You are viewing your 1 free article this month. Login to read more articles.

Waterstones sale 'makes sense', say analysts, as trade anxiety spikes

Analysts have said new ownership of Waterstones “makes sense”, following reports that its Russian owner, Alexander Mamut, has appointed banker N M Rothschild to contact potential buyers for the chain. But the development has sparked anxiety in the wider trade, with concerns over any uncertainty affecting the crucial retailer.

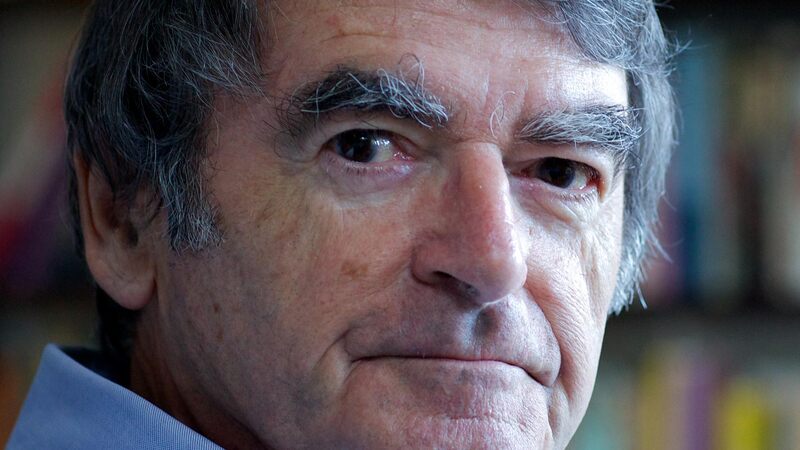

Douglas McCabe, analyst at Enders Analysis, said that Waterstones’ reported £40m profits would "give the owner some leverage and reinforces why the timing of new financing could be attractive". However, notwithstanding Waterstones m.d. James Daunt’s turnaround of the business, other market commentators remain sceptical that Mamut will secure a sum in the region of +£200m reportedly sought.

Following the takeover of private bank Otkritie last week, of which Mamut had been a major shareholder, Daunt was quick to nip any suggestion of a connection between the fortunes of Waterstones and the collapsed bank in the bud; but, according to analyst Nick Bubb, rumours of a forced sale could have a bearing on the perceived value of the business.

"Given the impressive turnaround of the business by James, I agree that it may make sense for a new owner to come in, but I’d be surprised if it’s worth £200m or more,” Bubb commented. "I haven’t seen any financial numbers, but that valuation feels high given the rumour is that Mamut may be a forced seller. Private equity funds have lots of money to invest in decent businesses but they are likely to drive a hard bargain.”

Bubb speculated further Foyles and Blackwells "will look at [buying] it", although "it’s probably too big for them”. Echoing the sentiment of much of the trade, he added: “And God forbid that Amazon buys it!” Speaking to The Bookseller last week, Daunt dismissed rumours then circulating of acquisition interest from Amazon, calling them "too silly to even dignify April Fool’s Day.”

McCabe said if Waterstones increases its profits in its next results, the "responsible thing" to do would be "to re-engineer its financing on a more stable footing”. He elaborated: "There are a range of possible outcomes - same owner, same owner and other owners, other owners - but essentially with any outcome the company should be looking for more flexibility to invest in the company, greater security for the long term."

Curtis Brown agent Gordon Wise observed, despite the good that has come from the capitalisation of Waterstones from Mamut, there were downsides in this coming from a single person.

“We’re so heartened at all the incredible work James has done over the last few years and with Mamut’s support to re-establish Waterstones as a lighthouse for books in the high street. And we hope no business restructuring affects all the good work they’ve done. This can only be a project that improves and continues to expand going forwards,” said Wise.

"I don’t know who the likely the players would be [to buy the business]. The capitalisation that they’ve had over the last few years has been fantastic - but it’s coming from one person, there’s a risk factor there. Would they rather be in the context of a broader based retail environment or is it good for them to have a line of credit that allows them to do things that others wouldn’t otherwise do?"

Asked how current talk of a sale will affect the trade, analysts and industry figures have pointed out uncertainty is never good for business.

