You are viewing your 1 free article this month. Login to read more articles.

Listening up: Nielsen data shows the audio sector continuing its recent growth

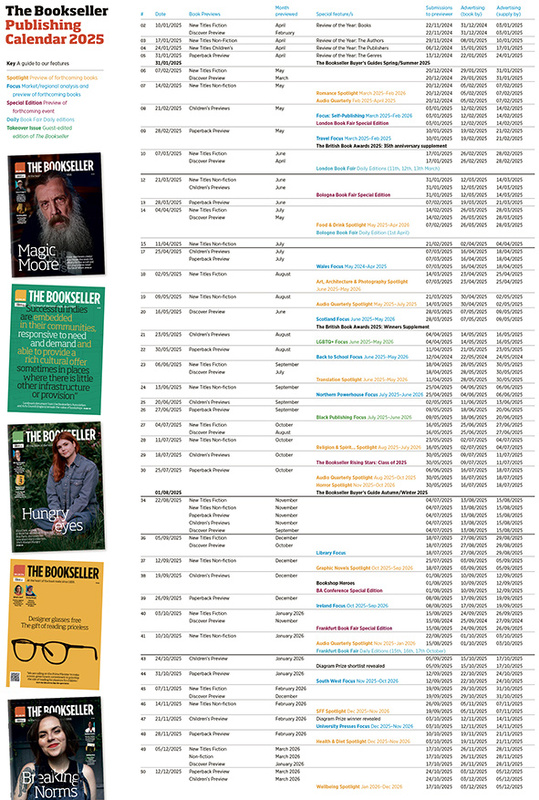

Audiobook sales have rocketed in 2019, and look set to achieve another record year, as the sector continues to attract first-time listeners. Nielsen’s latest Books & Consumers survey, which polls around 3,000 book buyers about individual purchases, has revealed that the audiobook market grew 15% in volume between January and July 2019, against the same period in 2018. In that time, consumers bought 10.3 million audiobooks for a value of £79m. The data firm’s annual Understanding the Audiobook Consumer survey, which explores the attitudes and behaviours of around 2,000 audio consumers, found that of those 10.3 million audiobooks, 70% were downloaded or streamed.

Last year was the audio market’s fifth consecutive year of growth, according to the survey, and 2019 looks likely to be a sixth. So far for 2019, audio accounts for 5.5% of the overall book market, an increase from 4.7% last year and up from 2.2% in 2012. Digital purchases have more than doubled in the past five years. Among respondents to the survey who had listened to audiobooks in the past year, over 75% listened digitally, with a third listening to an audiobook CD. Just one in five consumers listened to CDs exclusively—in contrast, 63% used only digital. Across all age ranges, the digital-only share has risen. While there is still a market for physical audio formats, the amount of CD purists is shrinking—the majority of consumers have managed to incorporate digital into their listening habits.

The survey showed that the largest share of audio consumers are the most recent adopters, as it has been in every year since the survey began in 2016. But the market is also retaining consumers after the first flush of novelty has worn off, with the share of consumers with a year or two of audio consumption under their belts increasing. Audio is still growing at an incredible rate, but it’s also holding on to more of its converts than ever before—a healthy sign for continued growth.

Subscriptions are also becoming more common among audiobook consumers, with 38% of all audiobook consumers taking out a subscription, an increase from 31% in 2018. Of digital audiobook buyers, the percentage of subscribers increased to 62%, from 57% last year. A hefty 81% of "heavy" audiobook consumers subscribed, up 5% from 76% in 2018. However, for 61% of subscribers, a regular credit wasn’t enough to satisfy them—they also bought books outside their subscription.

The survey found consumers were split over audiobook pricing. While 14% of respondents believed audiobooks to be cheaper than other books, and 22% liked that they could get audiobooks for free, 17% believed them to be more expensive—a perception that has increased by 2% since 2016.

But the main barrier to audiobook consumption was not liking a narrator’s voice. Not only has this remained the leading objection for two years running, it has increased in importance, with 22% of consumers citing it as their main reason not to buy more audiobooks. (This may be why Stephen Fry has such a monopoly on the narrator market—on vocals alone, he’s racked up 14 monthly

Audible number ones.) Some consumers also said they did not use audio formats because they had a preference for print or e-books, but at 20%, this reason is becoming less of a hurdle than it once was. Previously the leading barrier, it levelled up with narrator-hate in 2017 and has since dropped to second. Clearly, audiobooks are finding their place in the market, with consumers becoming more accustomed to them as an option.

