You are viewing your 1 free article this month. Login to read more articles.

Taylor & Francis grows 3% in first half as parent Informa's profits soar

Taylor & Francis has seen underlying revenue growth of 3% in the first half of 2022, parent company Informa has said, as it reported stellar results for the overall Informa business which saw profits up 226% on the same period last year.

Informa had revenue growth of 59.1% (underlying growth of 43.9%) to £1,096.3m for the six months to 30th June 2022, "reflecting strength in academic markets, growth in B2B digital services and continuing return of live and on-demand B2B events". Adjusted profit was up 226% to £234.5m (£71.8m in 2021). The company said the results also reflected progress in its Growth Acceleration Plan [GAP] strategy which included the divestment of the Pharma Intelligence business for £1.9bn on 1st June, leaving Informa with a positive net cash position of £15m on 30th June 2022 compared to £1,890m of net debt at the end of June 2021.

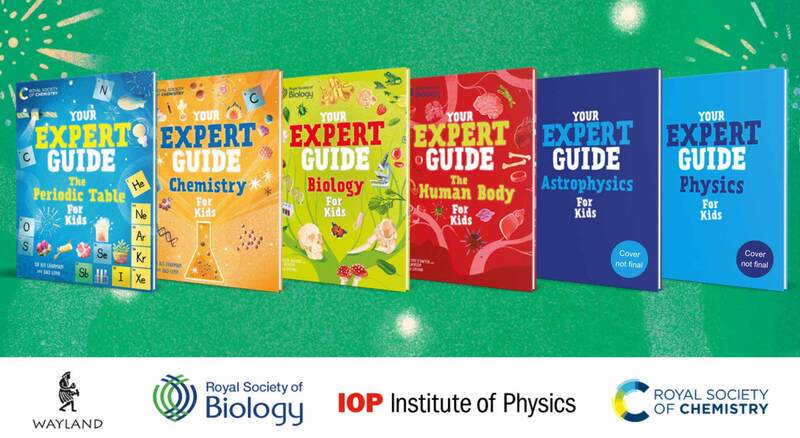

Academic division Taylor & Francis saw underlying growth of 3%, buoyed by "improving growth in academic markets, robust subscription renewals and good growth in e-books and advanced learning, combined with continuing growth in Pay to Publish services such as Open Research and F1000", with the Pay to Publish business now "well placed to deliver its 3% underlying revenue growth target for the year, up from 2.4% in 2021".

Informa’s GAP plan is leading to additional investment in technology and product development at T&F, with particular focus on expanding the range and quality of Open Research services, Informa said, with near-term "modest margin investment" to drive higher long-term growth.

Stephen A Carter, group chief executive of Informa, said: "Informa’s first-half results underline the benefits of our GAP II strategy, with strong growth in revenues, profits and cash. We remain on track to achieve the upper end of 2022 guidance with good forward visibility in subscriptions, exhibitors, delegates and digital services, while continuing to deliver accelerated shareholder returns, additional growth investment and further targeted expansion."