You are viewing your 1 free article this month. Login to read more articles.

Pearson celebrates strong financial performance with sales up 8% and profits booming by a third

Pearson has celebrated a strong financial performance, confirming full-year group sales were up 8% in 2021 with adjusted operating profits booming by a third to £385m.

Sales were led by the growth in Assessment and Qualifications, which were up 18%, driven by the growth in Professional Certification (VUE). US Student Assessment grew by 17% and Clinical Assessment was up 30%. Both Pearson VUE and Clinical Assessment revenues have now grown in comparison to 2019.

Virtual Learning was up 11% due to strong enrolment growth in Virtual Schools in the prior academic year, with underlying enrolment growth of 7% in Online Program Management (OPM), said the company. English Language Learning was also up 17% in both international courseware and Pearson Test of English (PTE) as markets recovered from the pandemic.

Workforce Skills was up 6% with strong growth in GED and TalentLens. Only Higher Education saw a decline, down 5% with growth in Canadian and UK Courseware offset by a 6% decline in US Higher Education Courseware. However, Pearson stressed this decline was less than last year “with margin stabilisation reflecting cost efficiencies”.

It added: “We expect enrolments to decline but at a lower rate than in 2021, although that could improve. We also expect pricing pressure to continue due to the shift from print to e-books and Pearson+, and from bundles to digital only, offset by continued recapture of the secondary market.”

