You are viewing your 1 free article this month. Login to read more articles.

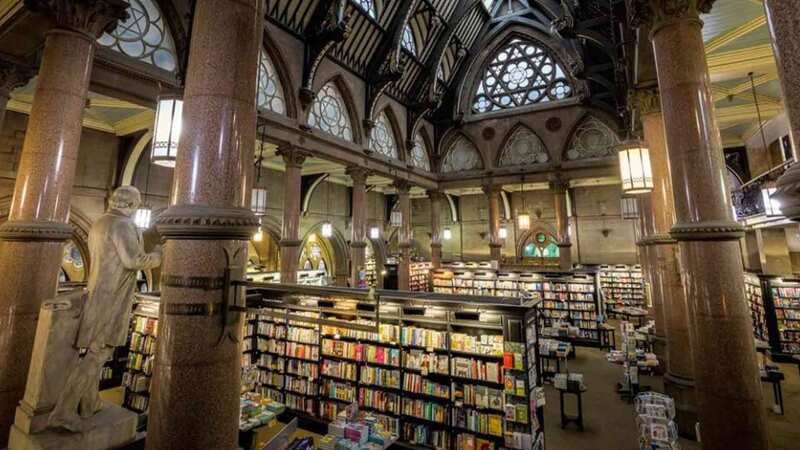

Waterstones buys Blackwell's for undisclosed sum

Waterstones has bought former family-owned chain Blackwell’s for an undisclosed sum, through funds advised by its hedge fund owner Elliott Advisors.

The move follows the acquisition of the Foyles bookshops in September 2018, and brings Blackwell’s under the same ownership as Foyles and US chain Barnes & Noble. Blackwell’s was put up for sale at the beginning of February for the first time in its 143-year history. The financial details of the sale were not disclosed.

