You are viewing your 1 free article this month. Login to read more articles.

Review of the Year: Hachette retains the digital crown as all of the Big Six post gains

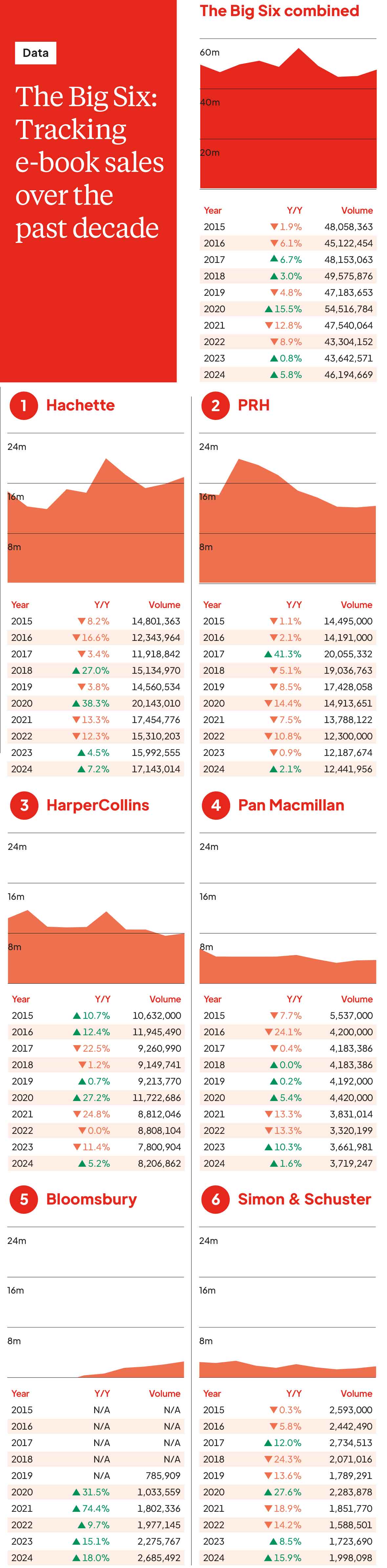

For the first time in 12 years, the UK’s six largest publishers all posted e-book sales growth, with Hachette leading the way for a fifth successive year.

The full complement of the UK’s six largest trade publishers grew their e-book sales in 2024 – the first time this has happened since The Bookseller began canvassing publishers for their totals in 2012. Collectively, the sextet’s volume rose 5.8% to 46.2 million e-units, though this remains some distance off 2020’s height and the strong digital returns for the Big Five (Bloomsbury joined the panel in 2019) for much of the 2010s.

Hachette remained the top digital dog for the fifth straight year, moving 17.1 million e-books, its third-greatest haul in the last dozen years. Hachette was 4.7 million copies to the good over Penguin Random House and it sold more domestic e-books last year than HarperCollins, Pan Macmillan, Simon & Schuster (S&S) and Bloomsbury put together.

We should note that the publisher-provided digital sales here are top-line volume units representing individual e-books sold (no free titles) in the UK only, excluding all overseas territories, even Ireland. It does not include audio or other products such as Collins’ or Hodder Education’s digital provision to schools. We have no value figures, nor any full-year digital sales broken down by divisions/imprints or individual titles, but can make assumptions on the latter based on The Bookseller’s weekly Bookstat charts and Publisher E-Book Ranking.

By the Bookouture

It was one of those divisions that undoubtedly helped Hachette’s ascension, as the group’s rise more or less coincided with the acquisition of digital-first list Bookouture in 2017, which in turn led to a subsequent revamp of company-wide e-book strategy. It did not happen overnight, though: in 2017 PRH sold 20.1 million e-books, a whopping 8.1 million units more than Hachette, helped by three monster digital hits (all from the Transworld stable): Dan Brown’s Origin, Shari Lapena’s The Couple Next Door and Lee Child’s Night School. But since 2020 Hachette has been the bigger player, outselling PRH by an average of 4.1 million e-units in each of the past five years.

Bookouture has claimed that 2024 would be its second consecutive year of “significant double-digit” sales growth. We can only speculate what that amounts to in terms of downloads to readers’ devices, but it will be a significant whack: in its most recent Companies House filing (for the year ending 31st December 2023), Bookouture reported after-tax profit of £6.2m on £33.8m in revenue.

Certainly Bookouture is well-represented in The Bookseller’s digital charts: there were only seven weeks across 2024 when at least one Bookouture title did not feature in the Bookstat Top 20. Freida McFadden’s The Housemaid was an almost permanent fixture, while her The Housemaid Is Watching bagged the number one in the week of its June launch.

