You are viewing your 1 free article this month. Login to read more articles.

Coronavirus, Brexit and Suez Canal cause five-year 'perfect storm' in shipping

Wholesalers and shipping companies are facing delays and increased costs owing to coronavirus outbreaks, Brexit and the continued disruption after the blockage of the Suez Canal, with warnings we could be seeing the effects for the next five years.

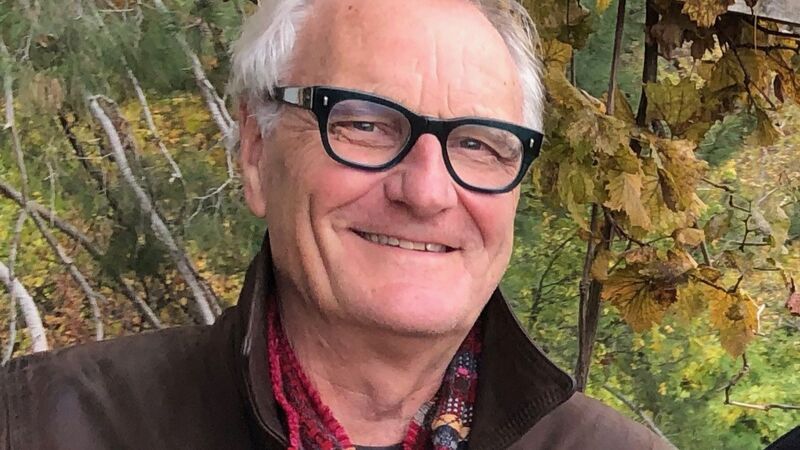

Charles Hogg, commercial director at the global freight and supply chain management company Unsworth, told The Bookseller the issues had combined to create “a perfect storm” and said: “We’re now living in this new world where there’s a lot of unpredictability.”

He explained that the coronavirus pandemic is causing more long-term problems because social distancing requirements and extra health checks slow down operating speeds at ports. A container vessel, which would typically have a 52-week schedule, is currently working to 40 weeks owing to restrictions.

He said: “So until Covid is no longer a significant issue, a bit like Sars or Japanese Influenza or the Spanish flu, we are going to see the impacts of it, thus meaning five years, six years would be my planning cycle, until there’s significantly more new vessels with greater capacity brought on.

“It takes about four years to build one. Even in a very short-term view I’m telling my customers that it will be Q2 next year until we see the rates starting to ease back down to the levels that we were once used to, if they go back to that sort of level.”

Coronavirus continues to make the economy unpredictable, which from a book perspective means higher costs and books being more expensive to consumers, he said. He advised publishers to look closer to home if they are printing in southern China.

He said: “Even if the cost to print is slightly higher, the reliability of coming out of a European country is suddenly a viable option. My biggest message to people is to look at your supply chain and actually consider using this as an opportunity to change how you’re doing things.”

Dave Thompson, group sales and development director at Publiship, which provides services to more than 200 publishers, said the shipping situation “is a whole lot worse now” and also fears “at some point, all of this must filter through to the market in terms of fewer products and higher prices”.

He told The Bookseller: “Back at the end of November, the cost of a 40ft container from Hong Kong to the UK had just increased from $1,800 port to port, to $2,500. Now, we are paying an average of well over $14,000 per 40ft container, and that allows for discounts we are still obtaining through contract rates. The spot market is seeing rates in excess of $16,000. It’s a similar situation for anyone shipping from Hong Kong or China to the US, and there are now surcharges on virtually every route around the globe.

“It's having a huge impact on book shippers, who are seeing freight price increases of 300% to 400% compared to this time last year, combined with shocking service from shipping lines.”

He added: “Publishers like to have stability in pricing, and in the past, we’ve tried to provide them with long-term rates where we ride out the peaks and troughs over the year. We have enough experience to work things out fairly accurately and generally it’s a good system for both parties, but obviously not something we can do in the current market. We have therefore chosen to implement variable weekly surcharges on top of our quoted rates as a means of giving clients rates which most accurately reflect the market. We know other forwarders have gone down the route of fixing over a month but they are usually inflated to cover the variances in the market.”

Caroline Summers, sales director for wholesaler Paperback Shop, also spoke about issues with the lack of containers, particularly with supply coming in from the US and the Far East. Closer to home she said Brexit had caused difficulties with apparently random hold-ups at the border in Dover “for no apparent reason”.

Other difficulties include the price of cardboard which “has gone absolutely through the roof” with monthly price increases. She said it was crucial to be “flexible” with clients and keep them abreast of what’s going on.

Lisa Finch, international sales director at Profile Books, agreed that with so much uncertainty flexibility is key, saying: “We are definitely printing more locally in Australia to hold pub dates there. Where we can’t print locally and have a big global title like Ryan Holiday we’re now printing in Asia to reduce shipping times to the bulk markets. But obviously we can only do this where it’s going to be profitable overall.

“Unsurprisingly, delivery delays and added import costs from freight forwarders mean that customers in Europe are adjusting their ordering patterns and this is having a negative impact on their own customer service levels. Indies are turning to wholesalers, instead of direct supply to try to limit their own exposure to rising shipping and import costs, so there is a hit to our margins and market visibility. It’s a vicious circle and I think it will be difficult to know what the long-term impact of the additional importing costs will be on our business until we are out the other side of Covid.”