You are viewing your 1 free article this month. Login to read more articles.

Elliott buys US chain Paper Source with Daunt to oversee company

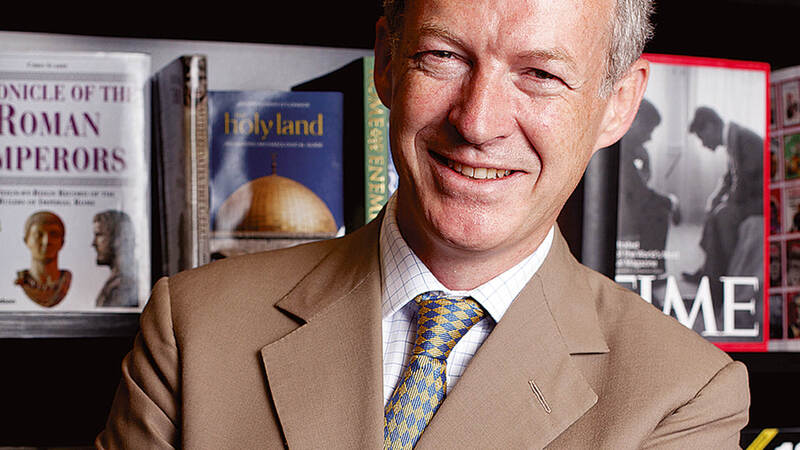

Waterstones and Barnes & Noble owner Elliott Investment Management is buying the assets and operations of US stationery and gift retailer Paper Source, with James Daunt overseeing the chain.

Paper Source, which filed for bankruptcy in March, has around 130 stores across the US, alongside a website and wholesale division.

Elliott pointed out the acquisition was “highly complementary” with Barnes & Noble, including shared product ranges. “While the businesses will continue to operate independently, considerable opportunities exist for mutually beneficial retail partnerships,” the investment firm said.

Daunt, who became Barnes & Noble c.e.o. after Elliott's 2019 takeover, will “have oversight responsibilities for both companies", Elliott said. Daunt also remains as m.d. of Waterstones in the UK.

He said: “I look forward to working closely with everyone at Paper Source. This is a wonderful brand, with a unique culture and community. With Paper Source’s management team, we will support and accelerate the brand’s strategic growth initiatives. Alongside this, the opportunities for Paper Source to work with Barnes & Noble are tremendously exciting for both businesses.”

Paul Best, portfolio manager and head of European private equity at Elliott, said: “As the country’s leading specialty retailer of stationery, cards and gifts, we see tremendous future potential in Paper Source’s business. We look forward to working closely with the management team to position the brand for continued growth coming out of the pandemic.”