m; the category should break the £400m mark for the first time ever by year’s end. Booming, too, is Fiction—thanks in large part to TikTok—which, at £205m, is the greatest first six-month haul in 12 years.

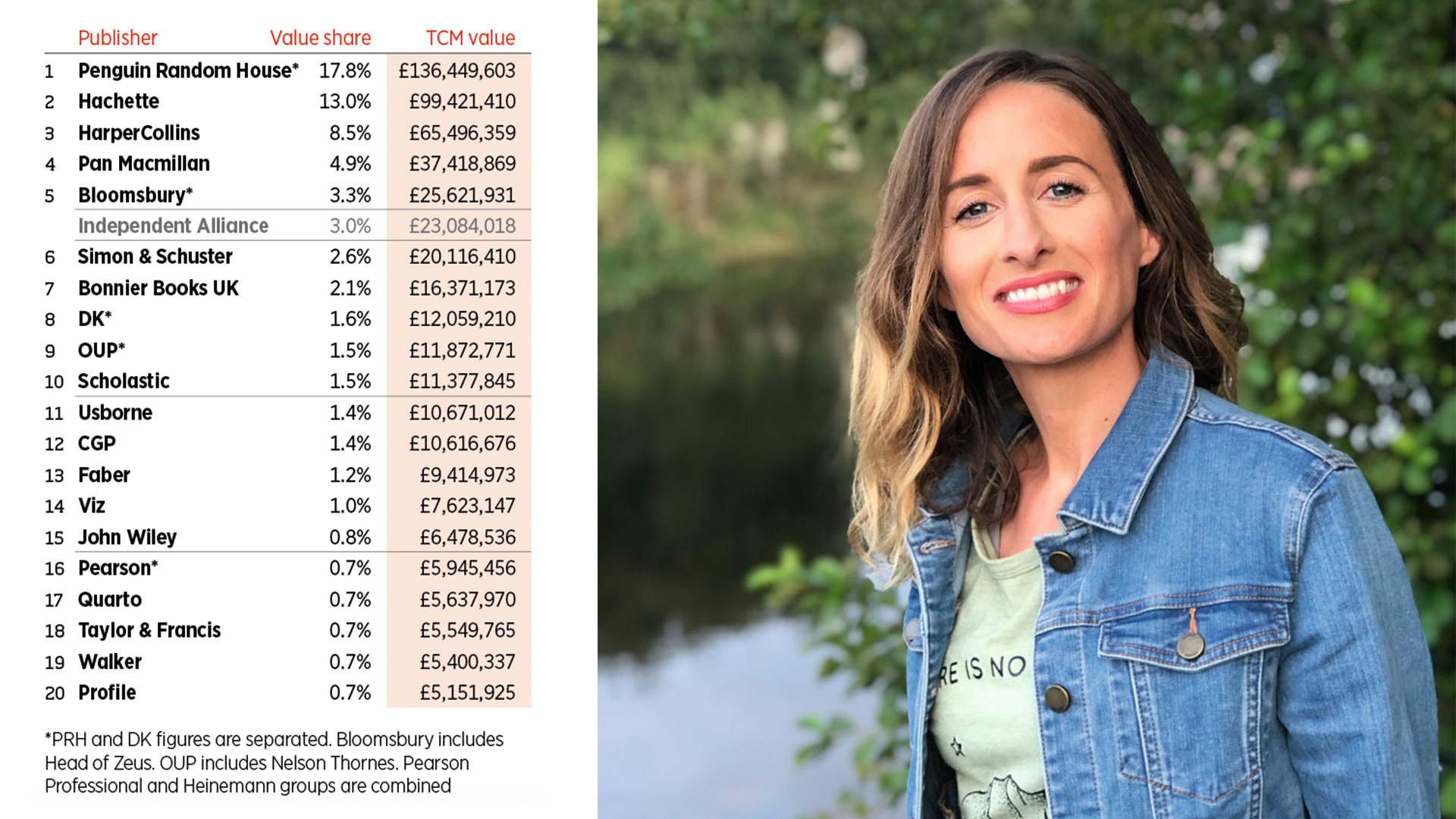

At the very top of the publisher league table, the big winners are Hachette and HarperCollins, which increased market share considerably from the last time we were able to run half-year tables, in 2019. A chunk of this is acquisition, including Hachette picking up Short Books and Laurence King, but particularly HC adding Egmont (now Farshore), which was the 20th-ranked TCM publisher in 2019. But it is not just growing the portfolio, as Hachette Children’s has had a standout year to date, led by Alice Oseman’s Heartstopper books (HC publishes Oseman’s non-graphic books), while Little, Brown has been strong with TikTokkers (Ali Hazelwood, a portion of Colleen Hoover’s list), underpinned by Delia Owens’ evergreen Where the Crawdads Sing. David Walliams has put in his usual shift for HC and Bella Mackie’s How to Kill Your Family has been its fiction breakout.

The big mover in the top 10 has been the British Book Awards’ reigning Publisher of the Year Simon & Schuster, which jumped from 10th to sixth and added a full percentage point onto its share

Penguin Random House remains by far UK publishing’s biggest beast, but it is fair to say that it has not had the most memorable 2022 to date: its 17.8% share is its lowest in a first half since the merger, with sales increasing by just £1m (or 0.7%) from 2019, in a period in which the market as a whole has improved by 10.3%.

The big mover in the top 10 has been the British Book Awards’ reigning Publisher of the Year Simon & Schuster, which jumped from 10th to sixth and added a full percentage point onto its share. In topping the bestseller list by some 50,000 units, Hoover’s TikTok smash

It Ends with Us is S&S’ first-ever half-year overall number one. But the biggest winner in the Top 20 is Viz, which blasted from 53rd place to 14th. Thus far in 2022, the Manga giant has exceeded its TCM totals in every other full-year total barring 2021, and outsold its entire output of the Noughties.