Copy of School Textbooks and Study Guides 2024 — New term sees a slight drop in school sales

Familiar faces lead the way but the market contracts.

Charts & Data Analyst – and owner of Bert's Books, Swindon

While the kids are settling back into their new year at school, the educational book market has seen its traditional September boost as new reading lists are released and revision guides are acquired.

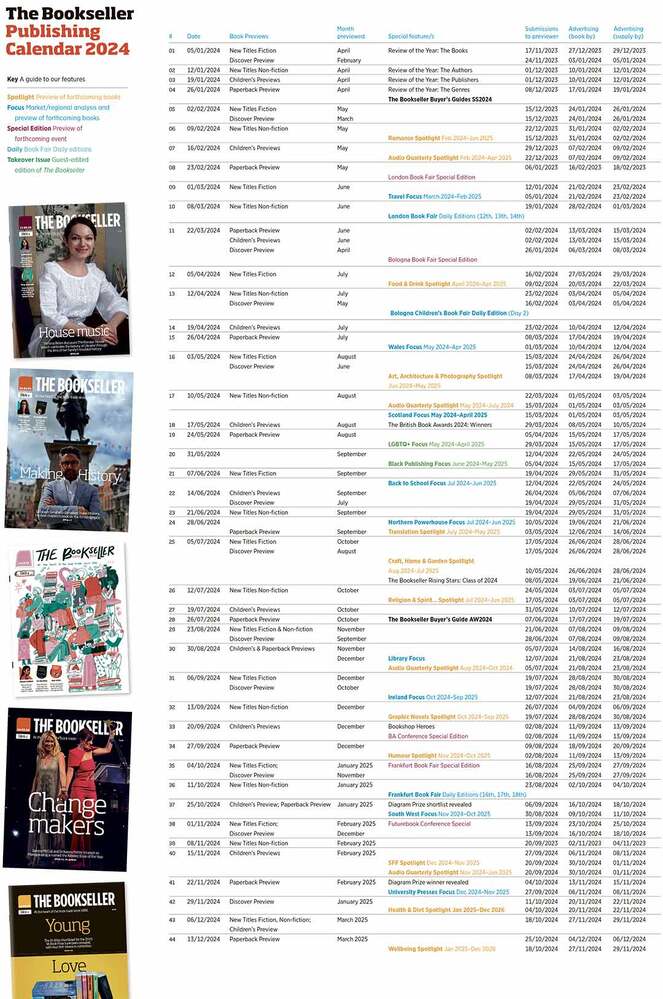

In the seven-day period ending 7th September, just shy of 200,000 units were sold in Nielsen BookScan’s Total Consumer Market’s School Textbooks and Study Guides category. That’s an increase of 3.7% on the same week in 2023, but a slight decline of 0.4% in value, with the average selling price of educational books falling from £8.26 to £7.93.

