You are viewing your 1 free article this month. Login to read more articles.

French publishers see sales fall 5.4%

French book publishers’ sales fell 5.4% last year to €2,911m from €3,079m in 2021, and the number of copies sold dropped 7.7% to 448.5 million from 486.1 million, according to the French Publishers Association (Syndicat National de l’Edition, SNE).

The comparison sounds worse than it is, because 2021 was an exceptional year as the world rushed to catch up after the Covid-19 pandemic. In fact, compared with the pre-Covid reference year 2019, the French book market grew last year by an inflation-adjusted 3.1% and 3.7% in numerical terms, the SNE said.

The results varied from one category to another. Literature lost 2.7% despite French author Annie Ernaux having won the Nobel Prize, comic books and manga shed 4.2%, and children’s books 8.2%. By contrast, art and coffee table books rose 14.7% and rights sales of all kinds advanced 1.26% to €148.5m. For the first time, Spanish overtook Chinese as the leading language for translations from French. Italian ranked third, and was followed by German and English.

Although paperback sales lost 1% year-on-year, they boosted their share of the market to 26.1% in real terms in 2022 from 25% in 2021 as customers tried to make their inflation-stretched budgets go further. This brought total paperback sales to €417.2m and the number of copies sold to 121.4 million. Literature was the most important segment, followed by children’s books, comics and practical books in what the SNE describes as a strategic sector for publishing houses. E-books accounted for 10.3% of all book sales in value terms.

French national statistics office (INSEE) figures show that retail book prices rose by only 1.48% between 2021 and 2022, against 5.9% for all consumer goods over the period. Editorial production increased by 1.8% from 109,480 titles from 111,503, but this was due mainly to reprints as the number of new titles fell 2.9% from 2021 and 15.3% from 2019. “This shows publishers are trying to manage their editorial policy better in order to limit the increase in new titles and not saturate the market,” the SNE said. Market saturation in France has long been a sore point for booksellers. Moreover, the average print-run for all books shrank by 4.8% and by 10.2% for reprints.

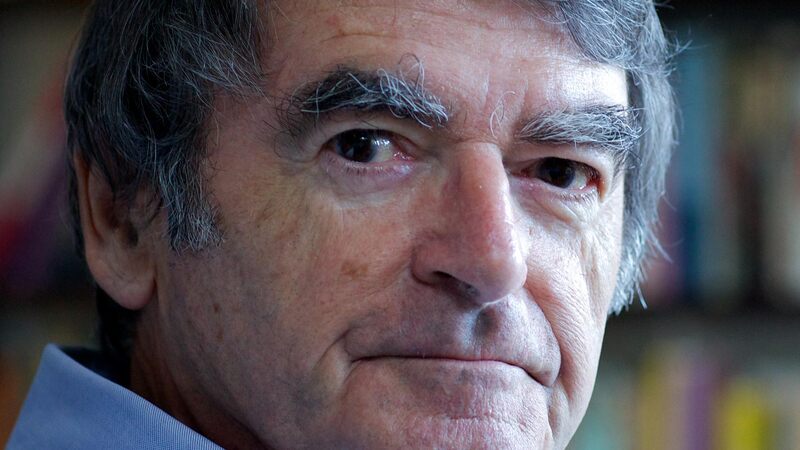

The overall sales dip last year is explained partly by the presidential and parliamentary elections in the first half, said SNE director Renaud Lefebvre. “They always have a negative impact on book sales.” One especially bleak sector was school textbooks, which reported a sales drop of about 9%. “The trend is not going to change this year,” he said. “The situation is worrying and complicated. There are no reforms to the curriculum in sight, despite announcements to the contrary, and there is hesitation over the print and electronic mix.”

By contrast, a good surprise last year was the 14.7% surge in art book sales. This is probably due to the return of art exhibitions and other cultural events following the Covid-19 pandemic, Lefebvre said.

Looking ahead, current indicators suggest sales will rise this year. “It is difficult at this stage to give a forecast, particularly in view of inflation, but we think the increase could be about 2%,” Lefebvre said. Fiction in paperback is again expected to lead the way.

Next year will be marked by the launch of the long-awaited Booktracker (the working name), the French equivalent of Nielsen. This should come before the association’s next annual general meeting at the end of June, SNE president Vincent Montagne told members at last Thursday’s annual general meeting. “My first comments on this subject at an AGM were in 2018.”

Another concern is second-hand books, which now account for one in five books sold in France, and could be considerably more in 10 years if the present trends continue, Montagne said. Apart from the fact only online retailers benefit, a way must be found to remunerate authors, he added.