You are viewing your 1 free article this month. Login to read more articles.

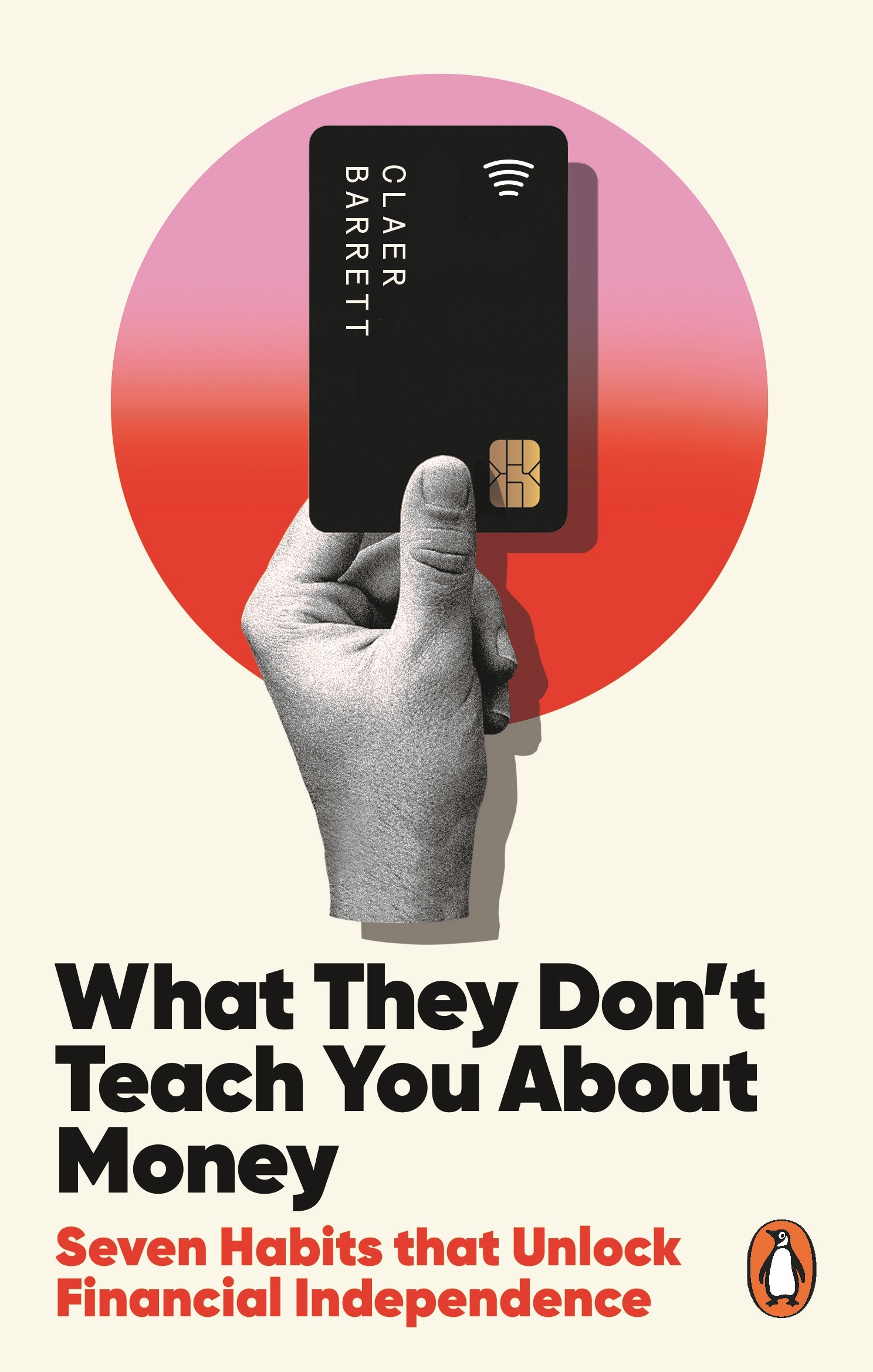

Ebury Edge pre-empts Barrett’s ‘indispensable’ book on finances

Ebury Edge has pre-empted Claer Barrett’s “essential” book What They Don’t Teach You About Money: Seven Habits that Unlock Financial Independence.

Géraldine Collard, commissioning editor, acquired UK and Commonwealth rights from Robert Caskie at Robert Caskie Ltd. It will be published in paperback on 16th March 2023.

“In the midst of the cost-of-living crisis, money agony aunt Claer Barrett is your voice of reason,” wrote the publisher. “She wants to help readers battle the gloom, reclaim control of their money and restore confidence via essential habits for financial independence.”

What They Don’t Teach You About Money is a “short and indispensable” book of the most efficient financial habits and the most common monetary problems. Barrett also looks at the psychology behind money issues such as “why we feel we have to keep up with the Joneses” and why get-rich-quick schemes are so compelling.

Collard said: “Claer answers the money questions we have all been too embarrassed to ask. Given the cost-of-living crisis, now is the time to tackle the gaps in our knowledge, beat the overdraft and finally get to grips with our finances. Claer’s trademark voice is alive and kicking on the page; never did I think that a personal finance book would make me laugh, but she has delivered a book that is as relatable and entertaining as it is essential. We are thrilled to have her as our money expert for Ebury Edge.”

Barrett commented: “Everyone is really fretting about their finances right now, but money has always been a topic we struggle to talk about – and I’m not surprised. When I help people work through their money worries, they often say ‘why don’t they teach this stuff in schools?’. I have made a career out of decoding the intimidating jargon and small print that the financial world is cloaked in. With this book, I hope I can hold readers’ hands and guide them through the complexity with practical tips and helpful habits designed to break down the barriers – and set them on the path to financial independence.”