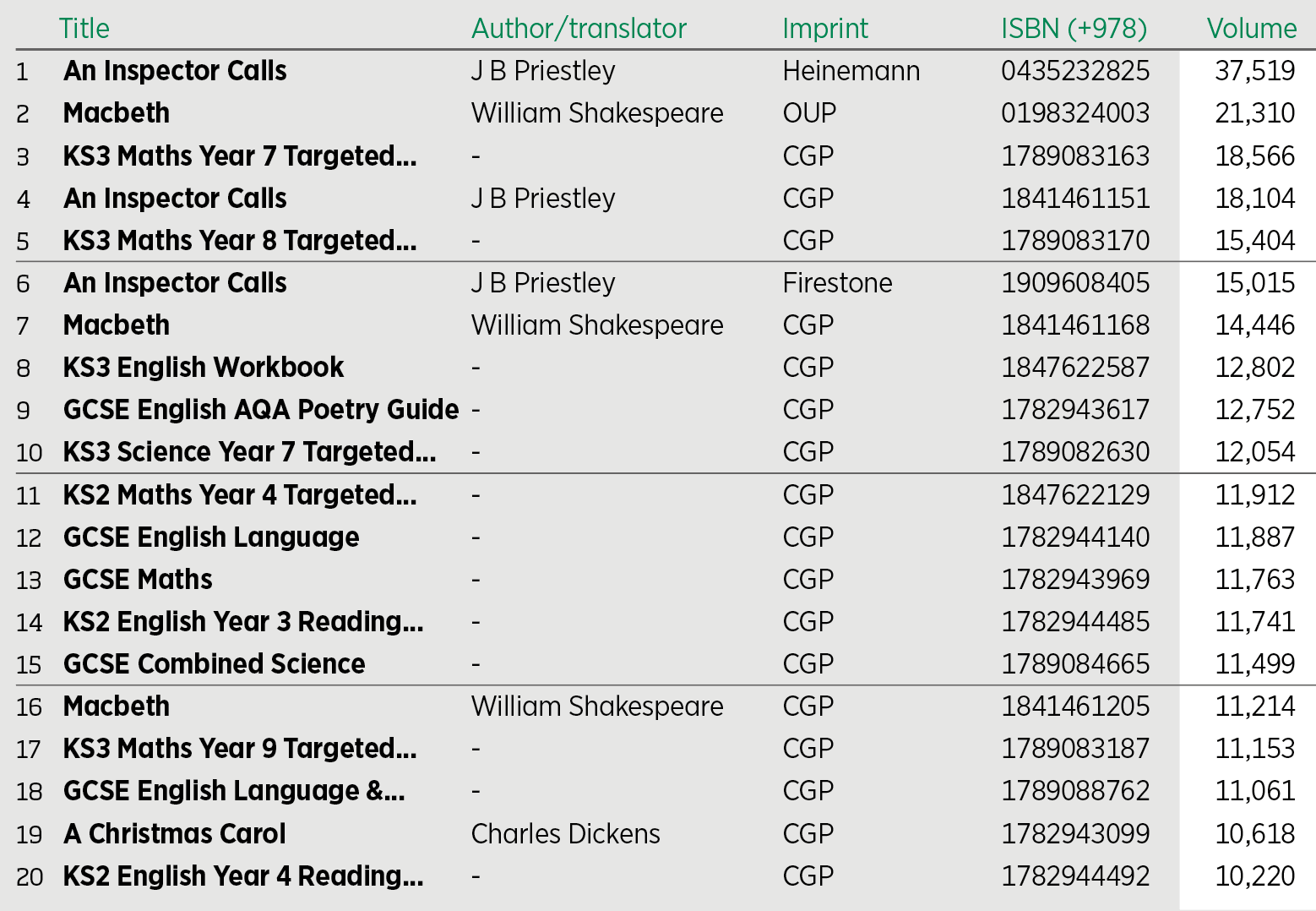

The growth in volume is almost entirely down to the performance of study guides powerhouse, CGP, which shifted 10,025 more books than in the same week last year, a 9.8% increase. CGP is by far the biggest publisher in this corner of the market through the TCM; its volume sales of just over 102,000 copies in the School Textbooks and Study Guides Top 5,000 corresponds to a market share of 51.2% – up from CGP’s 47.9% in the same period last year. It is a domination even more pronounced at the top: of the top 100 bestselling School Textbooks and Study Guides in 2024, 85 have been CGP-published.

The seven days ending 7th September accounts for 5% of all education books in the year to date, but despite the growth in this week year-on-year, School Textbooks and Study Guides is down over 200,000 units in 2024, hitting just under 4.1 million copies, a decline of 5.3% on 2023. The category’s 2024 value sales contracted slightly less (-4%) to £32.1m.

While it is the biggest publisher in the sector, at an individual title level CGP had to settle for third position with its top title, Key Stage 3 Maths Year 7 Targeted Workbook, beaten by two reading list staples: Oxford University Press’ (OUP) edition of “Macbeth” in second, and Heinemann’s version of reading list stalwart, J B Priestley’s “An Inspector Calls” (pictured right), in pole position. This is not unusual, as both books maintain their positions at the top of the chart from last year – yet the duo have seen a decline on 2023 with OUP’s “Macbeth” volume sales down 3% and “An Inspector Calls” contracting by 6.3%.OUP is in second position overall on the publisher Study Guides and School Textbooks league table in 2024, with 8.4% of the total market, just ahead of Pearson at 7.8% and HarperCollins – mainly due to the education arm Collins – on 7.4%.

The Priestley estate is the gift that keeps on giving for Pearson

The Priestley estate is the gift that keeps on giving for Pearson: one in seven of its books sold in the category are directly related to “An Inspector Calls”, including the text itself plus various York Notes workbook and study guide editions.

Yet while Priestley maintains the number one in the chart – and three spots in the top six – he has to settle for second on the Study Guides and School Textbooks author table with 99,453 copies sold, as William Shakespeare’s 109,010 units put the Bard tops.

Given their position on all the exam boards’ GCSE Shakespeare set text lists, it is no surprise that of the 21 plays that appear in Study Guides and School Textbooks Top 5,000, “Macbeth” and “Romeo and Juliet” lead the way, accounting for more than 80% of all Shakespeare’s sales. “Much Ado About Nothing”, “Othello” and

“The Merchant of Venice” round out the remainder of his top five; at the other end, just 74 students were interested in “The Two Gentleman of Verona” – or if not interested, at the very least purchased a copy of the play.

With Priestley and Shakespeare leading the way, Literature, Arts & the Humanities is the genre’s biggest sub-category, accounting for 45% (£14.7m) of Study Guides and School Textbooks’ value sales for the year, closely followed by Maths, Science & Technical (37.8%, £12.3m).