You are viewing your 1 free article this month. Login to read more articles.

Coronet buys journalist's story of a 'no spend year'

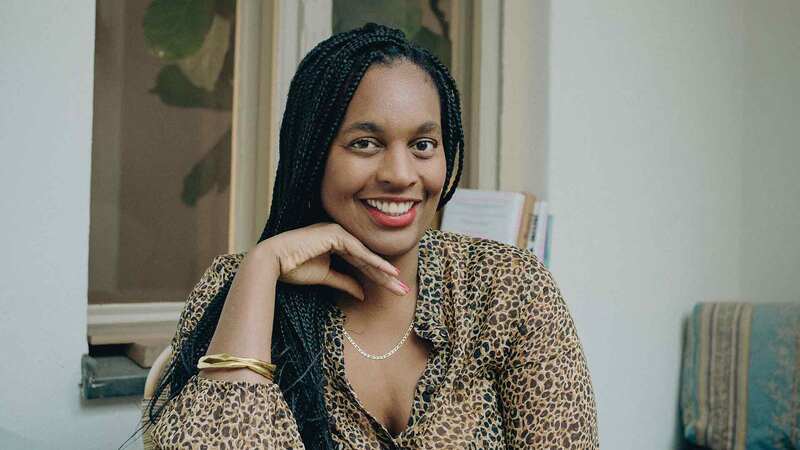

Hodder imprint Coronet has acquired narrative non-fiction book No Spend Year by personal finance journalist Michelle McGagh.

The book, which aims to "demystify money" and "think about their spending habits", charts the author's journey after setting herself a personal challenge to go a whole year without spending any money apart from essential bills and a minimal budget for basic groceries.

The result is how she learnt how to budget, plan, trade, make do and do without and as a result has changed her relationship with money. And the book offers, through her own story, "clever life hacks", tips and accessible explanations on personal finance topics, such as mortgages, pensions, saving and investing.

Charlotte Hardman, editorial director for Coronet, acquired UK and Commonwealth rights from Lauren Clarke of Bell Lomax Moreton.

McGagh writes for the Guardian, Money Observer, Citywire Money and has appeared on "BBC Breakfast" to discuss all things money-related. She has a blog www.londonminimalists.co.uk which she writes with her husband.

Coronet will publish a £12.99 trade paperback in January 2017. There will also be an accompanying app which incorporates "fun saving challenges" into budget planning.

Hardman said: "For too long financial advice has seemed intimidating and dry and we’re traditionally too shy or guilty to discuss money, but by drawing people in with a really engaging and fun personal journey, Michelle also gives some really invaluable advice that will help kick anyone’s finances into shape. What is impressive about Michelle’s experience of her no-spend challenge is that she hasn’t just saved a lot of money, she is also far happier and has redressed the balance in her life. I think people will find her really inspirational."

McGagh said: "I want to break the taboo around money so I’m putting my hand up and admitting I need to sort my finances out. I know I’m not alone, so I wrote the No Spend Year to help those who are scared of their credit card bill, don’t know what a pension is and think saving is too hard. This book aims to demystify money, encourage people to save, and importantly think about their spending habits."