You are viewing your 1 free article this month. Login to read more articles.

PA urges political parties to commit to axing 'unfair' reading tax

Trade bodies, including the Publishers Association (PA), have sent a letter to the political parties ahead of the release of their election manifestos calling for them to commit to removing “unfair and illogical” VAT on digital publications.

The letter is endorsed by supporters of the campaign to “Axe the Reading Tax”, who in addition to the PA include the Royal National Institute of Blind People, National Literacy Trust, Society of Authors, the Association of Authors Agents, Authors’ Licensing and Collecting Society, Listening Books and BookTrust.

The letter follows the EU council's decision in October last year to allow – but not force – member states to give digital publications the same VAT-free status as printed books. Countries including Ireland, France, Hungary, Italy, Malta, Belgium and Portugal have already taken advantage of the removal of this “EU barrier” and the letter's signatories urged the new UK Government do the same.

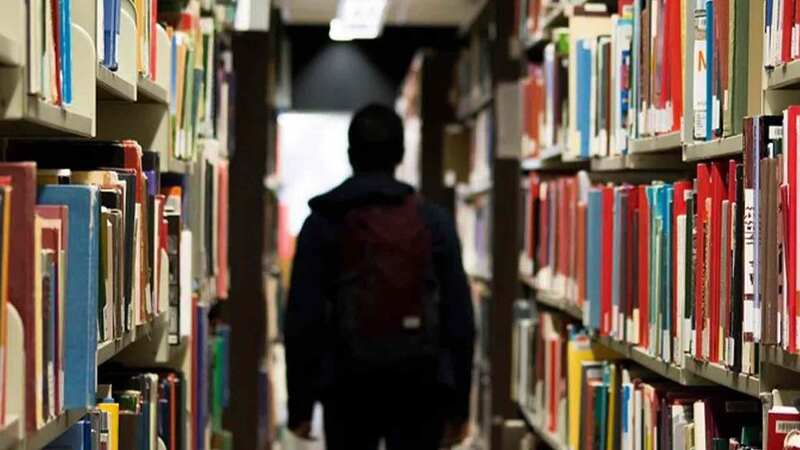

In the letter, it is argued ending tax discrepancy between digital and print would promote literacy, particularly among young people and disadvantaged school children who were "disproportionately impacted" by the tax on digital publications.

“A core incentive to Axe the Reading Tax is to remove the tax barrier to literacy,” the letter reads. “Research from the National Literacy Trust has shown that 45% of children prefer to read on a digital device and further research by the organisation has also demonstrated the benefits for young people of reading across all formats, with the most engaged readers more likely to read both on paper and on screen. Boys with the lowest levels of reading engagement are one of the groups most likely to benefit from digital reading and pupils eligible for free school meals are also more likely to read digitally and are therefore disproportionately impacted by this tax."

It goes on to emphasise that digital formats are "essential" for people living in the UK with sight loss, "who rely on audiobooks to be able to read or need to use ereaders to alter text size", as well as for the elderly and people with other disabilities, "who are unable to read or handle print books easily". The benefits also extend to military personnel, it is argued, "who often take e-books on tours of duty to preserve their luggage allowance".

In terms of the financials, although reduced VAT revenues would cost the Exchequer in the region of £210 million in 2019/20 rising to £250 million in 2023/2024, according to Frontier Economics' research, there are also savings to be made, the letter stressed; "publicly funded institutions such as universities, libraries, government departments and the NHS are large consumers of digital publications and could benefit by £50 million to £55 million per year." Furthermore, it could aid "significant market expansion".

"Frontier Economics predict that a cut to the tax would result in significant market expansion and an increase in the number of readers, books sold and a wider breadth of authors able to get their products to market," the letter reads.

"The Government has rightly never applied VAT to print books in order to protect access to knowledge and the free exchange of ideas. The imposition of a 20% VAT on digital publications shows a disregard for these long-held principles. We believe it is vital that there is no financial barrier to reading and learning and therefore call on you to commit to zero-rating VAT on digital publications in the General Election."

The letter is available to read in full below. The manifestos of the major parties are expected to publish this week, with UK voters set to go to the polls on 12th December 2019.

We are writing to you as supporters of the campaign to Axe the Reading Tax to call on you to commit to cutting the unfair and illogical 20% VAT on digital publications, which is not applied to their print equivalents, in your party manifesto for the General Election.

Last year, the EU barrier to reducing the rate of VAT on digital publications (ebooks, audiobooks, research journals, textbooks and educational materials, newspapers and magazines) was removed. This change allows EU member states to end any tax disparity between digital and print and a number of EU countries have already used this power, including Ireland, France, Hungary, Italy, Malta, Belgium and Portugal.

A core incentive to Axe the Reading Tax is to remove the tax barrier to literacy. Research from the National Literacy Trust has shown that 45% of children prefer to read on a digital device[1] and further research by the organisation has also demonstrated the benefits for young people of reading across all formats, with the most engaged readers more likely to read both on paper and on screen. Boys with the lowest levels of reading engagement are one of the groups most likely to benefit from digital reading[2] and pupils eligible for free school meals are also more likely to read digitally and are therefore disproportionately impacted by this tax. [3]

This tax also hits the estimated 2 million people in the UK living with sight loss.[4] Digital formats are essential for the blind and partially sighted who rely on audiobooks to be able to read or need to use ereaders to alter text size. Digital formats are also essential for the elderly and people with other disabilities who are unable to read or handle print books easily.

Ebooks also give people the opportunity to read no matter where they are. This is particularly advantageous for military personnel who often take ebooks on tours of duty to preserve their luggage allowance.

Research undertaken by Frontier Economics shows that the annual cost to the Exchequer in terms of reduced VAT revenues would be approximately £210 million in 2019/20, rising to £250 million in 2023/2024. However, publicly funded institutions such as universities, libraries, government departments and the NHS are large consumers of digital publications and could benefit by £50 million to £55 million per year.

Frontier Economics predict that a cut to the tax would result in significant market expansion and an increase in the number of readers, books sold and a wider breadth of authors able to get their products to market.[5]

The Government has rightly never applied VAT to print books in order to protect access to knowledge and the free exchange of ideas. The imposition of a 20% VAT on digital publications shows a disregard for these long-held principles. We believe it is vital that there is no financial barrier to reading and learning and therefore call on you to commit to zero-rating VAT on digital publications in the General Election.

Yours Sincerely,

Royal National Institute of Blind People

National Literacy Trust, Society of Authors

The Association of Authors Agents

Authors’ Licensing and Collecting Society

Listening Books

BookTrust