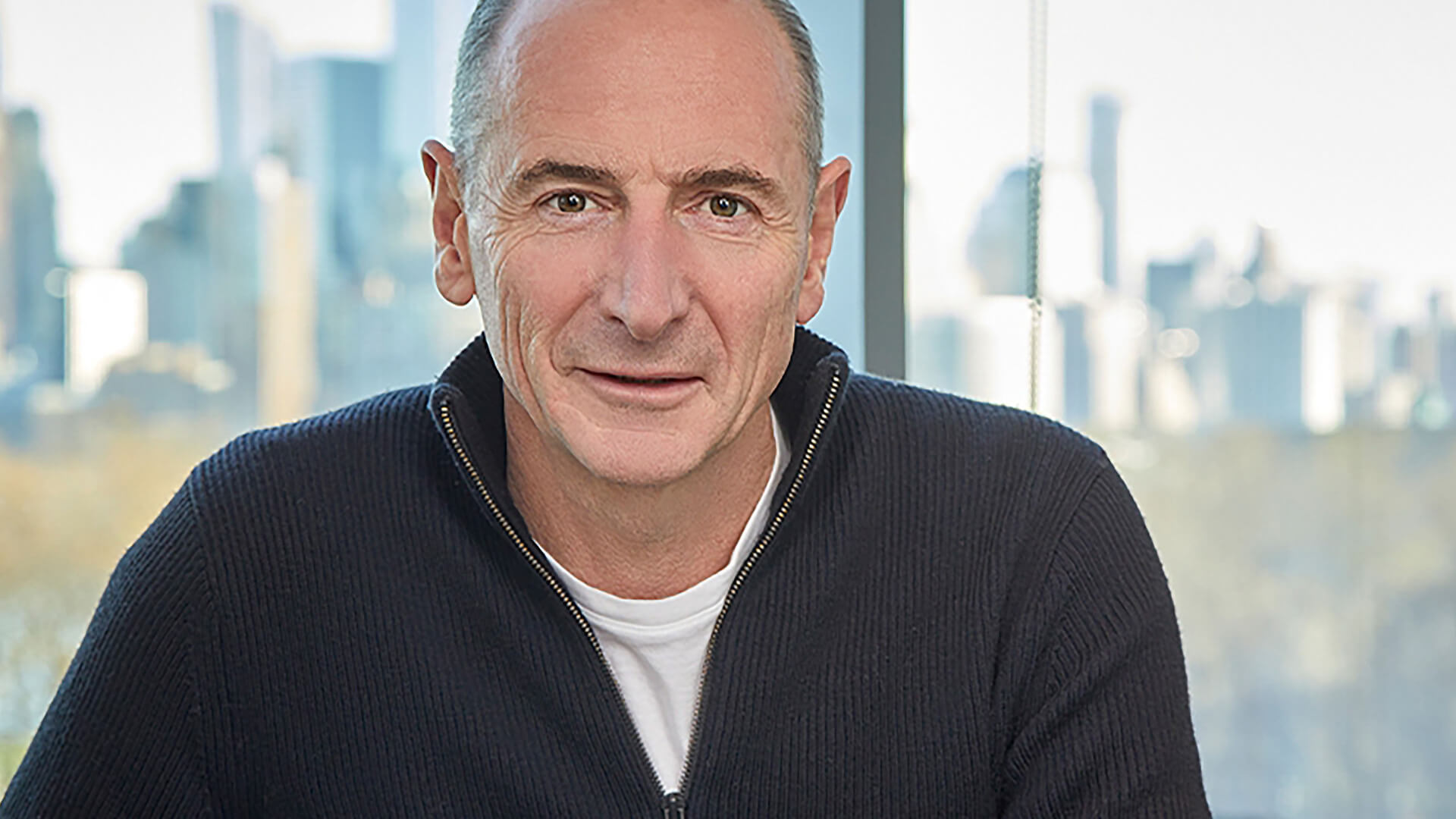

Chief executive Andy Bird said 2021’s “strong progress” reflected “disciplined management of the business” for successfully navigating challenging market conditions. He stressed the education giant’s decision to refocus and reorganise to capitalise on the new ways of learning that have been accelerated by the pandemic. The publisher has a “new purpose”, he said, with a focus on direct-to-consumer driven by Pearson+, which had 2.75 million registered users at the end of 2021.

In a conference call following the results Bird said the workforce skills division was the direction of travel for Pearson, to “help individuals and employers turn the great resignation into the great re-engagement”. He cited the publisher’s recent acquisitions of Faethm and Credly.

The report said margins in this area will be at break-even as Pearson invests to accelerate growth. He also announced an expanded set of student-friendly features such as social and video study channels that will ensure more growth of Pearson+.

Bird said: “Learning is no longer a stage of life, it’s a lifelong journey and the need to upskill and reskill has never been more urgent”.

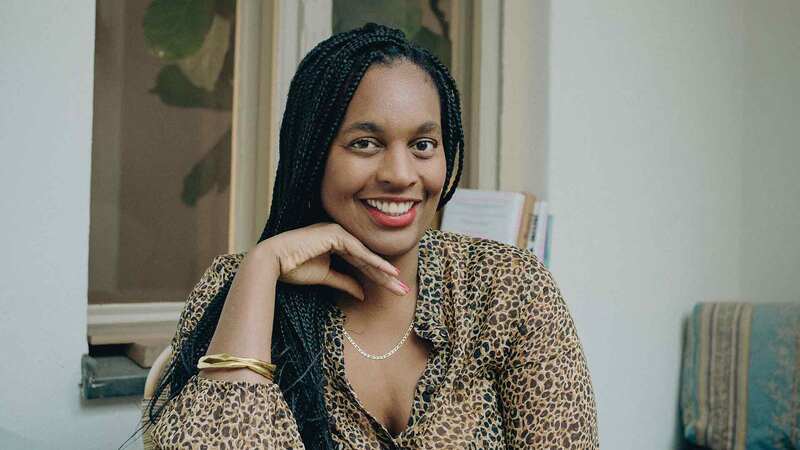

Chief finance officer Sally Johnson said Pearson expects workforce skills to make up 10% of the group in five years’ time, creating double the revenue it does today.

Both highlighted continued confidence in growth moving into 2022. It was a really exciting time to be at Pearson, they said.

The board proposed a final dividend of 14.2p (compared to 13.5p in 2020), which equates to a full year dividend of 20.5p (compared to 19.5p in 2020). It also intends to commence a buyback to repurchase shares of £350m in 2022.