You are viewing your 1 free article this month. Login to read more articles.

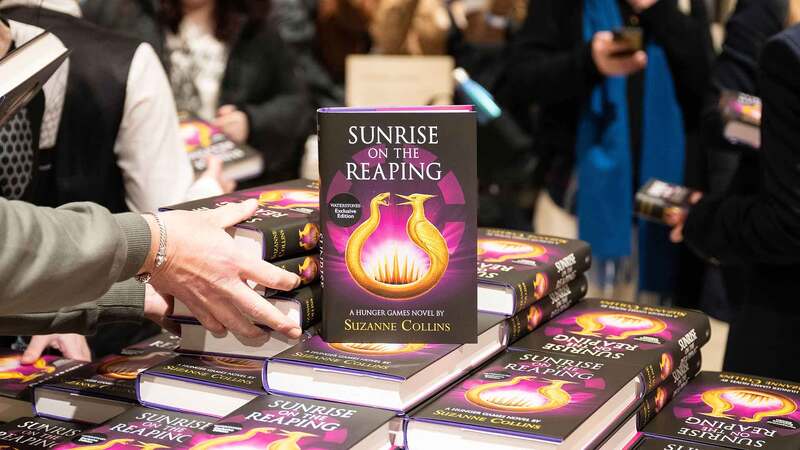

Waterstones sold to Elliott

Elliott Advisors has bought a majority stake in Waterstones, it has been revealed this morning (26th April).

Following the deal, James Daunt will remain as c.e.o. of the company he has led since Russian oligarch Alexander Mamut bought the bookselling chain for £53m in 2011 from the HMV Group.

The terms of the deal, which is expected to complete in May, have not been disclosed, but Elliott is providing all the financing for the transaction, including the consideration and ongoing operational finance. Mamut's Lynwood Investments will retain a minority stake, but the percentage of the business each will own has not been disclosed.

Daunt's key leadership team will also remain in place at Waterstones following the deal.

Daunt said: “This is a very happy outcome for Waterstones. Our booksellers can be immensely proud to have proved through good, old-fashioned bookselling, the enduring appeal and worth of real bookshops. I thank Lynwood Investments for their invaluable support through this turnaround, and we enter new ownership looking forward with great optimism to the next chapter in the development of Waterstones”.

He told The Bookseller: "I am pleased the sale has taken place and I am pleased for Alexander Mamut, who took a huge risk in buying the company in 2011. I think it is positive to have a domestic owner. A new ownership does bring a different energy to the company right from the beginning and this owner has deep pockets."

Paul Best, head of European Private Equity at Elliott said: “As the leading physical book retailer in the UK, Waterstones is a mainstay of UK high streets and has a huge and loyal customer base. We look forward to supporting James Daunt and his entire team over the long-term as they continue to build and grow the business”.

Marina Groenberg, c.e.o. of Lynwood, added: “Waterstones is not only the UK’s leading bookseller but also a much-loved British institution. We are therefore very proud that the business has been restored to profitability and good health during our ownership and thank James Daunt and the wider management team for delivering a successful turnaround. With many exciting opportunities for Waterstones to thrive further, we are enthusiastic to remain as minority shareholders and continue our journey with the UK’s favourite bookshop”.

Mamut put the 283-store chain up for sale in October, handled by N M Rothchild. In January hedge fund Elliott Advisors had reportedly been granted a small period of exclusivity to conclude the deal to buy the retailer after emerging as one of “a small number of bidders” which had lodged formal offers for the chain.

Elliott Advisors is the UK arm of an American “activist” hedge fund Elliott Management, run by Paul Singer. Last June, the firm recruited a head for its new European private equity operations - Best – to give it greater firepower beyond stock and bonds for which it is best known, reported the Wall Street Journal.

The New York-based Elliott Management oversees £22bn ($31bn) worth of assets, and according to the BBC has “earned a reputation over 40 years as a no-holds-barred activist investor, with an unusually large appetite for public face-offs.”

It has taken on some of the world’s biggest companies, such as Australian mining giant BHP Billiton, which it reportedly pushed to reorganise last year and sell its US shale business based on Elliott's recommendations, and South Korean mobile company Samsung, which it reportedly pressured to restructure. Just last week (16th April), it bought a 6% stake in Whitbread, with the reported aim of pressuring the company to split its Costa Coffee business from its hotel arm.

Publishers will welcome the news that Daunt remains at the helm of the chain. The bookselling chief, who also owns Daunt Books mini-chain in the Southeast of England and has been a banker in the US for J P Morgan, is seen as “crucial” for the continuing profitability of the chain in the eye of suppliers, winning plaudits for refocusing the company’s efforts on passionate booksellers, hand-selling and championing individual titles in his seven year stint at the firm, along with reducing the returns which plague the industry. He oversaw Waterstones’ turnaround to achieve a profit for the first time in five years in 2016 and saw pre-tax profit grow by 80% to £18m in 2017, although in that time costs were stripped and staff numbers have been reduced significantly, with a swathe of 200 managers let go in 2013.

The Bookseller understands the new owners have conducted talks with the chiefs of large publishing houses in the final stages before the sale completed to get a better understanding of the market.

One, who wished to remain anonymous, said: “They said all the right things, they said they loved books and they sounded really supportive of Waterstones. I have to say they seemed quite well-versed in book publishing and retailing and seemed to have done their research.”

Many seemed to have pressed the importance of Daunt’s continuance at the helm of the chain, which they viewed as more important than the type of company owning it.

Ahead of the sale, one senior publishing figure said: “We are relaxed if James Daunt is still leading the chain. If he is not, we are anxious.”

However, another said there were nerves over country’s major book chain being owned by a private equity firm, which they said was an “unknown” for the business–it was founded by Tim Waterstone in 1982, sold to W H Smith in 1993, was bought by a consortium of Waterstone, EMI & Advent International in 1998 before it was taken under the umbrella of HMV Group and sold to Mamut in 2011.

“The proof will be in the pudding – how the owners act when they come in. Private Equity firms usually like to strip companies for profit, but there is not a high margin to be made in bookselling,” one said.

Another welcomed the uncertainty surrounding Waterstones’ future coming to an end “because uncertainty is never a good thing”.

Waterstones staff will also be pleased the question of their company’s future ownership has been settled. “We haven’t been told much about it during the process, so it will be good to know what is going on,” one senior bookseller said, although another added "there’s a sense of inevitability around the sale of the business to a hedge fund."

Earlier this month, The Bookseller reported that Waterstones’ sale to Elliott Advisors was likely to complete by the end of April, which also marks the end of Waterstones’ financial year.