You are viewing your 1 free article this month. Login to read more articles.

Waterstones demands business rates reform, as Chancellor mulls online sales tax

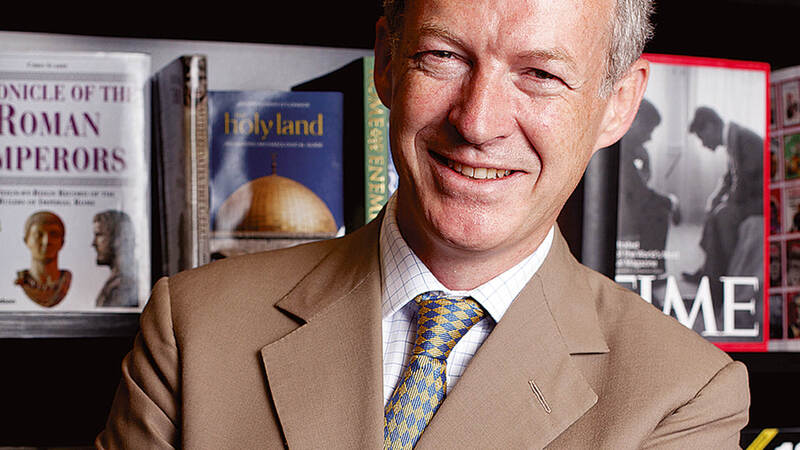

Waterstones is among a number of major retailers to have signed a letter warning Chancellor Rishi Sunak that the business rates burden on shops is risking thousands of high street jobs. Waterstones m.d James Daunt also appeared on BBC Radio 4's "Today" programme this morning (8th February), calling for "clear indication and clear certainty that rates are going to be reduced substantially, or ideally removed altogether".

The letter, sent to Sunak ahead of next month’s budget, is signed by the chief executives of 18 organisations, including Tesco, ASDA, B&Q, Morrisons and shopping centre and property development company Hammerson. In addition to urging a review of business rates, the letter calls for online retailers to pay their “fair share” of tax.

“We urge you to use the upcoming budget to commit to fundamental reform of business rates focused on reducing the burden on retailers and levelling the playing field between bricks and mortar and online businesses,” the letter states.

The signatories also warn "shops at the heart of communities will be at risk" if the current business rate system is not overhauled. The Treasury has said it will hold a business rates review, but Daunt has warned the time for reviews has passed. Speaking on the "Today" programme, Daunt said: "George Osborne launched a review and Philip Hammond talked about it at great length and very sensibly, but then didn't do anything. Frankly the emergency caused by this pandemic is such that I think further reviews really should be truncated, and a clear indication, a clear certainty that rates are going to be reduced substantially, or ideally removed altogether."

Daunt added that high street shops had "clearly suffered" in the pandemic, citing the loss of the brands including Arcadia and BHS as important in the welfare of the high street more generally. "You need your neighbours," he said. "[Otherwise] you don't have that sort of community, and you don't have local jobs."

He told the Sunday Times that 80 of his 290 Waterstones branches could close when leases expire unless business rates fall. He said: “It is clearly a cliff-edge and some businesses will fail if nothing is done. The government’s failure to do anything on business rates is mind-boggling ... how long can they go on year after year, wringing their hands and saying, ‘We’re thinking about it’? It’s pathetic.”

Business rates raise about £30bn for the Treasury each year, of which £8bn is paid by retailers.

The letter comes after reports over the weekend that the Treasury is exploring an online sales tax to “shift the balance” away from online retailers like Amazon and back towards the high street. Chancellor Rishi Sunak is supportive of the idea but could wait until the autumn to launch it, the Sunday Times reported.

According to the paper, Treasury officials have summoned online retailers to a meeting this month to discuss the tax, while an “excessive profits tax” on companies where profits have sky-rocketed during the pandemic is also mooted. Figures released last week showed Amazon's UK sales surged 51% last year.

A Treasury spokesman said: "We want to see thriving high streets, which is why we've spent tens of billions of pounds supporting shops throughout the pandemic and are supporting town centres through the changes online shopping brings.

"Our business rates review call for evidence included questions on whether we should shift the balance between online and physical shops by introducing an online sales tax. We're considering responses now."

An Amazon spokesman told The Bookseller: “We’ve invested more than £23bn in jobs and infrastructure in the UK since 2010. Last year we created 10,000 new jobs and last week we announced 1,000 new apprenticeships. This continued investment helped contribute to a total tax contribution of £1.1 billion during 2019 - £293m in direct taxes and £854m in indirect taxes.”