You are viewing your 1 free article this month. Login to read more articles.

'Level the playing field': BA urges Treasury Select Committee to reform business rates

Booksellers Association m.d. Meryl Halls has urged the Treasury Select Committee to "level the playing field" and reform business rates.

Halls, John Lewis partnership group property and development director Chris Harris and Boots UK chief executive Sebastian James appeared before the Treasury Select Committee, chaired by MP Nicky Morgan, as part of the Committee’s Consultation on the Impact of Business Rates, this afternoon (Wednesday 22nd May).

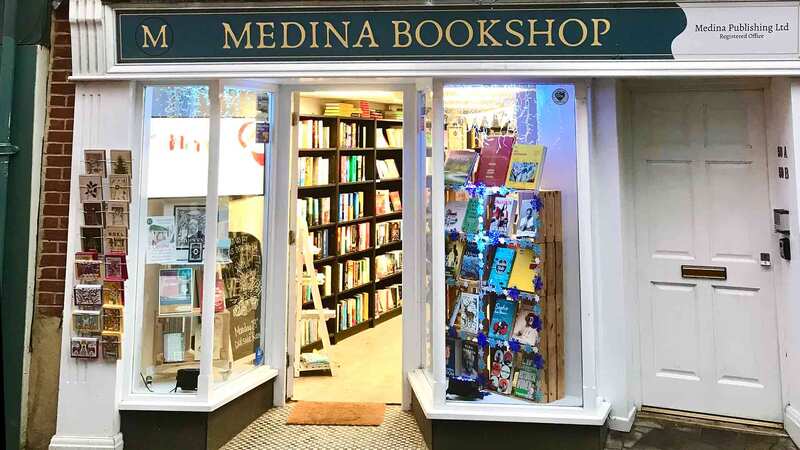

Discussing how indie booksellers such as BrOOK'S in Pinner were "blindsided" by changes to business rates, Halls warned the current system is "unfit for purpose" and stressed the current rates system does not help regeneration on the High Street.

"We want to level the playing field. We are keen on the digital sales tax floated by the Treasury and we want to make sure there are still bookshops and retailers on healthy high streets," said Halls in the one hour session with Morgan as she warned business rates relief is a "sticking plaster" and "emblematic that the system isn't working".

A long-running bone of contention for the book trade with Amazon coming under fire and trade figures calling for an overhaul of the system, business rates are currently worked out by multiplying the rateable value of property by the standard or small business multiplier. Chancellor Philip Hammond confirmed a two-year tax cut to business rates of one third for all retailers in England with a rateable value of £51,000 or less in October 2018 with the next re-evaluation of rateable values scheduled for 2021.

Addressing the Committee on behalf of the BA and its membership Halls highlighted the ways in which the present system of business rates has allowed an uncompetitive, unbalanced and unfair framework to develop across the book trade.

In its submission to the Treasure Select Committee, the BA put forward that the retail industry accounts for 5% of GDP yet pays 10% of all business taxes and 25% of all Business Rates. This year the Business Rate multiplier higher rate will rise above 50 pence in the pound for the first time – its highest ever rate. The BA believes the multiplier must be frozen.

Speaking after the hearing, Halls said: "On behalf of our members we are encouraged that the Treasury Select Committee is holding an inquiry into Business Rates. They seemed genuinely interested in the workings of the tax, how it impacts individual bookshops, and how we might improve it. Appearing in front of the committee gave us a chance to spell out again that the business rates system is an analogue system for a digital age, in need of fundamental reform. We were able to give some of the most egregious examples of the present system – including BrOOK'S in Pinner, who found their rates bill doubling and a backdated arrears payment demand, with no warning. Or the number of closures – or non-openings – of bookshops due to the heavy burden of rates on a business. This failing system makes the job of booksellers that much harder.

“Booksellers on our high streets face ongoing unfair competition from on-line only retailers such as Amazon who are able to profit from an out of date business taxation system that fails to acknowledge the changing shape and scope of the 21st century high street. This enormous disparity contributes to a system that hands Amazon a huge competitive advantage before a single customer has been through the door. BA members are paying on average eleven times more in business taxes per £100 of turnover than Amazon. The unfairness in this needs to be urgently addressed.

"Bookshops across Britain contribute so much to their local communities and proudly pay taxes to keep those communities viable and well-resourced, but it seems long overdue that the government looks to create a fairer, more up to date system is devised that levels the retail playing field for the UK's hard-working booksellers."