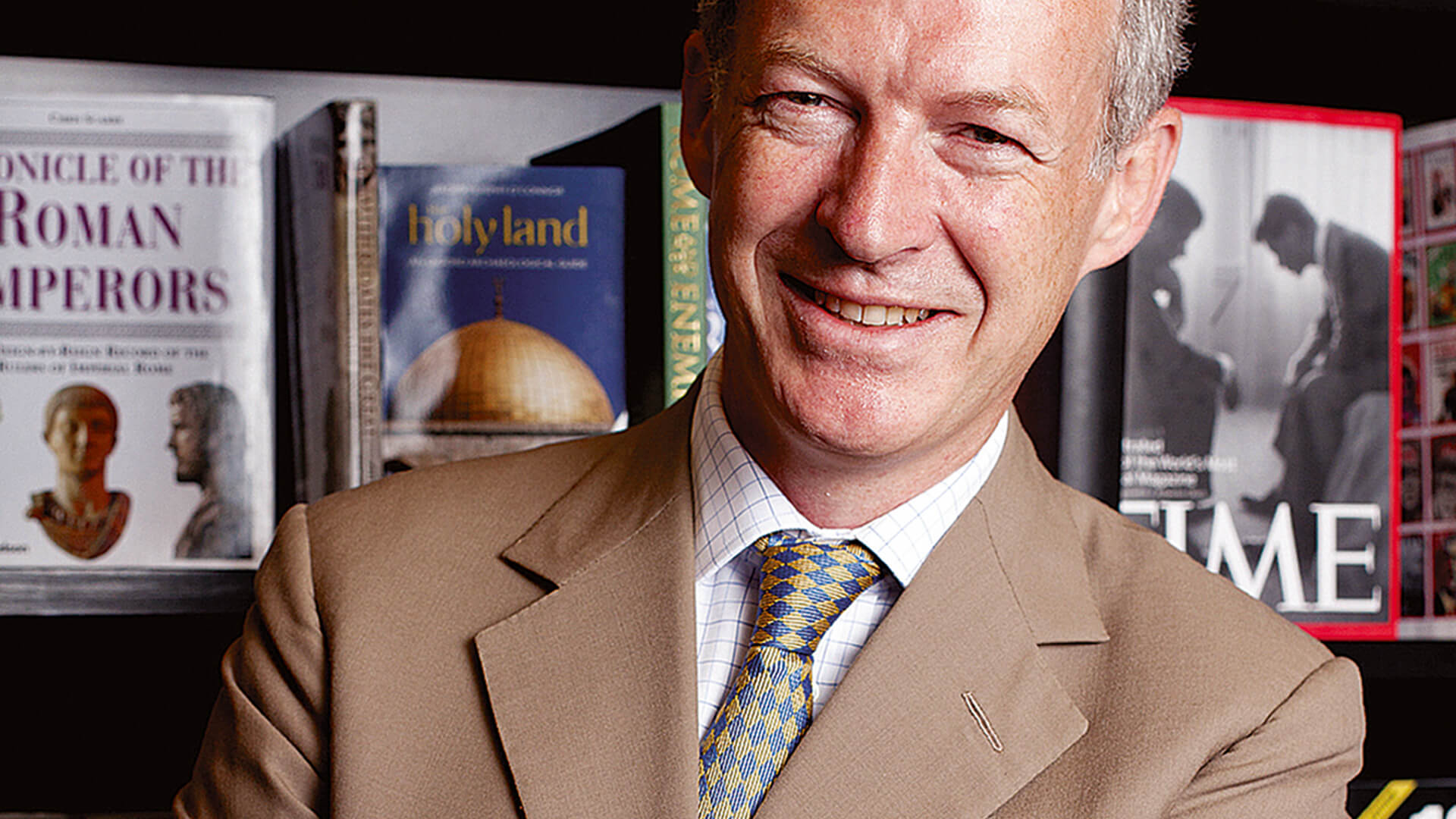

“Blackwell’s and Heffers are among the most illustrious names in bookselling, a legacy for which we have the utmost respect," said Waterstones m.d. James Daunt in a statement shared on Monday afternoon (28th February). "We greatly look forward to working alongside the booksellers at Blackwell’s as we secure the future of these wonderful bookshops and preserve academic bookselling in so many towns and campuses across the UK.”

Toby Blackwell, Blackwell’s outgoing owner and president, said: “After 143 years of family ownership, finding a new home for our business and our wonderful booksellers, has been an extraordinary challenge. Waterstones have demonstrated in their acquisition of Foyles most recently, that they understand the advantages and benefits of holding diverse iconic bookselling brands in their portfolio. I view them not just as a buyer of the business, but as the right buyer at the right time. This is a positive outcome for Waterstones, Blackwell’s and all our customers in the UK and abroad, who will still be able to enjoy the individual nature of what both brands offer. I would like to thank our chairman and board and all of our fantastic staff, past and present, for everything they’ve done to uphold the Blackwell’s name over the years. I wish everyone well with this new chapter.”

David Prescott, Blackwell’s c.e.o., said: “Blackwell’s is cherished by its customers for its brilliant booksellers and the unique position it holds in the bookselling landscape. Waterstones’ acquisition will ensure that the future of Blackwell’s and its booksellers is secure. Waterstones have outlined their commitment to invest in our people, our shops and in our growing e-commerce operation. Their acquisition will ensure that Blackwell’s remains part of the bookselling landscape for the long term.”

Prescott will remain in his role, and all staff will be retained following the acquisition.

Paul Best, senior managing director and head of European private equity at Elliott Advisors, Waterstones’ controlling shareholder, said: “Waterstones’ acquisition of Blackwell’s follows our successful investments in Waterstones and Foyles in the UK and Barnes & Noble and Paper Source in the US.”

Some indie booksellers had expressed concern earlier this month about the dominance Waterstones would have on the high street if the sale went ahead though most were pleased to see the family-owned chain rehomed safely, describing Daunt as a “force for good” for bookselling.