Bubb weighed in: "Consumers won’t notice the sale talk and the only risk is that staff get demotivated by the uncertainty. But I’m sure James will make clear that the best way for everybody in the business to do well out of a change of ownership is to focus on delivering as good a Christmas as possible and thus maximise the value of Waterstones."

"Clearly nothing will happen until after Christmas, given its importance to the book trade,” he added.

Wise commented: “No one likes uncertainty because you don’t feel like the sun is always shining on book land and there are so many good things Waterstones has been doing. For a certain lists it is very important as a platform for helping to make books. Without Waterstones where would you be with The Essex Serpent at the moment? When Breath Becomes Air? Joanna Cannon’s The Trouble with Goats and Sheep? These are all projects that Waterstones' commitment has really helped to drive and help set tredns within the industry as a whole. If you haven’t got someone doing that talking up in the way they have, and guarantee of physical availability, that’s a real loss.”

Although Wise however concluded he personally was “not feeling like a cat on hot bricks about it right now”, anxiety levels within the trade are high, according to bookseller and historian Tamsin Rosewell.

She told The Bookseller: “It has been a really interesting few days. I have spoken to a lot of authors, agents, booksellers and publishers over the last few days – there has been a high level of anxiety from them about it and not unreasonably so. There has been a lot of chatter about a potential deal with Amazon - that is symptomatic of the concern, even if nothing else.

"I think we need to sit up and take notice and really take this seriously. Whatever happens it will be an emormous impact to the whole industry, it will affect everyone. I think it will definitely be sold.

"Businesses get bought and sold all the time but makes this different is that this is the only chain within our entire industry and its presence on the high street is so important. I hate to use this phrase but they are product champions. They have brought the idea of browsing in a bookshop and spend time there, they have been instrumental to this. The importance of Waterstones in the industry can not be denied.”

Juliet Mabey, Oneworld publisher, also said the possibility to the sale was "likely to generate frissons of anxiety in all publishers”. She and other publishers said concern might be assuaged were it guaranteed James Daunt would remain at the helm.

“Waterstones is Oneworld's biggest single customer by far, and the possibility of a sale is likely to generate frissons of anxiety in all publishers who have watched its impressive turnaround under the brilliantly confident, steady hand of James Daunt,” she said. "It is a truly stellar achievement, and the envy of publishers in the US. Waterstones is absolutely vital to the literary ecosystem in the UK, and we would all be hard hit if the progress made were to suffer a reversal under new ownership. I have a deep-seated belief that bookshops do much better in the hands of book people, and I think this has already been demonstrated over the past six years, so a potential sale to a private equity firm outside the industry, particularly one bent on a fast turnaround, is a cause for concern. However, I would be far less anxious about such a prospect if I knew James Daunt might continue at the helm if it is sold.”

Agent Peter Straus agreed the health of Waterstones was imperative for the industry and he hoped too that Daunt would be able to stay on as m.d. “[The impact on the trade] will depend on who buys it. There will need to be a benign buyer who understands the business,” he said. "It is great that James Daunt has helped it to make a profit in the first time in years. It is an attractive proposition to buyers but it will depend if the buyers have an understanding of the sector.

“I hope James Daunt is able to keep on at the helm. Bookselling is a peculiar business and it needs someone with a special skill to maximise it and he has that. I remember when Borders was around and there were shops like Books Etc which have now gone … A healthy Waterstones is important for the trade. I want the business to continue in a strong and vigorous way. You need a benign buyer who can support it and continue its growth."

Will Atkinson, m.d. of Atlantic, said: "[There’s been] changes of management and ownership before, so I’m just hoping that the strong stable progress continues. The course Daunt has set looks like it is finally paying dividends.

"The change in ownership is bound to have impact on the trade. When most people come in from retail, they like to have a monochrome supply chain. Shops look the same. Waterstones suffered under HMV. Management needs to be able to say books are a bit different, the stores can’t all be the same. It’ll need intelligent ownership, and robust management.

"Daunt is generally striking the right balance with Waterstones between uniformity across the brand and individuality within each shop, especially due to his background with Daunt Books. It’s great having a large serious bookselling selling chain that really believes in books and we don’t want that to stop.”