Humour, Trivia and Puzzles 2024

Puzzles surge thanks to G T Karber, but Humour slumps.

Charts & Data Analyst – and owner of Bert's Books, Swindon

We are heading into the peak sales season for Humour, Trivia and Puzzles – 62% of the Nielsen BookScan Total Consumer Market category’s sales in the whole of 2023 came in the last quarter of the year. And yes, that share was helped by G T Karber’s Murdle phenomenon, but even in the Murdle-less 2022, Q4 accounted for 56% of the year’s sales.

The Humour, Trivia and Puzzles market enters the 2024 Christmas run-in in fairly fine form, overall, though there are ups and downs in the sub-categories. For the 37 weeks ending 14th September, the TCM sales for Humour, Trivia and Puzzles topped £10m, up 14% against the same period in 2023. In volume terms, the category is up 5%, all of which can be attributed to one book—the 2024 Book of the Year Nibbie-winning Murdle.

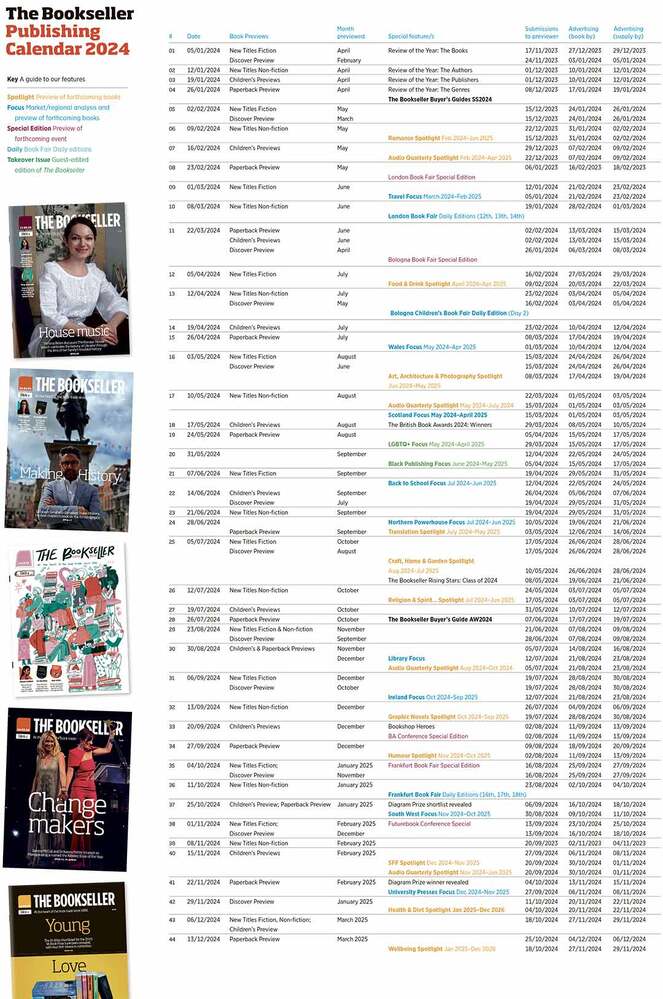

The first volume in the murder-themed logic puzzles series from Karber, first published in June 2023, has shifted nearly 130,000 copies in 2024 to date, 86,000 more units than this point last year. In total, the three Murdle books this year have moved almost 176,000 copies – accounting for a little over 10% of Humour, Trivia and Puzzles’ sales – and with a fourth edition in the series due out in October, it’s looking likely to be another Murdle Christmas.

If you strip the Murdle trio out of the equation, the volume in the category is down in 4.6%, but value is holding steady; a contraction of just £5,000 thanks to an increased average selling price of £6.92, up from £6.63.

The Puzzles sub-category in general is still doing well accounting for 18 of the slots inside the Humour, Trivia and Puzzles top 20 year-to-date. If we strip Murdle, the Puzzle side still accounts for 51% of the total volume in the overall category, though this is down from a 56% volume share from a year ago.

The hardback and paperback of Paul Whitehouse and John Bailey’s How We Fish have sold 5,361 copies combined

And while Murdle and crime logic games are the hot trend, it is worth noting how well tried and true formats work. Simple crossword titles have combined to shift nearly 189,000 copies in 2024 – 13,000 units more than

the Murdle series; cryptic crosswords boost that number to over a quarter of a million books.

After Puzzles, it’s a mixed bag for some of the other subcategories. Humour Collections are down 12.1%, though much of this is due to nothing replacing the two standout hits of 2023 – ”Clarkson’s Farm” star Kaleb Cooper’s The World According to Kaleb and Little Brown’s Prince Harry parody Spare Us! – which accounted for 10% of last year’s volume. Elsewhere in the sub-category the 2023 Private Eye Annual, down 3,000 units year-on-year, adds to the decline.

Cartoons and Comic Strips have reduced 14% in volumer terms, but as a much smaller sub-category this only amounts to a difference of 6,500 units, with the change being seemingly due to a general decline across the category, with the top 50 books responsible for two thirds of the category’s total sales.

It’s a better picture for TV Tie-ins as volume increased 5.5% and value surged ahead by 22.2%. This change can be attributed in near totality to just one book which features in the category’s top 10 in two formats: the hardback and paperback of Paul Whitehouse and John Bailey’s How We Fish have sold 5,361 copies combined, in 2024 for £56,903, nearly a fifth of the entire category.

With just over £1m worth of sales Trivia & Quiz Books are the second biggest portion of Humour, Trivia and Puzzles and is growing, bouncing up 31.5% in volume and 22.2% in value. Jordan Moore’s Interesting Facts for Curious Minds leads this sub-category with volume sales nearly double against last year—but with an a.s.p. nearly half that of 2023, it only accounts for a small part of the value increase. The rest of the top 50 is up 21%, but it seems the entire category is enjoying a blanket sales bump with titles outside the top 50 increasing 16% year-on-year.