You are viewing your 1 free article this month. Login to read more articles.

What lies ahead for the new version of Waterstones

Industry figures have outlined their hopes and fears for Waterstones following its acquisition by hedge fund Elliott Advisors last week.

Industry figures have outlined their hopes and fears for Waterstones following its acquisition by hedge fund Elliott Advisors last week.

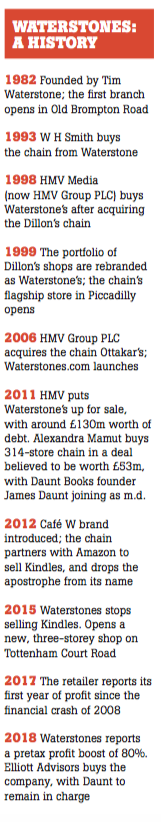

The UK arm of American "activist" hedge fund Elliott Management took on a majority stake from Russian businessman Alexander Mamut, who bought the ailing Waterstones in 2011 and helped return it to profit.

Elliott is providing all the financing for the transaction, with the sale due to be completed this month. Waterstones m.d. James Daunt is set to remain at the helm. Mamut’s Lynwood Investments will retain a minority stake, but the percentage of the business each will own has not been disclosed.

New York-based Elliott Management oversees £22bn ($31bn) in assets and often targets companies where stock is perceived to be undervalued, encouraging changes in leadership, spin-offs or share buybacks in order to increase the value for existing stockholders.

In recent years it has turned its attention increasingly to Britain with involvement in Game Digital, which it sold last month, as well as collapsed retailer Comet.

While it has recently shifted towards acting as a private equity business rather than an activist shareholder, analysts have told The Bookseller that Elliott was not an obvious acquirer.

Independent retail analyst Nick Bubb described Elliott as "an odd buyer", saying: "The staff will be entitled to feel nervous, given Elliott’s controversial record in UK retailing via Comet and Game." Douglas McCabe, c.e.o. at Enders Analysis, said: "If you were to list the ideal owners of Waterstones I am not sure anyone would have come up with Elliott, despite the optimistic public comments by James Daunt, and assurances regarding the leadership team and store openings."

Bubb agreed. "Private equity companies usually like to drive a turnaround and then move on after two or three years," he said. "But in this case the turnaround has already happened under Mamut and Daunt, with the business now back into useful profitability. It’s not obvious where the growth comes from now for Waterstones, or what the potential exit route will be for Elliott. More UK new store openings look unlikely, so it may be that they’re thinking of overseas expansion, but that is always risky."

Refinancing debt appears a more likely option, McCabe said. "The debt can be refinanced to grow value and, the industry should hope, investment cash for the business," he said.

Amazon could also be the "elephant in the room", he suggested. "Our sense is that Amazon’s share of the physical book market is now growing very slowly, in no small part due to the effectiveness of the Waterstones team and also the enhanced collective quality of the independent bookshop estate: the weaker shops have closed or been bought up and improved. The opportunity for enhanced profits and a better multiple may stem from this simple thesis regarding Amazon.

"So the best-case scenario is that Elliott focuses on leaving management alone, sustaining or growing investment funds for management, and concentrating on financial engineering without burdening the business with more debt... The worst case scenario is that profits become squeezed and the relationship sours. There would be very real consequences for publishers and readers if this were to happen."

Among trade insiders, one of the biggest concerns for the book trade is around staff. Agent Lorella Belli said: "The assets are the people there; if you start jeopardising that, you’ve bought something that isn’t going to be as profitable."

Long-term concern

However, an agent who preferred to speak anonymously warned: "I don’t think it’s possible not to have some level of concern when one of the most predatory, short-termist hedge funds is buying something so critical to British publishing."

Some shared relief at a buyer having been found six months after the chain went on sale. An independent bookseller said: "Waterstones on the high street is essential for everyone in the trade, including independent bookshops."

Among booksellers, Natalia de la Ossa, London Review Bookshop manager, said: "If it means expansion [by way of] reaching more readers and supporting the publishing industry and authors, then we welcome its investment. But there is...the danger that Waterstones will use its dominant market position to negotiate higher discounts... We sincerely hope Waterstones will invest in its staff as part of this— including increasing the rate of pay for booksellers."

Just one lone voice expressed dismay at Daunt staying on. "I was hoping for a change of management, because I think Waterstones is too centralised and doesn’t give enough autonomy to individual branch managers," the publisher said.

Meanwhile Gordon Wise, agent at Curtis Brown, said: "You wouldn’t find a single editor or agent who is overjoyed at the rather modest orders Waterstones tends to put in for books. It also remains opaque as to how much buying is a head office decision and how much is local stores."

Daunt told The Bookseller: "[The priorities] remain constant: improve our bookshops through better bookselling and a better selection of books; improve also the selling of things that are not books – these can make bookshops more interesting and compelling, as well as make us more money; run more efficient and more alluring cafés; and improve the estate, both through investment in existing shops and through opening new ones. Beyond the shops and our booksellers, invest in our website, in our IT infrastructure and in our logistics, especially The Hub [distribution centre]... There is a perception that the new owner will wish to see growth and that this is good news."

The new owners: trade reaction

Jonny Geller

Jonny Geller

Curtis Brown, joint c.e.o.

"I will say that an ‘activist’ private equity firm is likely to have ideas and want to see return pretty quickly. I hope that will come in the form of expansionist, creative growth plans, rather than the diminution of assets and leases. I suspect it will be looking at other media businesses on the high street or entertainment outlets in order to see if there are mutual advantages.

From the publishing and author point of view, I am most concerned about how it will continue to cultivate an inviting space in which to experience books. James Daunt has made good strides along that path, but that journey is not done yet and needs more investment in both the shopfloor and the staff. Waterstones proved that, with care, you can tackle the online challenge and sell books without an over-reliance on pencils, maps, coffee and overpriced greetings cards. I believe people are hungry for stories in book, audio, digital and in live events, and in all these areas waterstones could thrive. If not, I see a concentration of bookshops in privileged areas and a step backwards. that, we must fight.”

Richard Drake

Drake–the Bookshop, co-owner

"You can’t argue that there is very much change if you go from a russian oligarch to a financial company... there is not a huge shift. If it is all about asset stripping, then that is not good. We are in this situation for the foreseeable future.

If you consider when Borders closed... lots in the books trade rubbed their hands in glee because they thought people would buy more books [elsewhere]—but those people just stopped buying books. Having bookshops on the high street has to be a good thing."

Douglas McCabe

Douglas McCabe

Enders Analysis, c.e.o. and director of publishing and tech

“[Elliott Advisors’] role as activist investors should ring alarm bells across the publishing sector, and for readers. At the very least, it is hard to see it as a long-term owner looking for long-term value creation. It is in this to make money in the short or medium term, presumably three to five years.

It is possible it believes an investment programme to expand the footprint can deliver material value growth in the medium term, but chain bookselling has been a bumpy ride these past 30 years, and it is hardly getting easier."

Waterstones bookseller

"Everyone’s just weary. I suppose it’s comforting to know that James Daunt is hanging around despite the bloody nose he’s received for that communication failure over easter and the pay grades. It’s just uncertain times, and it never stops feeling uncertain. this is true of all high street retailing, to be honest."