You are viewing your 1 free article this month. Login to read more articles.

BA says Amazon ‘gaming system’ as £63m business rates bill revealed

The Bookseller's Assocation has warned Amazon is "gaming the system" and branded the business rates regime "unfair" yet again after it emerged the online retail giant paid £63m in business rates despite recording £8bn in UK sales.

Controversy over Amazon's business rates bill emerged after Lesley Smith, Amazon's director for Public Policy in the UK & Ireland, was forced to reveal the figure at a House of Lords communications committee meeting yesterday (8th January).

Amazon said business rates were "just one of a number" of taxes the online retailer pays in the UK but Jake Berry, minister for the high street, told MPs on the committee: "It doesn’t seem that is creating a level playing field to me."

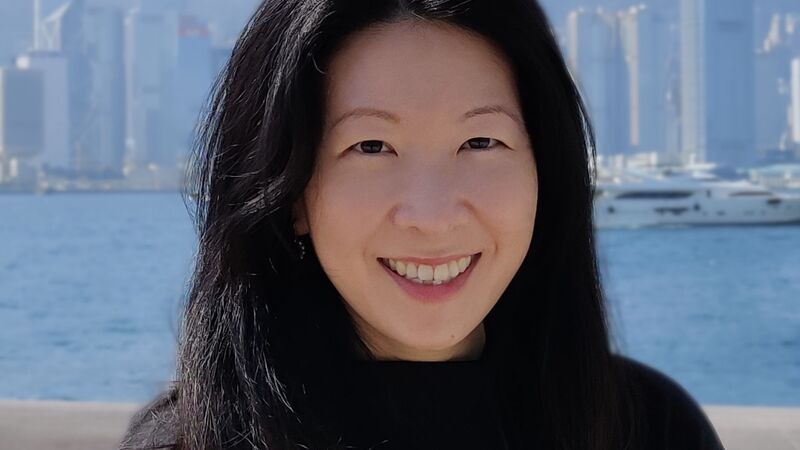

Meryl Halls, m.d. at the Booksellers Association, told The Bookseller the business rates regime is "systemically ruinous for traditional retailers" and, while calling for change, said booksellers were "sick" of having to restate their case is not fair while Amazon "games the system".

"The fact that Amazon have finally been forced to declare the amount they pay in business rates reinforces the point that their in-built advantages are breathtakingly large and systemically ruinous for traditional retailers," said Halls. "Let’s not forget that Amazon is now the highest valued company in the world, and Jeff Bezos the richest man on the planet. Their entire business model is built on minimising their contribution to the infrastructure the high street is supporting – local authority investments in roads, schools; government investment in hospitals, education, transport, the welfare state.

"High street retailers are sick, frankly, of being put in the position of constantly shouting ‘it’s not fair’ – it’s clearly not fair, but in the end Amazon are only gaming the system. The system needs to change, and the government needs to act to reinvent a rates and taxation system that is now broken beyond repair, anachronistic, no longer fit for purpose - and to act quickly and decisively if we to avoid seeing the demise of more high street retail businesses, and the long term jeopardy of all high streets."

As well as Amazon addressing the issue of business rates in a recent blog - which said "the story of Amazon’s contribution to the UK economy ... hasn’t always been clear", emphasising it has invested nearly £10 billion across the UK since 2010 - a spokesman for Amazon said: “Last year, Amazon paid local authorities in England and Wales over £63 million in business rates for the sites we use to serve our customers. Business rates, which are just one of a number of taxes Amazon pays in the UK, are set by local authorities and are based on the rateable value of the land a business uses. Since most of our facilities are very large—a million or more square feet with many thousands of employees—they need to be located away from city centres and near major transportation infrastructure, which enables us to meet the needs of the customers and sellers that rely on Amazon every day. These payments are just part of Amazon’s broader £9.3 billion investment in the UK economy since 2010, which includes creating 2,500 jobs last year — bringing our total UK workforce to over 27,500.”

Business rates are a long-running bone of contention for the book trade, with Waterstones m.d. James Daunt recently warning that the government needs to rethink business rates, while Blackwell’s c.e.o. David Prescott told The Bookseller he does not expect the government to change business rates this year after offering mild relief aimed at small retailers in the 2018 budget.

Daunt recently told The Bookseller: “They [the government] need to rethink business rates completely. It’s by no means straight forward and obvious as to how you do that and in particular the government needs the certain billions or whatever it gets from rates so it’s not something that can just be magicked away. They’ve talked also about some form of tax on online which -scratching at that - that’s been very, very modest and I think that’s something that should be considered.”

Prescott has said: “Business rates help was helpful, everything is welcome on that front. It doesn’t change anything for bigger retailers. The system is broken and has been broken for a long time. The government know that and between shops and online there are big inconsistencies to bout it mildly. I was on the BA board eight years ago and business rates was top of the agenda then. It’s taken far too long.”

Yesterday's hearing also came in wake of the closure of the physical premises of the Big Green Bookshop, one of London's best loved independent bookshops, due to "absolute monster" rates and rents. "Rents and rates are the two biggest outgoings and it's going to be really nice not having to pay £10,000 a year rates," co-owner Simon Key said of its recent decision to go online-only.