But there were other hits, such as Daniel Hurst’s The Doctor’s Child, KL Slater’s The Married Man and Angela Marsons’ Guilty Mothers and 36 Hours, which hit the Bookstat summit in June and December, respectively.

This is not to suggest Bookouture was carrying all of Hachette’s water. Little, Brown had a particularly strong year in the digital-friendly romance and romantasy space, with hits from the likes of Ana Huang, Elsie Silver and, of course, Rebecca Yarros, whose Iron Flame and Fourth Wing were regulars in the e-book charts for much of 2024. Meanwhile, two different Julia Quinn outings, Romancing Mr Bridgerton and To Sir Phillip, with Love (both originally published more than 20 years ago) bagged Bookstat pole positions that coincided with the staggered release of Bridgerton’s third season on Netflix in May and June.

If we combine Hachette’s digital sales with the physical units it sold through Nielsen BookScan’s Total Consumer Market, overall the firm shifted 44.3 million books in 2024. At nearly two in every five books, it had by far the biggest share of “e” in its total sales compared to the other Big Six publishers; PRH, on 23.2%, a little under one in four books sold, had the slimmest digital slice of the pie.

Continues…

Chapter and verse

HarperCollins’ 5.2% e-book jump was no doubt aided by a standout year from its digital-first list One More Chapter, which had hits galore throughout the year. Jackie Kabler is one of the imprint’s stars who indexes more in digital; her 2023 outing, The Vanishing of Class 3B, was a digital hit of 2024, sticking in the E-Book Ranking Top 20 for most of the summer (cresting in second place), though it sold a mere 323 print units through BookScan. Laurie Gilmore was a champ in both camps, with The Pumpkin Spice Café a Bookstat staple across the autumn – and bagging the number one spot in late October – while chalking up sales of £2.3m through the TCM. Meanwhile, Evie Woods’ The Lost Bookshop was nigh-on unstoppable (again, a 2023 title selling well in its second year), scoring nine consecutive E-Book Ranking number ones over the summer, while also chalking up 81,000 print copies via BookScan.

Both Bloomsbury (18%) and S&S (15.9%) had double-digit percentage leaps, with the former’s 2.7 million e-units sold representing its UK domestic record (the digital versions of JK Rowling’s Harry Potter series are published under the author’s Pottermore business). Both publishers benefited hugely from BookTok. For Bloomsbury, this was represented primarily by Sarah J Maas; when her House of Flame and Shadow was launched in the week ending 3rd February, that title not only bagged the E-Book Ranking number one – Maas had an additional five books in the top 20. Bloomsbury said that in the month of February, House of Flame and Shadow sold 27,572 e-books; in the same period it sold around 54,000 units through the TCM. One of the benefits for bricks-and-mortar shops of late is that BookTokers love print in all its sprayed-edged and limited-edition glory, but they also love digital, and clearly some consumers are buying multiple formats of the same title.

S&S enjoyed another slice of Colleen Hoover, with both It Ends with Us and It Starts with Us bossing the summer, helped by the film adaptation of the former (It Ends with Us’ metadata still has “now a major film starring Blake Lively and Justin Baldoni” in its title field, which gets more uncomfortable with each passing day). It also benefited from YA breakout Lauren Roberts, romance star Hannah Grace and, outside of the TikTok sphere, another fine turn from Bob Mortimer.

A bigger pie?

As we stress every year, the Big Six publishers represent just a slice of the overall digital market. Exactly how big is perhaps only answerable by Amazon, which is responsible for selling around 90% of trade e-books in the UK – and the e-tailer is not telling. The Publishers Association’s Publishing in 2023 report said that its members’ UK consumer digital revenue was £292m for that year (the figures for 2024 should be available around the time of this year’s London Book Fair). But that is invoiced, not retail sales, and excludes self-publishing, which might account for one in every three e-books sold. For fun, let’s go with a back-of-a-fag-packet calculation of a 5% rise in e-book sales across the board in 2024, a 50% margin with Amazon (I know, hilarious) and a 33% self-publishing share – that would give us a retail revenue in the £580m range. With an average e-book selling price of £4.50, that would equate to around 127 million digital books sold, meaning a Big Six e-book share of around 38%.

Which perhaps chimes, given the size of the self-publishing market. At any rate, the Bookstat charts suggest the e-book arena is a more level playing field for smaller businesses and indie authors, with many seemingly more able to hit the digital bestseller list than the print equivalent. (Bookstat scrapes the positional data of the hourly-updated Kindle bestseller lists and uses it to estimate those e-books’ volume sales.) In 2024, an average of six spots on the weekly Bookstat Top 20 were filled by indie authors, digital-first specialists like Boldwood or Canelo, or Amazon’s own publishing imprints. Compare that against the weekly TCM top 20, which averaged just three titles per week published by a house outside the Big Six.