You are viewing your 1 free article this month. Login to read more articles.

US tax ruling 'tremendous victory' for indie booksellers

The Supreme Court in the US has ruled that online retailers are required to pay taxes in states where they have no physical presence in what has been described as a "tremendous victory" for independent booksellers.

On Thursday (21st June) the court ruled in favour of South Dakota in a case (South Dakota v. Wayfair, Overstock, and Newegg) that will redefine the legal obligation of online retailers regarding sales tax collection.

The ruling is an "important step" in levelling the playing field for bricks-and-mortar stores competing against online retailers, said the American Booksellers Association (ABA).

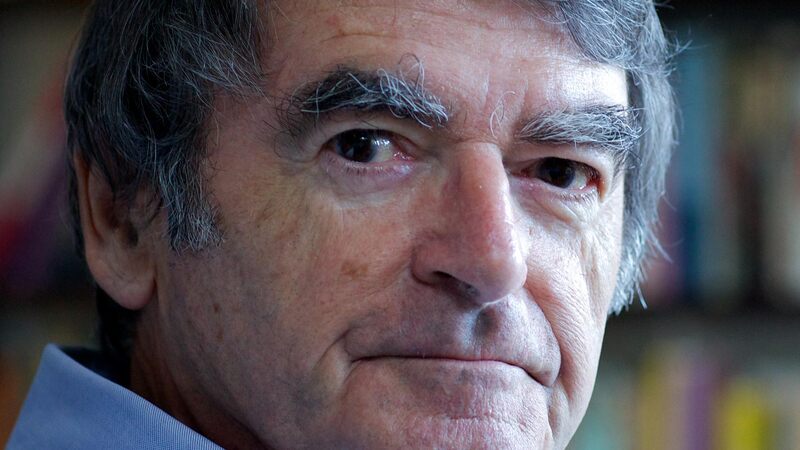

ABA c.e.o. Oren Teicher said the importance of the decision "cannot be overstated" and it represented a "tremendous victory" for independent booksellers and retailers throughout the country.

"This victory is a testament to the hard work and perseverance of independent booksellers, who began advocating on behalf of sales tax fairness almost two decades ago", sad Teicher. "Their tireless efforts played a pivotal role in this win for small businesses and e-fairness.”

Teicher said the ABA would be reviewing the ruling and providing booksellers with more information in the weeks ahead.

The case reevaluated the Supreme Court’s 1992 Quill v. North Dakota decision, which prevented states from requiring retailers without a physical presence in that state – such as a store, office, warehouse, or sales agent – to collect and remit sales tax to the state.

South Dakota’s petition to the Court stems from a state law passed in 2016 aimed at challenging the Quill decision, which was issued before the explosive growth of e-commerce.