You are viewing your 1 free article this month. Login to read more articles.

Bertrams confirms its future is under strategic review

The future of the Bertrams wholesaling business is at risk following the sale of its online bookshop Wordery and the temporary closure of its book supply business as a result of the coronavirus lockdown.

A number of publishers have confirmed to The Bookseller that they have stopped or curtailed the supply of new books to the business as a result of unpaid bills, dating back to before the lockdown. The Sunday Times reported yesterday (3rd May) that the wholesaler will now appoint an administrator, confirming fears that have been spreading in the trade for some time.

Despite repeated requests by The Bookseller for a statement about the situation from its senior management and parent group Aurelius, the only announcement made last week was the sale of Wordery to Elliott Advisors, revealed late on Friday (1st May).

However in response to the ST report, chief executive Raj Patel told The Bookseller: "In light of the sale of Wordery, Erasmus and Houtschild businesses we are currently reviewing strategic options for the rest of the Bertram Group... The wholesale division supplies books to the high street which is currently problematic as the bookshops are closed with no indication as to when they might re-open." Aurelius ddeclined to respond to requests for comment, but a note posted on its website stated: "Separately, as a result of the economic uncertainty created by Brexit and more recently the Covid-19 pandemic, Aurelius is reviewing its strategic options for the Bertram wholesale division, Education Umbrella, a key supplier of books to schools, and Dawson Books."

If confirmed, this will be the second time Bertrams has gone into administration in the past 12 years. In November 2008, following the collapse of its then parent company Entertainment UK, Bertrams was placed in administration, before being bought in February 2009 by Smith News. The latter sold the business to private equity firm Aurelius for £6m (half what was originally agreed) in February 2018.

The loss of Bertrams will be a major blow to the trade, leaving close competitor Gardners in pole position to pick up new business and dominate the marketplace. There are also significant debts, which publishers may look to ameliorate by reclaiming stock, though that will be complicated by the current lockdown.

In its last set of accounts, for the end of 2018, Bertrams owed £50m to trade creditors, though that figure will likely have been much reduced by publisher credit controls. Nevertheless, a number of publishers have told The Bookseller that they are owed significant amounts of money by the business, with the exposure among the bigger groups thought to be around £10m. In 2018 Bertrams employed 460 staff, but the Sunday Times reports that is now has 400 staff.

In response to the reports, Laura Jones publisher at Scottish press @404Ink, tweeted: "Not that we're anywhere near the millions but yes, been waiting to hear of Bertram's administration, they've not paid our dues for months and there were problems back in mid 2019." Juliet Mabey founder of Oneworld, added: "It’s catastrophic for publishers who are owed tens of thousands of pounds, for some probably six figures, on top of all the other pressures we have on cashflow."

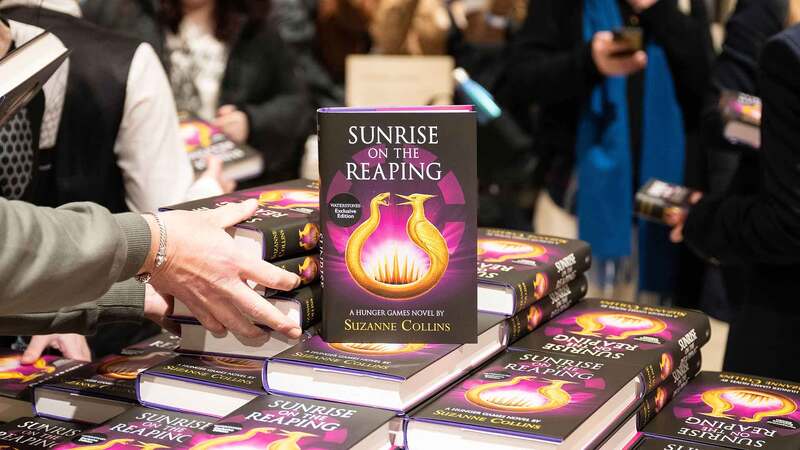

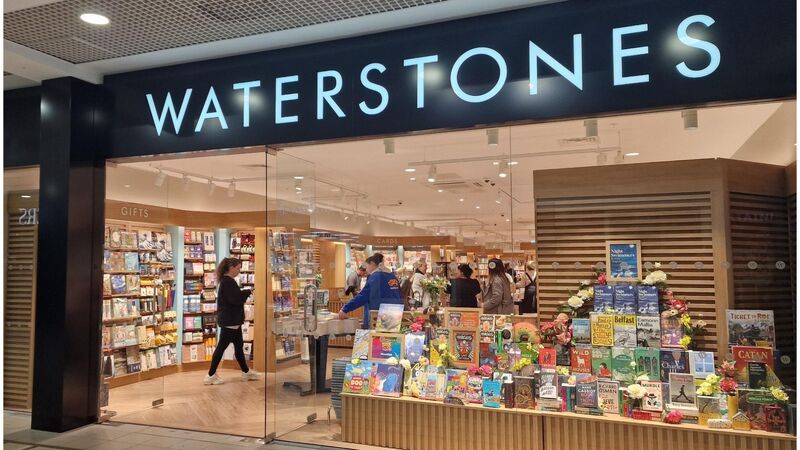

On Friday, Wordery's management team, including Rob Moss m.d., told The Bookseller that it had been sold to Elliott Advisors, which also owns Waterstones and Barnes & Noble. Aurelius later put out a statement reading: "These successful disposals of the e-commerce and library businesses have secured many jobs and, in both cases, complement their new owners’ existing models, thereby securing the futures of both businesses."

Moss said the business would be run independently from Waterstones, and that he would report direct to Elliott Advisors. Moss said: "It's a strategic move that we are very excited about, it is a great thing for Wordery moving forward." Acknowledging the problems with the supply of new titles, Moss said he would work to widen its supply, including using other wholesalers.