The festive season: Christmas 2024 — Frontlist stutters in the race to number one

New titles sales have contracted, though backlist has surged.

For most, Christmas begins on the 1st November when Mariah Carey starts belting out the high notes—not so for booksellers, who know that Christmas truly begins in the last week of August when the first tranche of big hardbacks start to be released, with more and more coming until the peak of Super Thursday in early October.

In the nine weeks from the 25th August, nearly 18,000 new titles have gone through the country’s tills according to Nielsen BookScan’s Total Consumer Market (TCM). This might seem like a back-breaking amount to many bookshops, but it’s 2,000 fewer than the same period in 2023. This decline in quantity could help partly explain why new releases have seen £3m less spent on them when compared with the same nine weeks last year.

We’ve already seen over the course of the summer that backlist titles have enjoyed a bump, and this is continuing into the autumn—the total market is up £4m, meaning that “non-new” titles have put an extra £7m through the tills. That doesn’t mean we should underestimate these frontlist books, though—while they make up only 3% of the nearly 700,000 different titles scanned through the tills, they still account for nearly a quarter of the £314m that the market has taken in the last nine weeks.

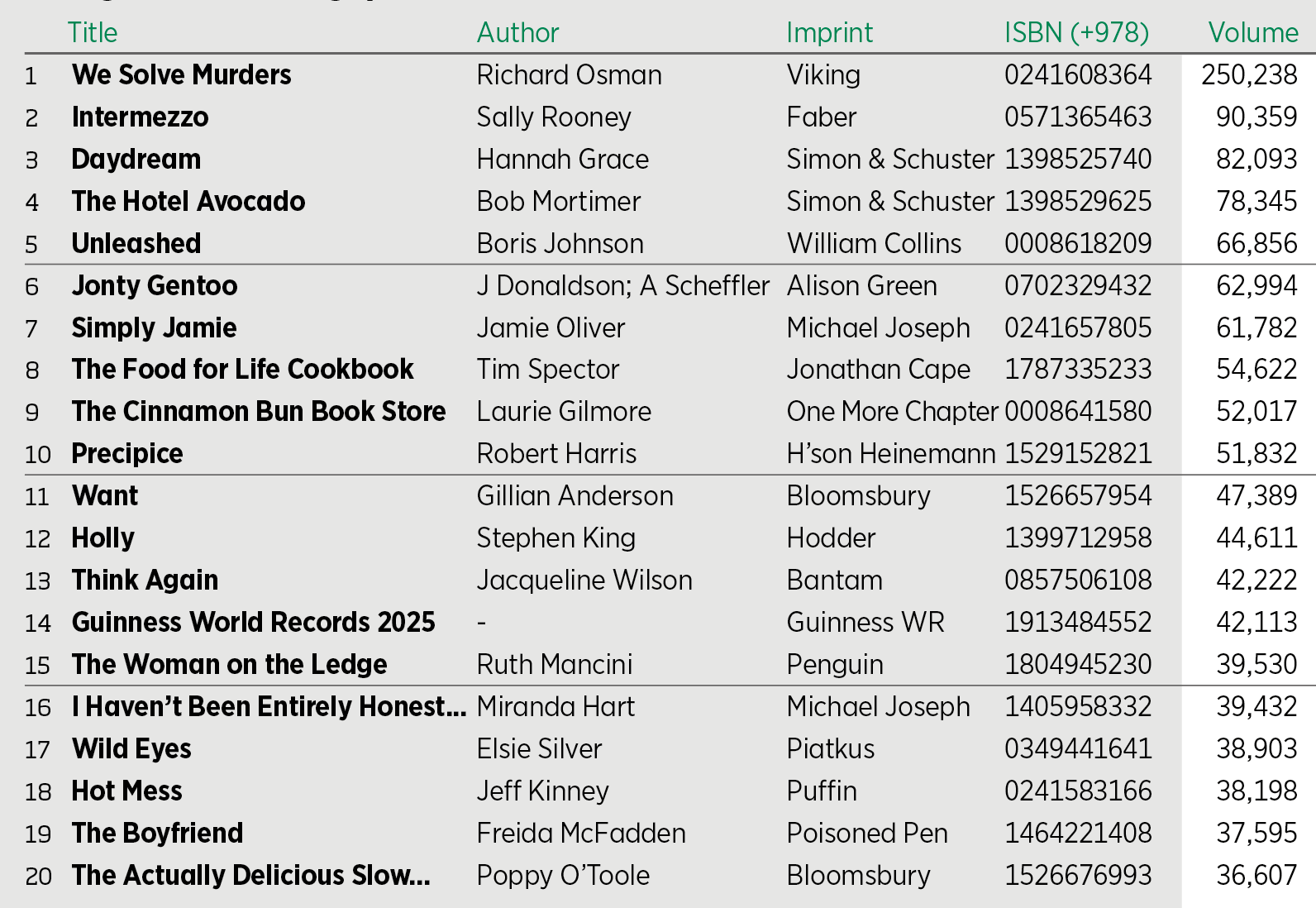

While the sheer quantity of new releases could be driving some of the reduced spending, some of the big brands have seen declines in their total sales—none more so than Richard Osman. Most authors would love to have shifted 250,000 copies of their book—and with 160,000 more than the second-place title, Intermezzo by Sally Rooney, it’s nothing to be ashamed of—but We Solve Murders has sold 24% fewer copies than 2023’s The Last Devil to Die, resulting in £1m less through the tills—a third of the total decline the new releases have seen.

Speaking of Intermezzo, to date Rooney has shifted 90,359 copies—easily making up for the lack of a Robert Galbraith this year whose 2023’s The Running Grave was the second-biggest fiction title in this period. Britney Spears’ The Woman in Me was 2023’s biggest biography across September and October—the “Toxic” singer’s sales of £1.1m are more than covered by Boris Johnson’s Unleashed.

In fact, the Top 20 this year is doing a pretty good job of filling all gaps from last year. It’s down 3.7%—around £560,000—which, considering Osman’s miss and a £384,000 decline for Jamie Oliver versus last year, suggests that the biggest titles are still attracting customers attention in the shops.

Adult Fiction is experiencing a strong autumn—making up half of this year’s top 20 and delivering an extra £3.3m worth of sales across the TCM’s top 5,000—but it’s a different story for Children’s Fiction, which is down £1.6m this year. It’s a category that’s very much following the pattern of some of the biggest brands this year, with J K Rowling and David Walliams—the genre’s biggest authors last year—experiencing a combined contraction of £1m between them.

These numbers across Fiction and Children’s means that Non-Fiction has shrunk by £4.6m so far this year, but with some big names still yet to publish—including Chris Hoy, Michael Caine and Cher as well as a new Pinch of Nom cookbook—the category could still rally to deliver a good winter.

All of these new releases will be hoping to make it to the Christmas number one—but while Osman’s The Last Devil to Die was the biggest-selling title across the last third of 2023, it was actually a title published in June of that year—Murdle by G T Karber—that took the coveted number one slot in Christmas week.