You are viewing your 1 free article this month. Login to read more articles.

UK firms seek to avoid printing and shipping hold-ups as a result of Brexit

Brexit turmoil is forcing UK publishers to prepare for potential supply chain delays, with measures taken including printing titles months in advance and offering European distributors discounts as an enticement for stocking up.

At the time The Bookseller went to press, the UK was still officially due to leave the European Union on 29th March, although a delay may be agreed in Brussels after months of deadlock (contingent on the deal passing). That would mean the threat of "no deal" has retreated for now, but book publishers, like other UK industries, are still in the dark over what happens next.

For publishing, the most pressing concerns are logistical, particularly the potential for disruption at the borders with new books arriving from Europe or being exported to the continent. There have been suggestions some publishing houses could do their entire summer print runs in advance, or remove colour illustrated books printed in the EU from the schedules in order to avoid hold-ups. While those might be drastic measures, many publishers contacted by The Bookseller said they had factored in extra time for forthcoming releases, printing them earlier, plus reprinting core lists and extending credit to European wholesalers.

Penguin Random House UK has carried out preparations for a range of Brexit scenarios, including "no deal", and said it should be able to minimise any disruption. The planning has seen a full assessment of paper stock, printing and scheduling.

The publishing giant has secured several months’ worth of paper stocks for UK monochrome printing and it has a European printer in place for titles with high continental sales. Printing for backlist titles outside the UK, due to deliver from April to June, were brought forward to March. A spokesperson said: "We will continue to be in very close dialogue with all our printers over the coming months to ensure we remain ahead of any unforeseen challenges. Additionally, we have worked closely with our retail partners to manage stock where we might expect supply chain delays."

HarperCollins has implemented a strategy of early printing, longer print runs and moving books to market early, while Faber has also created and distributed key titles early.

Relationships key

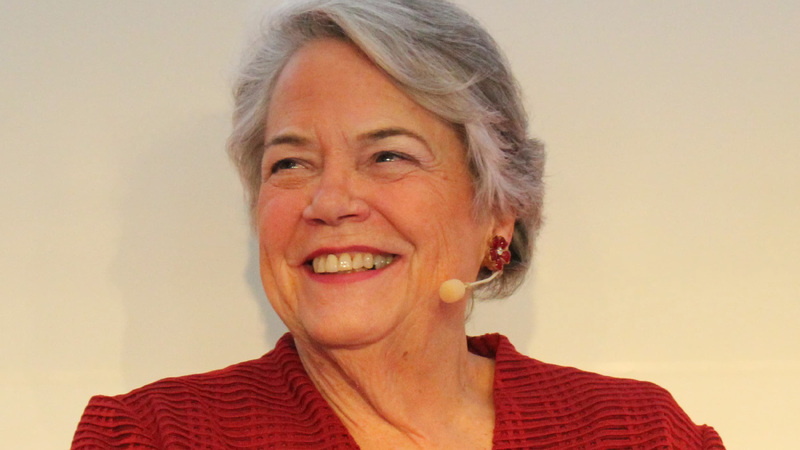

Last week Bloomsbury managing director of group sales and marketing Kathleen Farrar warned those in the trade about the impact of Brexit at a packed London Book Fair panel, organised by the Publishers Association and titled "Deal(s) or No Deal(s): How Brexit and the UK’s Future Trading Arrangements Will Impact Publishing". Farrar told The Bookseller that extra time has been built into her firm’s printing schedules, adding that Bloomsbury was having ongoing discussions with its warehouses over stock, but was confident space would not be a concern. Farrar explained: "We’re working with our international customers to ensure the key frontlist and backlist titles are stocked in advance, and new releases are being monitored closely. Our close relationships with our European and other international customers ensures we have a constant dialogue as to how they’re planning and ensuring we can support them, no matter a deal or no deal."

Simon & Schuster mainly prints titles in the UK, but extra time has also been built into its schedules for any European printing, and it is in continual talks with its printers. The publisher has also factored additional time in its schedules for deliveries to Europe of books publishing before and soon after the official 29th March Brexit date. The firm said customer demand has "remained steady" and it will be able to reprint quickly if necessary.

Suffolk-based printing firm Clays has secured three months’ worth of materials in case of delays at ports when bringing in supplies. But while larger publishing houses have the necessary infrastructure to cope with disruption, it’s the small presses that could struggle owing to a lack of resources, with even small delays hitting margins. One indie press founder, who preferred to speak anonymously, said printers had tried to beat a potential shortage by pre-ordering enough paper to supply all the publisher’s requirements "for this year and beyond". Its European distributors have also discussed offering extra credit or discounts to stockists, encouraging them to buy bestselling titles ahead of time.

The publisher explained: "I think printers were actually approached by stockists, trying to come up with a strategy that would ensure smooth distribution over the coming months. The idea is that the wholesalers have larger stock of faster selling titles, so that they don’t have to re-order from Britain. In a disruptive ‘no deal’ scenario, that would ensure, in the short term at least, that sales of bestselling or fast turnaround titles are not affected."

At Profile Books, the focus has been on its core backlist of around 20 titles, printing enough copies at the start of the year to make sure there is enough stock and before printing firms became too busy. Sarah Ward, the non-fiction publisher’s international sales director, said the potential for weeks of delays meant it was a necessary precaution.

Indie challenges

Some indies have distribution deals in place with firms such as NBN or Bookpoint, and are relying on them to smooth out any complications. However, others say there is little they can do to prepare. Sam Jordison from Galley Beggar Press said he was caught in an "absurd Brexit paradox" where the cost of UK printing was going up but printing abroad represented a gamble. He said: "There are no steps you can take when you’re as small as us. Especially before 29th March. We’re in the hands of the oafs in parliament. Looking on the bright side, if there’s ‘no deal’, I guess I’ll be so busy scavenging in bins and fighting my neighbours for food that a few thousand missing literary masterpieces won’t exercise me as much as they would otherwise."

In the academic sector, Oxford University Press, which only sources a small amount production in the EU, said it had focused on anticipating outbound pinch points and then taken steps to mitigate the problems. Distribution and logistics director Ray MacFadyen said the publisher had warned business-to-business customers disruption to the supply chain was likely between March and April. Like others, it has printed and shipped stock early for titles due in the next month, and encouraged its EU wholesalers to order before Brexit day. A portion of its UK bulk shipping has been redirected to China, while some customers will see goods shipped directly from the printer.

SAGE has highlighted its supply chain and the dispatch of books to Europe as the main concerns, with fears of delays at ports caused by customs checks. To protect its supply chain, the firm has a contract with Dutch firm PrintForce to supply local printing in continental Europe. Despite that, it has told customers no impact on delivery times or shipping costs are expected, and it has arrangements in place to prevent disruption.

In fact, while the clock ticks down towards Britain’s exit date, the book world’s big operations, such as Waterstones, insist it will be business as usual and there is no sign of panic setting in. Wholesaler Bertrams struck a soothing tone this week, stressing the potential risks to operations remain "low".

"We do not expect book supply to be impacted greatly, as our existing import process of books from non-EU countries is a very smooth operation," a Bertrams spokesperson said. "There is some potential that the import process to and from EU countries will be slightly interrupted while new regulations are put in place, meaning there may be delays to sourcing books from the EU. However, on the whole books are very easily moved between countries—including non-EU countries—so we do not imagine that this impact will be great. Our demand planning team is tasked with ensuring our warehouse is sufficiently stocked to maintain adequate supply to our customers, and it is taking extended lead times into account in its planning for March 2019 and beyond."