You are viewing your 1 free article this month. Login to read more articles.

Travel guide market sees first rise in seven years

Travel guide publishers are feeling cautiously optimistic after the genre saw a rebound last year for the first time in seven years.

Last week Time Out confirmed it would cease publication of its Time Out Guides in 2016 as part of a “continued evolution of the business”, sparking debate in the national press about whether the era of the printed travel guidebook was over.

However, figures from Nielsen BookScan have revealed that although the market has been in steady decline since 2007, an upturn in last year’s sales has given the sector cause for optimism.

After hovering around the £103m-£104m mark between 2004-2007, the travel guide market has fallen steadily since, reaching its lowest point since BookScan records began between 2012 and 2014, at around the £59m mark.

However, 2015 saw marginal growth in Nielsen BookScan’s Atlases, Maps and Travel category, with sales up 0.2% to £59.2m. Within that, Travel and Holiday Guides were up 1.1% to £34.1m, Phrasebooks up 4% to £1.1m, and General Folded Maps & Walking Guides up 3.7% to £11.2m.

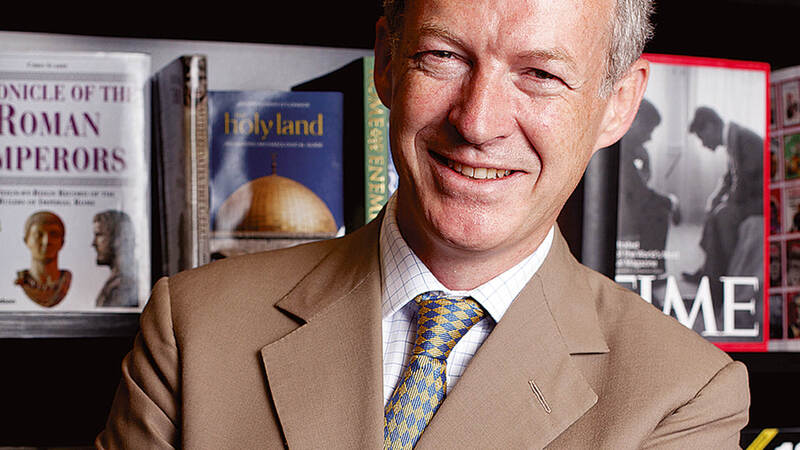

M.d. at Marco Polo, Ian MacDonald, whose career in travel publishing spans 30 years, hailed 2015 a “very good year”. The company, founded in 2012, saw sales grow by 9% in 2015, he said.

“[The past few years], were really, really bad,” MacDonald said. “There was the difficult economy in a number of markets, especially the US market, the on-going threat of terrorism, and the assumption that everything would go digital. But that hasn’t really happened. There is a percentage that is digital, without a doubt, but it is nowhere near where people predicted.”

Brett Wolstoncroft at Daunt Books agreed digital had not been the game changer many thought it would be. He said: “I think there has been far less change than people think. The guidebook industry is slightly chasing its own tail. Those that have stuck around and carried on with a wide range of guides, like Rough Guides and Lonely Planet, have simply lapped up some of these changes. And you’ve got people who are otherwise thought about as being quite small, like Bradt guides, particularly, who have ended up being the last man standing, often the only people doing a guide to a place - and consequently I suspect doing very well indeed because of it. We don’t see any evidence of people abandoning guidebooks - apps certainly haven’t been the answer.”

Referring to the announcement about the Time Out’s guides’ closure, Wolstoncroft said he thought it was “a curious time for anybody to be pulling out” of the guidebook market during what is “quite a healthy time” for the sector.

Sales of print travel guides over the past 12 months had been “significantly up” for Daunt Books and that sales of travel guides had been “gently rising” over the past two years, albeit from a low point.

“We thought [Time Out] was making a mistake,” said Wolstoncroft. “We were surprised by that since a lot of new guides seem to be coming out. Having had a fallow period from 2008, where you had companies such as AA withdrawing from the guidebook market, and word was out there that ‘guidebooks were dead’, and people were all going to go to e-guides, or apps, or whatever it is . . . we didn’t think that was the case.

“I think it’s champagne all round at Rough Guides and Lonely Planet,” he said. “Frankly, for a lot of cities, we would have been recommending the Time Out guides. It covers that cosmopolitan, busy weekend city destination. And I would expect Rough Guides and Lonely Planet to be very happy to fill that gap. DK, too, with their Top 10 guides; those will also pick up sales.”

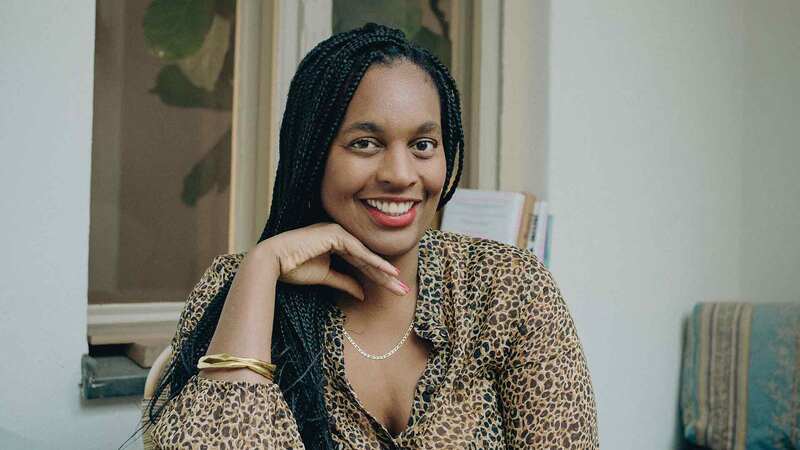

Georgina Dee, publishing director for travel at DK, said that while there were some “obvious benefits” in Time Out's move to those still in the guidebook market, it “didn’t help” encourage the public’s perceptions of the travel guide market in general. “We are feeling pretty positive about where we are and it's not giving us a pause for concern," she added.

DK is re-launching its bestselling Top 10 series, a range that is 15 years old next year. The series has been redesigned, as part of a “natural progression” after re-launching its Eyewitness guides a few years earlier. Dee said: “We believe we should be investing in the guides that are doing well for us. We wanted to give them some love and ensure they are fit for purpose in today’s market.

“We are certainly seeing an upturn in the market generally, but also an upturn in our guides, so I am feeling pretty positive," she added.

Also positive is Dan Lewis at Stanfords, who said that travel guides had continued to “sell well”, “particularly the pocket guides”.

Since the travel market is at the mercy of "the wider economy as well as political factors", explained Lewis, the economic recovery in the years since 2008 has mapped the rise and fall of guidebook sales.

Territories such as Cuba opening up had led to "a natural uplift in related guides,” he said, “but we also see a downturn in demand for guides for regions affected by terrorism when people choose to go elsewhere.”

“Overall our own sales during this current year have recovered to the levels of 2008 prior to the downturn in the economy – and the signs are that these sales will continue to increase. Travel guide sales are certainly up year on year and we expect to see growth again in 2016,” he added.

Neil Manders, Lonely Planet’s director of sales for EMEA, said the company had “invested heavily in new and existing products over recent years, both print and digital” to address the “tumultuous” past few years in the travel guide market. “We have focussed on offering trusted Lonely Planet content across a broad range of channels, including mobile and online, as well as innovative print products such as Make My Day and our forthcoming Best of series," he said.