On the Road

Audiobooks won out against other formats when consumers were commuting or travelling, and when the audiobook was the cheaper option. No particular genre was more popular in audio than it is in "p" or "e", though consumers said they were equally likely to listen to certain genres as read them, including the five most popular audio genres.

Crime and thriller titles were the most-listened to, as well as being the most read genre in print and e-book, with 27% of the survey’s respondents listening to a crime title in the past year. The Stephen Fry-narrated Sherlock Holmes: The Definitive Collection has been a perennial feature in Audible’s download chart since its release in 2017, and more cross-format crime bestsellers—such as Robert Galbraith’s Lethal White and veteran crime authors Lee Child and Ann Cleeves’ long-running series—have also performed strongly in audio.

Sci-fi, fantasy and horror was the second-most popular genre, at 22%. George R R Martin’s A Game of Thrones rocketed to the top of the monthly Audible chart after the finale of its HBO television adaptation, and Terry Pratchett and Neil Gaiman’s Good Omens received a similar small-screen boost in audio, as its Amazon Prime adaptation launched. Ben Aaronovitch’s Rivers of London series also appears regularly. General and popular fiction came in just behind on 21%, with historical fiction on 14%.

In total, 70% of consumers had listened to a fiction book, with 57% listening to a non-fiction title. The most popular non-fiction genre was history, historical and political biography, at 14%. Michelle Obama’s Becoming, a huge audio bestseller, number one for seven non-consecutive months in the Audible chart and still dominant in Amazon’s most-read charts, may have played a part there.

When it comes to children’s books, just 19% of survey respondents had listened to at least one in the past 12 months, though 11% of consumers had listened to a YA title. It’s interesting to note that the two kids’ series that dominate the audio charts—J K Rowling’s Harry Potter books and Philip Pullman’s His Dark Materials and Book of Dust titles—are coded by Audible as Young Adult and, therefore, don’t appear in the year-to-date Children’s chart. Nielsen’s survey was based on consumer perception, rather than defined genres.

In October’s monthly Audible chart, Pullman’s The Secret Commonwealth, La Belle Sauvage and Northern Lights chart in the top 20, while Harry Potter and the Philosopher’s Stone is yet to fall out of the chart since its release in November 2015. It’s rare for any kids’ title that isn’t by Rowling or Pullman to feature in the monthly Audible chart at all, despite the might of David Walliams and Jeff Kinney in print. The 11% of consumers listening to Young Adult audiobooks are possibly nostalgia-fuelled Millenials downloading their childhood favourites, rather than actual teenagers.

On the other hand, the monthly physical audiobook chart, with sales data from Nielsen BookScan, is usually overwhelmingly dominated by kids’ titles, and most often by books for very young children—with only the occasional Collins language guide staking out a claim for non-fiction. October’s top 10 CDs are all children’s.

In the habit

The survey also found audiobooks have gained in terms of their share of consumers’ weekly listening and reading time in the past 12 months. Weekly listening is still dominated by music and talk radio, but audiobooks climbed to a 15% share, and podcasts to 13%. Audio consumers were more likely to listen to podcasts than ever before: 40% listen to podcasts weekly, compared to 27% in 2017; and 59% do so at least monthly, up from 47% two years ago. Among two of the most intense groups of audiobook consumers—paying subscribers and "heavy" buyers—more than 50% of respondents listen to podcasts daily or weekly, with the former at 55% and the latter on 62%. This suggests podcasts may be familiarising people to the aural format and encouraging them to graduate onto audiobooks, rather than directly competing with audio editions of books for listeners’ time.

For the second consecutive year, audio consumers spent more time each week listening to audiobooks than they did reading e-books. Among listeners, audio occupied 33% of their weekly reading time, up 2% from last year’s survey, and e-books took 28%, after declining by 1%. Print books are still the dominant format for audiobook users, claiming 39% of weekly reading time, though time spent reading print has fallen hard since 2017, when it claimed a 47% share. However, for weekly or daily listeners, more than half their reading time was spent on audiobooks, with print occupying 28% and e-books 24%.

With more than half of audio consumers increasing their consumption over the past few years, 31% claimed they were watching less television or fewer films as a result, up from 28% in 2018. Last year, consumers were most likely to say they were reading fewer print books, with 30% mentioning it. This year print held steady at 30%, but it was leapfrogged as the most popular answer by TV and films. One in five believed they were reading fewer e-books to fit audiobooks into their lives, but 18% said they hadn’t cut down on any other forms of entertainment at all.