You are viewing your 1 free article this month. Login to read more articles.

Waterstones 'in takeover talks with Elliott Advisors'

Elliott Advisors, the UK arm of an American hedge fund, has reportedly made a formal offer to buy Waterstones.

Citing a single source, Sky News reported that the investment fund is “one of a small number of bidders” to have lodged formal offers for the retailer. Elliott has now reportedly been granted a short period of exclusivity to conclude the deal.

The offer for the 275-store chain is “much lower” than the £250m previously suggested, according to the report.

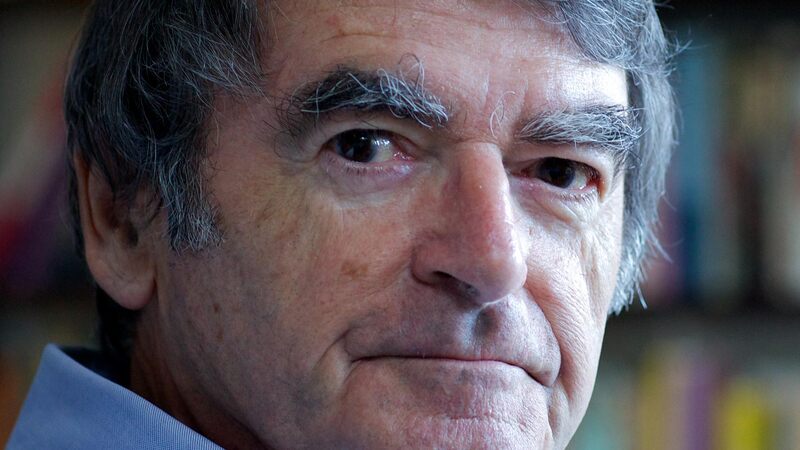

Waterstones' managing director James Daunt declined to comment.

The New York-based Elliott Management Corporation is founded by c.e.o. Paul Singer. His son Gordon Singer runs the London-based Elliott Advisors, which currently owns a stake in retailer Game Digital.

Elliott Advisors is known for “taking aggressive activist positions in a string of major public companies”, according to Sky News and has helped to drive up the acquisition price of deals including Steinhoff’s bid for Poundland, reported the Financial Times, which also said the company had been criticised for being “overly aggressive, a ruthless opportunist, even a bully.” However, the newspaper also reported the firm had “established a reputation as one of the most successful activist funds across Europe". In 2016 the UK arm’s profits jumped from £3.7m to £4.7m, reported the Daily Mail and it has recently hired Paul Best, previously managing director at Warburg Pincus, to focus on private equity deals. When Elliott Advisors briefly opened its main fund to new investments last year, it raised $5bn in 24 hours, according to the Financial Times.

Waterstones’ current owner Russian oligarch Alexander Mamut put the business up for sale in October, with bankers N M Rothschild handling the deal. The chain revealed its financial performance for the year to April 2017 earlier this month, showing that pre-tax profit was up 80% to £18m, although sales were marginally down by 1.3% to £403.8m.

Daunt has previously indicated he wanted to stay on at the helm of the chain following the sale.