You are viewing your 1 free article this month. Login to read more articles.

Bertelsmann formally completes full acquisition of Penguin Random House

Bertelsmann has formally completed the full acquisition of Penguin Random House (PRH), following the sale of Pearson's remaining 25% stake for $675m (£530m).

As Bertelsmann became PRH's sole owner, after the transaction was originally announced on 18th December 2019, c.e.o. Thomas Rabe reaffirmed it intends to develop the trade publisher over the long term and with continuity, both through organic and acquisitive growth.

Rabe said: "The completion of this transaction has a historic dimension for Bertelsmann: 185 years after C Bertelsmann Verlag was founded by the printer and bookbinder Carl Bertelsmann, our company will become the sole owner of the undisputed global market leader in book publishing. We are proud of the creative diversity, publishing quality, and commercial and entrepreneurial strength of our book publishing business, to which many of the most popular authors from all over the world entrust their literary work."

He continued: "We will ensure that our book business can continue to expand through organic growth and acquisitions in future, and remain a home for the world’s best creative talent. Books in all formats have a bright future. Their high degree of relevance is particularly evident at present during the coronavirus crisis, when many people are looking for knowledge and entertainment‚Äìand are finding it in books."

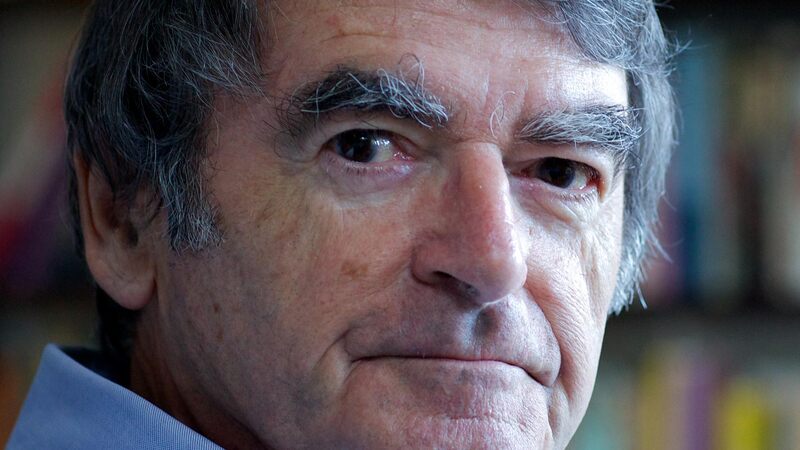

Marking Pearson’s exit from the venture, Pearson's outgoing c.e.o. John Fallon said: "As our joint venture with Bertelsmann comes to an end, we wish our colleagues and authors in Penguin Random House every future success."

He added, addressing the threat of the pandemic to Pearson's business, which has already led Pearson to pause its £350m share buyback: "While we are experiencing unprecedented times as a result of Covid-19, we are taking all precautionary measures to protect our business. Our balance sheet is strong, our net debt is relatively low, and we have good liquidity. Furthermore, the growing interest in online learning puts us in a strong position given our global leadership and investment in this area."

A spokesperson for Pearson said the firm was "looking at all options to maximise our liquidity and therefore will retain the proceeds from the disposal of our 25% stake in Penguin Random House to further strengthen our short-term financial position".